UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K /A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): October 7, 2011

TONIX PHARMACEUTICALS HOLDING CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-150419

|

26-1434750

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

509 Madison Avenue, Suite 306, New York, New York 10022

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 980-9155

Copy of correspondence to:

Marc J. Ross, Esq.

Harvey Kesner, Esq.

James M. Turner, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway

New York, New York 10006

Tel: (212) 930-9700 Fax: (212) 930-9725

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

This amendment No. 1 to the current report on Form 8-K/A is being filed to incorporate changes to the current report on Form 8-K (the “Form 8-K”) filed by us on the Company on October 14, 2011 in response to comments received from the Securities and Exchange Commission (the “SEC”) as a result of the SEC’s review of the Form 8-K. In addition, the unaudited financial statements for the nine months ended September 30, 2011 and 2010, corresponding Management’s Discussion and Analysis of Financial Condition and Pro Forma financial information are being included to replace the corresponding disclosure for the six months ended June 30, 2011 to comply with SEC rules and regulations. Unless otherwise disclosed herein, the disclosures contained herein have not been updated to reflect events, results or developments that have occurred after the original filing of the Form 8-K, or to modify or update those disclosures affected by subsequent events unless otherwise indicated in this report. This amendment should be read in conjunction with our filings made with the SEC subsequent to the filing of the Form 8-K, including any amendments to those filings.

TABLE OF CONTENTS

|

Item No.

|

|

Description of Item

|

|

Page No.

|

| |

|

|

|

|

|

Item 1.01

|

|

Entry Into a Material Definitive Agreement

|

|

3

|

| |

|

|

|

|

|

Item 2.01

|

|

Completion of Acquisition or Disposition of Assets

|

|

4

|

| |

|

|

|

|

|

Item 3.02

|

|

Unregistered Sales of Equity Securities

|

|

53

|

| |

|

|

|

|

|

Item 4.01

|

|

Changes in Registrant’s Certifying Accountant

|

|

53

|

| |

|

|

|

|

|

Item 5.01

|

|

Changes in Control of Registrant

|

|

54

|

| |

|

|

|

|

|

Item 5.02

|

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

|

54

|

| |

|

|

|

|

|

Item 5.06

|

|

Change in Shell Company Status

|

|

54

|

| |

|

|

|

|

|

Item 8.01

|

|

Other Events

|

|

54

|

| |

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits

|

|

55

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

Unless otherwise specified or required by context, references to “we,” “the Company”, “our” and “us” refer collectively to (i) Tamandare Explorations Inc. (“Tamandare”), (ii) Tonix Pharmaceuticals, Inc., a Delaware corporation (“Tonix”), which is wholly-owned by Tamandare, and (iii) Krele LLC, a Delaware limited liability company (“Krele”), which is wholly-owned by Tonix.

Item 1.01 Entry into a Material Definitive Agreement

Background

As more fully described below, on October 7, 2011, we consummated a number of related transactions through which we acquired control of Tonix. Tonix is a specialty pharmaceutical company focusing on developing new pharmaceutical products that are safer and more effective than widely prescribed central nervous system (“CNS”) drugs in large and growing markets.

The Share Exchange Transaction

On October 7, 2011 (“Closing Date” and the closing of the share exchange transaction, the “Closing”), Tamandare executed and consummated a share exchange agreement by and among Tonix and the stockholders of 100% of the equity securities of Tonix, including, the holders of 5,207,500 shares of common stock, 1,500,000 shares of Series A Preferred Stock and 2,275,527 shares of Series B Preferred Stock (the “Tonix Shareholders”), on the one hand, and Tamandare and David Moss (“Moss”), the sole officer and director and majority shareholder of Tamandare, on the other hand (the “Share Exchange Agreement” and the transaction, the “Share Exchange”).

In the Share Exchange, Tonix’s Shareholders exchanged their shares of Tonix for newly issued shares of common stock of Tamandare (“Common Stock”). As a result, upon completion of the Share Exchange, Tonix became Tamandare’s wholly-owned subsidiary.

Upon completion of the Share Exchange, the current shareholders of Tonix received in exchange for all of their shares of Tonix’s Common Stock, an aggregate of 22,666,667 shares of Tamandare’s Common Stock. Moss returned 1,500,000 shares of Common Stock to Tamandare, which were retired, and Tamandare’s existing stockholders retained 4,000,000 shares of Common Stock. The 22,666,667 shares issued to Tonix’s Shareholders constituted approximately 85% of Tamandare’s 26,666,667 issued and outstanding shares of Common Stock post-Closing.

In addition, Moss resigned as an officer of Tamandare, and all of Tonix’s current officers became executive officers of Tamandare, and Seth Lederman was appointed as Chairman of Tamandare. In addition, Moss resigned as a director effective ten days after the filing and mailing of the Schedule 14f-1 in connection with the Share Exchange, at which time, Tamandare will appoint Stuart Davidson, Patrick Grace, Donald Landry, Ernest Mario, Charles Mather and John Rhodes as directors.

Our board of directors (the “Board”) as well as the directors and the shareholders of Tonix, each approved the Share Exchange Agreement and the transactions contemplated thereunder.

As a result of the Share Exchange, we acquired 100% of the capital stock of Tonix and consequently, control of the business and operations of Tonix and Krele. Prior to the Share Exchange, we were a public reporting company in the development stage that was considered a shell company (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). From and after the Closing Date of the Share Exchange, our primary operations consist of the business and operations of Tonix and Krele.

In connection with the Closing, on October 7, 2011, we sold to certain investors (the “Purchasers”) for aggregate cash proceeds of $1,125,000, secured convertible debentures (the “Debentures”) in the principal face amount of $1,125,000 and the exchange of $500,000 in previously issued Notes, as hereinafter defined, of Tonix that were converted into Debentures in the principal face amount of $500,000 (the “Financing”). The description of other material terms and conditions of the Financing are set forth in Item 3.02 below.

Item 2.01 Completion of Acquisition or Disposition of Assets .

As described in detail in Item 1.01 above, on October 7, 2011, we acquired the stock of Tonix pursuant to the Share Exchange Agreement. As a result of the reverse acquisition, our principal business became the business of Tonix, which is a specialty pharmaceutical company focusing on developing new pharmaceutical products that are safer and more effective than widely prescribed CNS drugs in large and growing markets.

DESCRIPTION OF OUR BUSINESS

Corporate Overview

In 1996, Seth Lederman, MD, and Donald Landry, MD, PhD, formed L&L Technologies, LLC, (“L&L”), to develop medications for central nervous system (“CNS”) conditions. Dr. Lederman is Chairman and President of Tonix and Dr. Landry is a Director. L&L was a founder of Janus Pharmaceuticals, Inc., later renamed Vela Pharmaceuticals, Inc., (“Vela”), which developed various therapeutics, including a very low dose, or VLD, version of cyclobenzaprine, under an agreement with L&L. Vela decided to focus its resources on other programs and transferred the rights in VLD-cyclobenzaprine and certain other technologies to L&L in March 2006. Dr. Lederman, our Chairman and CEO and Dr. Landry, our director, are members of L&L.

We were formed in June 2007 as Krele Pharmaceuticals, Inc. by L&L and Krele Pharmaceuticals, LLC (now known as Plumbline LLC) (“Plumbline”). Dr. Lederman, our Chairman and President, is managing partner of Plumbline. Plumbline possessed rights to certain technology for the treatment of alcohol dependence and abuse. In connection with founding Tonix, L&L and Plumbline entered into an intellectual property transfer and assignment agreement with Tonix for the purpose of assigning patents and transferring intellectual property and know-how in exchange for shares of common stock of Tonix. As a result of economic conditions related to the financial crisis of 2007 and 2008, we were not successful in raising money to fund our programs until 2009. As a result, we were unable to advance the development programs and had little activity except for prosecuting and maintaining patents and maintaining contracts.

In 2009, we contracted with the Toronto Psychiatric Research Foundation to analyze the sleep data from the 2001 Phase 2a study of 36 patients with FM (the “Moldofsky Study”), who were treated with bedtime VLD cyclobenzaprine or placebo. The Moldofsky Study was conducted in Canada by the Toronto Psychiatric Research Foundation, and we obtained the data from this study from L&L. In addition, in 2009, we contracted with Caliper Life Sciences (formerly, NovaScreen Bioscience Corp.) (“Caliper”) to analyze the interactions of cyclobenzaprine with certain receptors. In June 2010, we entered into consulting agreements with L&L and Lederman & Co, LLC (“Lederman & Co”) and also acquired certain rights to develop isometheptene mucate as a treatment for certain types of headaches from Lederman & Co., which we are developing as TNX-201. Dr. Lederman, our Chairman and President, is managing partner of Lederman & Co. Since June 2010, we have recruited several members to the BOD (Dr. Mario and Messrs. Davidson, Rhodes and Mather), hired additional management (Ms. Rosen and Mr. Selzer) and started dosing normal healthy volunteers for the pharmacokinetic trial for TNX-102.

Lederman & Co predominantly provides us with clinical development expertise. L&L predominantly provides us with scientific development expertise. Relative to traditional pharmaceutical development companies, we can be considered a virtual company, since we contract with third-party vendors to provide many functions that are core to traditional pharmaceutical companies. For example, we have contracted with PharmaNet Canada, Inc., or PharmaNet Canada, to develop methods for analyzing cyclobenzaprine in the blood and to conduct a human clinical study to evaluate the performance of our formulation technology. Lederman & Co is responsible for overseeing the scientific and technical aspects of PharmaNet’s contract work product.

In July 2010, we changed our name to Tonix Pharmaceuticals, Inc. In August 2010, Tonix formed a wholly owned subsidiary, Krele LLC (“Krele”).

Business Overview

Our lead product candidate, TNX-102, is a new optimized dosage form of cyclobenzaprine. TNX-102 is being developed for the management of fibromyalgia syndrome, or FM. FM is a CNS condition that is characterized by diffuse musculoskeletal pain, increased pain sensitivity, fatigue and disturbed sleep. Cyclobenzaprine is the active pharmaceutical ingredient of two U.S. Food and Drug Administration (“FDA”) approved and widely prescribed muscle relaxant products: Flexeril®, an immediate-release form, marketed by the McNeil Specialty Pharmaceuticals division of Johnson & Johnson, and Amrix®, a controlled release form marketed by Cephalon. Generic copies of Flexeril (cyclobenzaprine in the immediate-release form) are available and many patients receive a generic when their physician prescribes Flexeril. According to a study conducted by Frost & Sullivan on behalf of Tonix relating to the FM market in the United States (“Frost and Sullivan”), the immediate-release dose form of cyclobenzaprine is widely used off-label to treat FM. We are working to optimize the dose and formulation of TNX-102 to treat FM safely and effectively. We plan to subject TNX-102 to the strict testing required for FDA approval, which we believe will take at least four years and significant clinical studies. We have conducted an initial study of TNX-102 and are currently undertaking a comparative pharmacokinetic and bioavailability study, which we anticipate will be completed by the end of 2011 and the analysis of the subjects’ blood samples will be completed in the first quarter of 2012. If TNX-102 is ultimately approved by the FDA for the management of FM, we believe it will be adopted by physicians and reimbursed by managed care companies.

Our other leading product candidate, TNX-105, which we are also developing, is a new dose form of cyclobenzaprine to treat symptoms of post-traumatic stress disorder, or PTSD. PTSD is a psychiatric disorder that begins in the aftermath of traumatic experiences. Sleep disturbances, including nightmares and insomnia, are core features of PTSD and are included in two of the three main symptom clusters. Patients with PTSD may have any single or combination of symptoms that include re-experiencing, emotional numbing and avoidance, and hyperarousal reactions that persist for more than one month after the traumatic event. PTSD shares several features with FM and some patients are believed to suffer from both PTSD and FM.

Cyclobenzaprine is the active pharmaceutical ingredient in each of our lead product candidates. We are utilizing drug delivery technology to produce new formulations. In addition to cyclobenzaprine, each formulation of TNX-102 and TNX-105 will contain inactive ingredients, called excipients that are well-characterized and have been FDA approved previously in other products. As a result, we anticipate seeking FDA marketing approval of our lead product candidates, TNX-102 and TNX-105, through the New Drug Application, or NDA process under Section 505(b)(2) of the U.S. Federal Food, Drug and Cosmetic Act, or the FFDCA, which we also refer to as Section 505(b)(2). This process permits the FDA to make some safety and effectiveness determinations through review of materials in the public domain or in already approved NDAs. This approach would spare us some of the burden of generating all of these data for ourselves and may allow our lead product candidates to progress through a shorter development pathway than is typical for pharmaceutical products based on novel active ingredients. We have not filed an NDA for either of our lead product candidates.

We also have a pipeline of several other product candidates that we are constantly evaluating. For example, we are developing TNX-201, which is a treatment for certain types of headaches and TNX-301, which is a potential treatment for alcohol dependence and addiction. For commercial reasons, we normally do not disclose the identities of the active ingredients or targeted indications of products in our pipeline until a U.S. patent has been allowed. Consistent with our mission, these product candidates are, or likely will be, reformulations of active ingredients that have been used by patients in other FDA-approved products. We anticipate that some of our other pipeline products will be submitted to the FDA for approval under Section 505(b)(2). In other cases, we expect that the products will be formulated to match earlier predicate products closely enough to rely, in part, on their regulatory review and status. There may be instances where the predicate product is a medicine that was reviewed for safety and effectiveness by the National Academy of Sciences under the Drug Evaluation and Safety Initiative, or DESI, and would be considered by the FDA to be an “unapproved product.” For DESI products, it is our intent also to develop NDA versions by modernizing the chemistry, manufacturing and controls and to perform new clinical studies to support an NDA filing under Section 505(b)(2).

Because of our size and being in the development stage, we do not currently devote a significant amount of time or resources towards our other pipeline candidates. We anticipate that sometime in 2012 we will begin developing formulations for TNX-201 and possibly TNX-301, but do not expect to start clinical trials until 2013 at the earliest.

Krele’s mission is to commercialize products that are generic versions of predicate NDA products or existing marketed products that it may acquire from other pharmaceutical companies. We expect that Tonix’s relationship to Krele will be similar to that of several other pharmaceutical companies and their subsidiaries that market generic versions of the parent’s branded products at different periods in their product life-cycle. We anticipate that when one of our branded products loses patent protection, Krele may market generic versions of it. In such instances, Krele’s product would be an “authorized generic” and would rely on our NDA. Krele may also develop or acquire generic products approved under Abbreviated New Drug Applications (“ANDAs”). For ANDAs, the predicate product is a medicine approved by the U.S. Food and Drug Administration (the “FDA”) under an NDA. Tonix may market branded versions of such products that rely on Krele’s ANDAs which would be referred to as branded generics. Neither Tonix nor Krele currently market any products and have only begun the process of obtaining state licenses, which are legally required before a company can manufacture, distribute and market prescription medications. Krele has been issued a state license in New York.

Our Strategy

Our objective is to develop and commercialize our product candidates to treat CNS conditions, including FM and PTSD. The principal components of our strategy to achieve this objective are to:

| |

● |

pursue development and regulatory approval pathways by reformulating versions of approved drugs for new uses and by using the Section 505(b)(2) pathway for FDA approval;

|

| |

●

|

adopt a two-pronged patent strategy by seeking methods of use patents for the active ingredients in our products and by seeking protection for the formulation technology employed in our products;

|

| |

● |

provide clear value propositions to third-party payers, such as managed care companies or government programs like Medicare, to merit reimbursement for our product candidates; and

|

| |

●

|

enter into collaborations with other pharmaceutical companies with respect to, among others, our FM and PTSD product candidates and other products that will benefit from development or marketing resources beyond those in our Company.

|

Pursue development and regulatory approval pathways. We believe our lead product candidates may be approvable under pathways that are potentially shorter than those typically available for drug products based on novel active ingredients. By focusing on developing new formulations of approved drugs for new uses, we believe that we will be able to use the Section 505(b)(2) pathway for FDA approval. This pathway can reduce the time and expense required for our development programs by allowing our use of previously-generated safety and efficacy information regarding the active pharmaceutical ingredients in our lead product candidates to support the filing and approval of our NDA application. Doing so may help reduce the size and scope of our preclinical and clinical trials.

Adopt a two-pronged patent strategy. We are pursuing a two-pronged patent strategy by seeking intellectual property protection for our methods of use for certain known active pharmaceutical ingredients and by seeking patents to protect the formulation technologies we employ. With respect to the methods of use patents, we believe the therapeutic uses we target are new uses for these active ingredients and we have been issued patents directed to certain aspects of our new uses. We are seeking additional patents to cover other new uses. For example, the invention of bedtime VLD cyclobenzaprine as a treatment for FM was novel and unexpected when our patents were filed in 2000. With respect to formulation patents, we believe our products will be protected by patents that describe inventions of technology for making new formulations and possibly also by patents that describe the invention of products that achieve novel and useful blood levels at certain times after administration.

Provide clear value propositions to third-party payors to merit reimbursement for our product candidates. We are designing our clinical development programs to demonstrate compelling competitive advantages to patients and prescribers and also to demonstrate value propositions to third-party payors. We believe TNX-102 might help in the management of FM by reducing pain and other symptoms, such as fatigue. In addition, we believe that bedtime treatment with TNX-102 will have fewer day time side-effects than off-label bedtime treatment with immediate release cyclobenzaprine. For FM, we believe an FDA-approved product would capture some of the off-label use of generic cyclobenzaprine. Because FDA approvals are based on objective data, we believe that third-party payors will provide reimbursement for an FDA approved product, even at a premium price relative to other drugs that are used off-label, such as immediate-release cyclobenzaprine, tizanidine, baclofen, carisoprodol or metaxalone. For example, third-party payors reimburse for using FDA approved Lyrica® and Cymbalta® for fibromyalgia over off-label generic versions of Neurontin® (gabapentin) and generic anti-depressants, respectively.

Enter into collaborations to maximize the value of our technology. We believe certain of our drug development candidates, including TNX-102 and TNX-105, can be marketed more effectively by companies that already have significant drug development and marketing capabilities. We will seek to enter into collaborations with pharmaceutical or biotechnology companies for the commercialization of these product candidates at the times we believe most effective.

Our Lead Product Candidates

Our lead product candidates are TNX-102, for the treatment of FM and TNX-105 for the treatment of PTSD. Both of these consist of cyclobenzaprine in a mixture of inactive ingredients that are called “excipients”, which we believe will improve the absorption rate of cyclobenzaprine in ways that will optimize the product for bedtime treatment.

Cyclobenzaprine

Cyclobenzaprine was first synthesized in 1961 by Merck, and the 10 mg Flexeril® immediate-release dose form was FDA approved in 1977 for the relief of muscle spasm associated with acute, painful musculoskeletal conditions as an adjunct to rest and physical therapy.

Although a number of clinical studies have addressed the potential use and benefit of cyclobenzaprine in treating symptoms of FM, to our knowledge these studies have not motivated a sponsor to pursue FDA approval.

Based on cyclobenzaprine’s safety and efficacy for treating muscle spasm, in the 1990s, Merck conducted studies to support an application to market a 5 mg cyclobenzaprine tablet (low dose) for the over-the-counter, or OTC, market, where patients can purchase medicine without a physician’s prescription. Although Merck’s studies re-affirmed the safety and demonstrated efficacy of 5 mg cyclobenzaprine in several large trials, the OTC division of the FDA rejected the application for use without a prescription, apparently, we believe, because muscle spasm was deemed a condition that required a physician to diagnose and supervise treatment.

Merck divested the Flexeril franchise to Alza Pharmaceuticals, or Alza. Alza subsequently was acquired by Johnson and Johnson and Flexeril is part of their McNeil Specialty Pharmaceuticals division. Based largely on the Merck studies, McNeil won approval of Flexeril 5 mg tablets as a prescription medicine to treat muscle spasm. McNeil promoted Flexeril 5 mg tablets for the three year period of market exclusivity based on The Drug Price Competition and Patent Term Restoration Act of 1984, generally referred to as the Hatch-Waxman Act. Following this exclusivity period, several generics entered the market and took market share from Flexeril. McNeil continues to manufacture Flexeril, but we believe McNeil no longer actively promotes it.

Despite the approved uses of cyclobenzaprine in treating muscle spasm, we believe current marketed formulations of cyclobenzaprine are limited for treating FM by unpredictable absorption. As described in the Flexeril package insert, the amount of cyclobenzaprine absorbed into the bloodstream varies between 33-55% of the dose ingested. The variability in absorption may be due to several factors, including effects of the stomach pH (acidity or base) on the dissolution of the tablets, as well as the context of either an empty stomach or a recent meal. Food in the stomach and small intestine from a recent meal contributes to variability in absorbing other drugs. The uncertainties in absorption rates make it challenging for a physician contemplating a bedtime treatment for FM to ensure the intended therapeutic effect is achieved without risking side effects like next-day drowsiness, which could result if the patient has too much cyclobenzaprine remaining in the bloodstream the next day.

If a product could deliver a predictable absorption rate of cyclobenzaprine, it would mean patients would be less likely to receive too little drug to receive a therapeutic effect. Conversely, patients would be less likely to be over-dosed, which might lead to potential side effects, including next-day drowsiness. An optimal VLD-cyclobenzaprine product could have faster absorption, faster clearance and more predictable effects than the immediate release tablet format. To optimize the properties of TNX-102 for FM and TNX-105 for PTSD, we are developing a novel gelatin capsule (gelcap) that employs a proprietary mixture of lipids with cyclobenzaprine. The proprietary lipid mixture is designed to increase the rate and efficiency of absorption of cyclobenzaprine from the gastrointestinal tract into the bloodstream. This formulation is expected to result in increased dosage precision. However, the science of formulating drugs is not sufficiently advanced to predict the performance of the new gelcaps in the humans. We will only learn if our design has advantageous properties when we test TNX-102 in human subjects.

TNX-102 in Fibromyalgia Syndrome

TNX-102, our most advanced product candidate, is a bedtime pill containing VLD-cyclobenzaprine (2.4 mg). The development of TNX-102 is supported by the results of the Moldofsky Study of VLD cyclobenzaprine in FM patients. TNX-102 has been manufactured in small quantities for use in human clinical trials. Based on our formulation of TNX-102, we believe it will provide more predictable effects and decreased risk of next-day drowsiness than commercially available immediate-release cyclobenzaprine tablets. We are designing our pill for faster and more efficient absorption relative to currently marketed cyclobenzaprine products.

FM is diagnosed by groups of symptoms that have been defined by committees of the American College of Rheumatology, or ACR, and a committee of experts from the organization Outcome Measures in Rheumatology. In 2007, Pfizer’s Lyrica® (pregabalin) became the first medicine approved by the FDA for the management of FM. In 2008, Eli Lilly’s Cymbalta® (duloxetine) became the second medicine approved by the FDA for the management of FM. In 2009, Savella® (milnacipran) was the third medicine approved by the FDA for the management of FM. Savella is marketed by Forest Laboratories.

Product Development Path

Phase 2a Pilot Data in FM Patients

Our motivation to focus our efforts on developing TNX-102 for FM stems from the results of a clinical study on 36 patients in 2001, the related rights to which we acquired from L&L. Specifically, this study was a randomized, double-blind, placebo-controlled, dose-escalating eight week trial conducted at two study centers. The study subjects met ACR criteria for FM.

Patients received VLD-cyclobenzaprine immediate-release 1 mg capsules or corresponding placebo capsules to ingest after dinner and before bedtime. Initially, patients took one capsule each evening, but over the course of the study, they were allowed to increase the number of tablets taken in increments of one capsule per week. The maximum number of capsules allowed was four per evening, which would be a total dose of 4 mg immediate-release cyclobenzaprine.

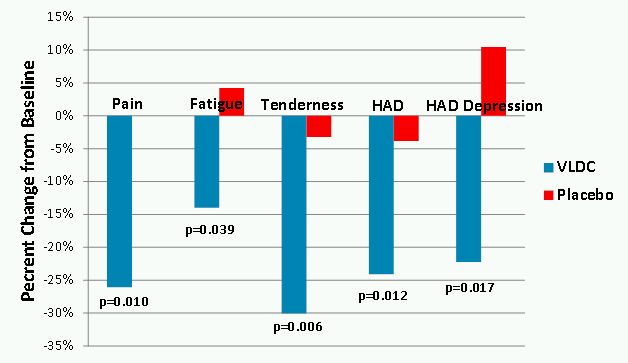

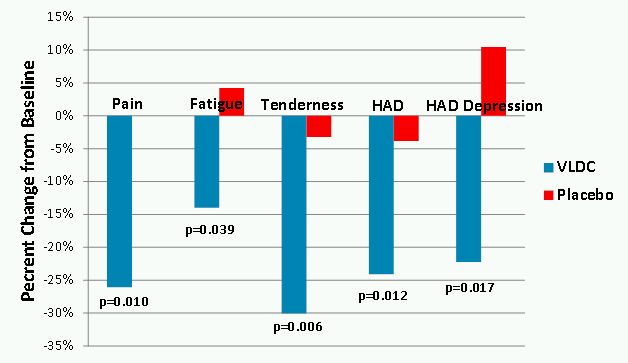

Patients treated with VLD-cyclobenzaprine demonstrated significant improvements in pain, fatigue and tenderness at week 8 relative to baseline whereas, placebo-treated patients did not improve (Figure 1). Although this study excluded patients who met formal criteria for major depressive disorder or any anxiety disorder, there is a high degree of co-existing symptoms of depression and anxiety associated with FM. VLD-cyclobenzaprine treatment resulted in significant reductions in total Hospital Anxiety and Depression Scale, or HAD, which measures symptoms of anxiety and depression, and the HAD depression subscale which measures depressive symptoms (Figure 1).

Figure 1.

This study showed treatment with VLD-cyclobenzaprine:

|

●

|

provided benefit in core symptoms of FM, including pain and fatigue;

|

|

●

|

improved mood, by demonstrating a significant decrease in HAD scores; and

|

|

●

|

was well tolerated, with no serious adverse events, or SAEs, or discontinuations due to adverse events, or AEs.

|

Pharmacokinetic Study

We have initiated a human clinical study being conducted by a contract research organization, or CRO, under an US Investigational New Drug Application, or IND, and a Canadian Clinical Trial Application. We received FDA and Health Canada clearance for this study, which is being conducted in Canada. This study will determine the blood levels of cyclobenzaprine in approximately 30 healthy adult volunteers after they ingest either TNX-102, a candidate gelcap formulation containing low-dose cyclobenzaprine or a currently marketed, immediate-release cyclobenzaprine product. Studies that measure the blood levels of drugs over time are called “pharmacokinetic studies”. The TNX-102 formulation is being tested in subjects who are either fasting or recently fed. This study seeks to measure the circulating blood levels of cyclobenzaprine after oral administration of the TNX-102 candidate formulation in a fed or fasting state and determine how they compare to the blood levels resulting from oral administration of the currently marketed product in a fasting state. Each subject receives each of the trial doses and conditions in a random order, in what is called a crossover study design. The crossover design allows the assessment of the variability of drug blood levels over time in the same people during each phase. We selected PharmaNet Canada to conduct this pharmacokinetic study. We expect the clinical portion of this study to be complete by the end of 2011 and to analyze the specimens and interpret the data in the first quarter of 2012. The study is expected to cost approximately $1 million, which includes the cost of manufacturing TNX-102 and placebo.

Prospective Phase 2b Study

If our pharmacokinetic study is successful, we expect to advance the clinical development of TNX-102 for the management of FM by conducting a larger Phase 2b placebo-controlled study. Utilizing our gelcap formulation, we will seek to replicate and expand upon the efficacy and safety findings of our Moldofsky Study by administering the commercial form of TNX-102 or placebo to approximately 300 FM patients for twelve weeks. We expect that our proposed Phase 2b will be one of the two clinical efficacy trials required for FDA approval.

We expect the outcome measures for efficacy in this study will be similar to those utilized by drug products currently approved for use in FM. Specific efficacy outcome measures will include the Brief Pain Inventory, the Patient Global Impression of Change (PGIC) and the Fibromyalgia Impact Questionnaire (FIQ). Additional outcome measures for this trial will be carefully planned to further our exploration of treatment effects in important areas such as sleep, fatigue, mood, sexual function and quality of life. We will seek FDA concurrence on the study design and expect to engage a CRO to conduct this study on our behalf. We expect the study will enroll a first patient in the third quarter of 2012 and will be completed in the third quarter of 2013. We anticipate this study will cost approximately $15 million, which includes the cost of manufacturing TNX-102 and placebo.

Prospective Multi-dose Pharmacokinetic Study

Since cyclobenzaprine will be used chronically, we will study TNX-102 in comparison to immediate-release cyclobenzaprine in multiple day dosing (once daily). Subjects will ingest TNX-102 or immediate-release cyclobenzaprine for four or more days. Peak and trough blood levels of cyclobenzaprine will be measured. The results of this study will provide information regarding blood levels of cyclobenzaprine when taken in a multiple day regimen.

Prospective Study Comparing Side-effects of TNX-102 with Immediate-Release Cyclobenzaprine

We plan to conduct a small study designed to compare the bedtime use of TNX-102 and immediate-release cyclobenzaprine on next morning drowsiness. The goal of this study is to determine the potential benefit of TNX-102 compared with immediate-release cyclobenzaprine on next morning drowsiness.

Prospective Phase 3 Study

If our Phase 2b study is successful, then we expect to conduct a Phase 3 study in support of product registration. At this time, we plan to conduct one large scale, randomized, double-blind, placebo-controlled Phase 3 study in which patients with FM will receive TNX-102 or placebo for six months. It is likely that the outcome measures for efficacy in this study will be similar to those used in the Phase 2b study. Other outcome measures will be carefully considered to best support desired label claims and optimal marketing message for product differentiation. We expect that at least 300 FM patients will be enrolled in this trial.

Safety Exposure Study

To study the safety of our product in chronic use, we expect to conduct an open label study in which approximately 300 FM subjects would receive TNX-102 for up to one year. Together with our other studies, we believe this safety exposure study will support the FDA and international regulatory requirements to provide data for at least 300 subjects treated with TNX-102 for six months and at least 100 subjects treated for 1 year.

Regulatory Strategy

The approvals of Lyrica®, Cymbalta® and Savella® establish a regulatory approval standard for management of FM. However, given the heterogeneity of patients with this disease, it may not prove to be the only pathway or approval requirement. Prior to meeting with the FDA for an End-of-Phase 2 (EOP2) meeting, we plan to strategically assess the regulatory environment and further evaluate our Phase 2 results in order to determine the optimal design of phase 3 clinical program. The phase 3 study design will be discussed with the FDA at the EOP2 meeting to receive regulatory acceptance for a differentiated product for the management of FM.

We hope to register TNX-102 with the FDA through the provisions of Section 505(b)(2). This regulatory pathway may help to accelerate product development and reduce overall business risk. The 505(b)(2)-based product development plan for TNX-102 is designed to leverage the safety data that has been generated by other manufacturers for cyclobenzaprine-containing products and accepted by the FDA in support of their product registration. TNX-102 contains significantly less active cyclobenzaprine than other marketed products. We believe that the safety data package from these products will provide adequate safety margin to support TNX-102 development.

On August 11, 2011, we had a pre-IND meeting with the Division of Anesthesia, Analgesia and Addiction Products within the Center for Drug Evaluation and Research at the FDA to discuss the IND and NDA requirement of TNX-102 for the management of FM. Based on the meeting outcome, we successfully filed an IND application on October 10, 2011, which received FDA clearance on our IND study on November 10, 2011. The planned IND study is conducted in Canada under a Canadian Clinical Trial Application filed October 7, 2011, which received “No Objection Letter” on November 7, 2011. We will continue working with the FDA to seek guidance and agreement on the TNX-102 development program, specifically the necessary data to support the 505(b)(2) NDA regulatory pathway. As FDA indicated at the pre-IND meeting, the clinical trials in our development plan, if successful, will provide efficacy and safety data sufficient to support an NDA filing.

If NDA approval is granted for TNX-102, in addition to the 3-year marketing exclusivity granted, TNX-102 is expected to be covered under patents that extend through at least 2020, during which time it should not be subject to generic substitution. We plan to continue to support the TNX-102 program with new patent applications as we obtain data from the clinical evaluation of our new formulation in healthy human subjects and FM patients.

TNX-105 in Post-traumatic Stress Disorder

TNX-105, our second most advanced product candidate, is another pill formulation of cyclobenzaprine to be taken at bedtime for PTSD, a psychiatric disorder that begins in the aftermath of traumatic experiences. We have not yet conducted any clinical trials on PTSD patients.

Parallels Between FM and PTSD

A number of parallels have been noted between FM and PTSD. In addition, symptom overlaps may exist between patients diagnosed with FM or PTSD. In a survey of males with PTSD or major depression (Amital, Fostick et al, Posttraumatic stress disorder, tenderness, and fibromyalgia syndrome: are they different entities? J. Psychosom Res 2006. 61(5):663-9.2006), 49% of PTSD patients met the ACR criteria for FM compared to 5% of major depression patients. Conversely, in a different survey of FM patients (Cohen, Neumann et al., Prevalence of post-traumatic stress disorder in fibromyalgia patients: overlapping syndromes or post-traumatic fibromyalgia syndrome? Semin Arthritis Rheum 2002. 32(1):38-50), 57% of the sample had symptoms associated with PTSD.

Emerging Market Opportunity

The selective serotonin reuptake inhibitors Paxil® (paroxetine) and Zoloft® (sertraline) are FDA approved for PTSD, but are not satisfactory treatments for many patients. Other drugs that show promise for the treatment of PTSD, but are not FDA approved, include antidepressants such as nefazodone, mirtazapine and trazodone; the antihistamine cyprohetadine; certain atypical antipsychotics such as olanzepine and resperidone; and an adrenergic alpha-1 receptor blocker, prazosin. Prazosin may decrease nightmares and insomnia and has been associated with improvements in daytime PTSD symptoms, depression, and quality of life.

Our rationale for studying the effects of cyclobenzaprine in PTSD derives from the following:

|

●

|

our clinical studies that very low dose cyclobenzaprine improves FM symptoms, a disorder having significant overlap with PTSD; and

|

|

●

|

in studies conducted by Caliper, cyclobenzaprine interacts with a receptor on brain cells called the serotonin type 2a receptor. Based on numerous peer-reviewed scientific publications, we have identified a number of compounds that bind this receptor that have been shown to have effects in treating PTSD. Therefore, it is our belief that cyclobenzaprine, because it binds to the serotonin type 2a receptor, will have a therapeutic effect in treating PTSD like other compounds that bind to it.

|

In 2009, we engaged Caliper to learn which receptors in the brain blind cyclobenzaprine. Caliper measures the interactions of receptors with active pharmaceutical ingredients and has built a proprietary database. Arthur Weissman, PhD is Vice President and Chief Scientific Officer at Caliper and supervised the receptor study. Dr. Weissman holds a M.S. degree in Physiology, a Ph.D. degree in Neuroscience, has over 25 years of scientific research and has authored (or co-authored) over 20 peer-reviewed scientific publications. The receptor studies were conducted at Caliper’s facilities. Caliper is constantly conducting receptor studies to expand and refine its database, so the date of each individual receptor-drug analysis is different. Caliper provided us proprietary data from their database, which showed cyclobenzaprine binds to the serotonin type 2a receptor.

Product Development Path

Prospective Phase 2a and 2b Studies

We anticipate that the dose for treatment of PTSD symptoms may be higher than that of TNX-102 for FM. We plan to utilize the data obtained from the pharmacokinetic study of TNX-102 to design a Phase 2a study for TNX-105. We expect that this study will employ the same formulation technology used for FM, but will be dosed with multiple pills to explore a dose range for efficacy and tolerability in PTSD. The estimated treatment period will be six to eight weeks in duration.

As part of our contemplated Phase 2a study, we plan to assess the appropriateness of a number of clinical outcomes for use as primary and secondary measures. The PTSD clinical study measures used for further development work must provide adequate specificity and sensitivity to measure the potential effects of cyclobenzaprine. In our Phase 2a study, we anticipate that we will study TNX-105 in less than 50 subjects with combat-related and/or civilian PTSD. We expect to engage a CRO to conduct this study on our behalf.

After exploring the clinical utility and dose range in a Phase 2a study, we intend to advance the clinical development of TNX-105 for the treatment of PTSD by conducting a larger randomized, double-blind, placebo-controlled study in Phase 2b. The treatment period is estimated to be eight to twelve weeks in duration. We will seek to replicate and expand upon the efficacy and safety findings of the Phase 2a study in a larger population of PTSD patients. In our Phase 2b study, we anticipate that we will study the drug in 100 to 150 subjects with combat-related and civilian PTSD. We expect to engage a CRO to conduct this study on our behalf.

Prospective Phase 3 Study

If our Phase 2b study is successful, we expect to conduct a Phase 3 program in support of an NDA. At this time, our general plan includes two large scale, randomized, double-blind, placebo-controlled Phase 3 studies, and one open-label extension study. We anticipate that the treatment duration for the two large studies will be approximately 12-16 weeks in length. The numbers of patients to be evaluated is unknown at this time. We plan to confer with the FDA concerning the suggested sample sizes in an End-of-Phase 2 program review meeting. Once completing their participation in one of the two large scale studies, we expect our subjects will have the choice of enrolling in an available open-label study whereby we can assess the longer-term benefits of TNX-105 therapy in PTSD.

Regulatory Strategy

The approvals by the FDA of Paxil® (paroxetine) and Zoloft® (sertraline) for treating PTSD establish a regulatory approval pathway for symptom reduction in PTSD. We plan to strategically assess the regulatory environment and further evaluate our Phase 2 results to determine the design of Phase 3 clinical studies. We believe these studies will result in a differentiated product for the treatment of PTSD. We hope to register TNX-105 with the FDA through the provisions of Section 505(b)(2).

We anticipate meeting with the Center for Drug Evaluation and Research at the FDA to discuss TNX-105 at the appropriate time in the future and would review the basis of our Section 505(b)(2) clinical development plan and discuss any other clinical and nonclinical trials necessary to support an NDA filing. We believe that the clinical trials in our development plan, if successful, will satisfy the requirements for sufficient evidence of clinical efficacy and safety to support an NDA.

TNX-105 is expected to be covered under patents that have been submitted to the USPTO. The USPTO has not yet allowed or granted any claims protecting the use of TNX-105.

Drug Delivery Technology

We identified and obtained an exclusive worldwide option on technology from Lipocine, Inc. (“Lipocine”) that employs mixtures of different types of lipids to envelop cyclobenzaprine molecules in the small intestine and facilitate absorption into the bloodstream. We believe this approach has potential for more consistent absorption and decreased variability in blood levels.

Under our agreement, Lipocine studied a number of combinations of lipids for their ability to form micelles that solubilize the free base of cyclobenzaprine and which might serve as inactive ingredients in a gelatin capsule formulation. We selected a candidate formulation based on properties that included the dispersion of the active ingredient in simulated gastric or small-intestinal fluids and the stability of the formulation over time prior to testing. Lipocine was also engaged to manufacture gelatin capsules of TNX-102 for use in our pharmacokinetic trial. In the option agreement, we agreed to make certain sublicense, royalty and milestone payments, which are subject to a request for confidential treatment. Pursuant to the agreement, we have an option to license Lipocine’s US patent 6,294,192 “Triglyceride-free compositions and methods for improved delivery of hydrophobic therapeutic agents” and US Patent 6,451,339 “Compositions and methods for improved delivery of hydrophobic agents”. These patents expire on September 24, 2021 and September 16, 2022, respectively. If we exercise the option to license these patents, we will be obligated to pay Lipocine low single-digit percentage royalties based on net sales or mid-teen sublicense fees based on the consideration that we receive from a licensee.

Both of our cyclobenzaprine-based product candidates consist of cyclobenzaprine in capsules that also contain proprietary mixtures of lipids, that are inactive but help the small intestine absorb cyclobenzaprine. TNX-102 and TNX-105 are formulations of cyclobenzaprine and mixtures of lipids that are intended as bedtime treatments for FM and PTSD, respectively. We have concluded a study of the stability and dissolution of several candidate formulations in simulated gastric and small-intestinal fluids. The study was conducted in 2007 at Lipocine’s facilities. The first element of the study was to screen lipid ingredients for use in a gelcap. In this study, various lipid ingredients were mixed with cyclobenzaprine to determine solubility and suitability for formulating cyclobenzaprine in gelatin capsules, or gelcaps. Based on the results of the screening, four formulations of cyclobenzaprine hydrochloride were prepared and analyzed for how efficiently they released or dispersed cyclobenzaprine into solutions of simulated gastric and small-intestinal fluid. Each of the four formulations resulted in about 95% or more of cyclobenzaprine in solution. Three of four formulations rapidly (at 30 minutes) released more than 90% of cyclobenzaprine into an acidic solution that simulates gastric conditions. The second element of the study evaluated physical stability of the formulations. The four candidate formulations were filled into capsules and subjected to stability conditions at high temperature and temperature cycling. None of the four formulations showed signs of phase separation or crystallization of cyclobenzaprine. All four formulations were stable and none showed signs of reduction in cyclobenzaprine potency compared to the initial time. From these data, we selected two potential formulations for further study based on solubility level and speed of dissolution in acid.

Results from this study showed that certain proprietary lipid mixtures interact with cyclobenzaprine to help solubilize it in simulated gastric and small-intestinal fluids. Based on the study, we have selected a candidate formulation for cyclobenzaprine to be dosed at bedtime. We expect TNX-102 and TNX-105 will employ the same formulation, but TNX-105 will contain a higher dose of cyclobenzaprine in the gelatin capsule. We believe our gelcap formulation will result in the more efficient and more predictable cyclobenzaprine absorption than immediate-release cyclobenzaprine tablets that are commercially available for daytime use to treat muscle spasm. Since we expect our formulations will be more efficiently absorbed, we believe lower doses of cyclobenzaprine in our proprietary formulations with lipids will provide a similar therapeutic benefit to higher doses of immediate-release cyclobenzaprine.

Market Dynamics

We believe the U.S. market for products that treat CNS conditions has several characteristics that make it an attractive market for pharmaceuticals, including that the customer base is driven by physicians who are involved in long-term care of patients with chronic disorders. Patients with CNS disorders sometimes carry disease burdens that require long-term treatment.

We believe the market for FDA-approved FM treatments is underserved and that there is a constant need for new treatment options, since many prescription drugs provide relief only to some of the affected patients or provide relief only for limited periods of time.

Until 2007, there were no FDA-approved drugs to treat FM. A number of effective medicines have been identified by physicians who observe improvements in a patient’s condition as an unintended consequence of prescribing a particular medicine for another purpose. These anecdotal observations are sometimes substantiated by exposing additional patients in progressively more systematic studies. As information about a potential benefit is reported in scientific literature, or shared among physicians, an increasing number of physicians may prescribe such medicines to their patients. This practice, which is not sanctioned by the FDA, is referred to as “off-label” prescribing or use. Off-label prescription practices in the U.S. are acceptable under a long-standing principle that grants physicians the ability to use their professional judgment beyond the FDA recommended uses.

Before 2007, a variety of drugs, often in combination, were utilized off-label to treat symptoms associated with FM. The following three classes of drugs were prescribed as the primary treatments for FM: (1) pain killers, also referred to as analgesics, (2) antidepressants and (3) muscle relaxants.

In 2007, Lyrica® (pregabalin) became the first medicine approved by the FDA for the management of FM. Lyrica previously had been approved and marketed to treat pain in other conditions. FM shares a number of symptoms with depression, and a number of FM patients are believed to experience depression as a co-existing condition. In 2008, Cymbalta® (duloxetine) became the second medicine approved by the FDA for the management of FM. Cymbalta previously had been approved and marketed to treat depression. Savella® (milnacipran) was the third medicine approved by the FDA for the management of FM. Savella’s active ingredient, milnacipran, is approved in Europe to treat depression.

Since Lyrica and Cymbalta also are marketed for other conditions beyond FM, the sales of these products related specifically to FM can only be estimated. According to Frost & Sullivan, the overall gross sales for FM prescription drugs in 2010 was believed to be about $1.2 billion, which has grown since 2007 at a compounded annual growth rate of 18.4%. This significant increase is a result of more FM patients switching to branded FM prescription drugs that sell for a higher cost than the generic FM prescription drugs previously used. For example, in 2010, Lyrica prescriptions are estimated to have accounted for 248 million doses for FM and to have generated $478 million in sales, while Cymbalta prescriptions are estimated to have accounted for 93 million doses for FM and to have generated $342 million in sales. Launched in January 2009, Savella, which is only approved for the treatment of FM, prescriptions accounted for approximately 43 million doses and generated approximately $68 million in sales in 2010.

Use of the FDA approved medications for FM is growing while the use of off-label treatments is declining. Overall, in terms of the number of doses of FM prescription drugs prescribed, Frost & Sullivan expects the FM market to grow at only a 1.2% compounded annual growth rate from 2007 to 2010. These market dynamics are consistent with the interpretation that Lyrica’s growth came at the expense of off-label pain killers and Cymbalta’s and Savella’s growth came at the expense of off-label anti-depressants.

According to Frost and Sullivan, FM is an emerging market and sales are anticipated to continue growing in future years. Despite the availability of FDA approved products, we believe the current treatment options for FM continue to leave many patients dissatisfied.

The FM market for muscle relaxants lacks an FDA-approved product and continues to be satisfied by off-label medicines such as cyclobenzaprine, tizanidine, baclofen, carisoprodol and metaxalone. These muscle relaxants have generic and branded versions. According to Frost & Sullivan, 48 million doses of the Flexeril brand and its associated immediate-release cyclobenzaprine generic products were prescribed off-label for FM in 2010 and accounted for approximately 35% of the muscle spasm pills prescribed for FM. However, the off-label cyclobenzaprine sales for FM in terms of dollars amount to only approximately $10 million, due to the low price of generic cyclobenzaprine.

Challenges in the Market for CNS Therapies

Developers of pharmaceutical treatments for syndromes and disorders that affect the CNS face special challenges. In many cases, the causes and exacerbating factors of CNS conditions remain unknown. Frequently, key symptoms are known only by patient reports and cannot be objectively validated or measured. Symptoms like pain, fatigue, disturbed sleep or altered mood are characteristics of more than one condition. Often, physicians may not agree that a particular patient is affected by one or another condition or by more than one co-existing conditions.

CNS conditions are typically defined by committees of expert professionals who set criteria based on the presence of several symptoms or groups of symptoms. Sometimes groups of subjective symptoms are insufficient to describe CNS disorders and further refinement of diagnostic categories can be achieved by patient demographics, such as gender, age or concurrent medical processes, such as menopause or adolescence. Many CNS conditions, including syndromes and disorders, have not yet been characterized by laboratory tests, such as blood tests or x-ray imaging. However, laboratory tests are often important to exclude other conditions, such as inflammatory or infectious processes. Consequently, a CNS condition is sometimes called a diagnosis of exclusion because inflammation and infection should typically be ruled out by laboratory tests before applying the criteria of groups of symptoms to diagnose it.

Once a CNS condition is diagnosed, physicians may select from among treatment options based on a patient’s symptoms and history. Some medications improve or relieve only one or another symptom in a condition. Consequently, physicians may prescribe several different medications concurrently to treat individual symptoms or groups of symptoms. A desirable quality for CNS medications is the ability to relieve more than one symptom of a CNS condition. Another desirable quality for CNS medications is safety, particularly if a medicine is safe enough to be used with other medicines concurrently or at different times of the day.

Opportunity for New Treatments of FM

We believe the market for the treatment of FM is underserved which we believe fuels a need for new therapeutic options. Due to the market acceptance of FM treatments (such as Lyrica, Cymbalta and Savella), we believe there will be a growing interest in alternative drug treatment options.

We believe that if TNX-102 won FDA approval, it would be an appealing option because it has an entirely different mechanism of action from the currently approved products and we expect TNX-102 will be recommended for use before bedtime. Lyrica is recommended for twice or three-times daily dosing. Cymbalta was found effective at once-daily dosing and is generally restricted to daytime use and not recommended for bedtime use. Cymbalta and Savella act on the CNS in ways that are believed to interfere with sleep.

Competition

Our industry is highly competitive and subject to rapid and significant technological change. Our potential competitors include large pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug companies, academic institutions, government agencies and research institutions. We believe that key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety, tolerability, reliability, price and reimbursement level. Many of our potential competitors, including many of the organizations named below, have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Accordingly, our competitors may be more successful than we may be in obtaining FDA approval for drugs and achieving widespread market acceptance. Our competitors’ drugs may be more effective, or more effectively marketed and sold, than any drug we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing any of our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. Further, the development of new treatment methods for the conditions we are targeting could render our drugs non-competitive or obsolete.

The markets for medicines to treat FM, PTSD and other CNS conditions are well developed and populated with established drugs marketed by large and small pharmaceutical, biotechnology and generic drug companies. Pfizer (Lyrica), Eli Lilly (Cymbalta) and Forest Laboratories/Cyprus Biosciences (Savella) market FDA approved drugs for FM. Pfizer (Zoloft) and GlaxoSmithKline (Paxil) market FDA approved drugs for PTSD.

As of September 15, 2011 several companies are pursuing treatments for FM. Chelsea Therapeutics International, Inc. (CHTP) is developing droxidopa for the treatment of fibromyalgia. Droxidopa is a precursor of the neurotransmitter norephinephrine which suggests it would compete with Cymbalta and Savella which also increase norephinephrine activity. Clinical trials in the U.S. are registered with the FDA and reported on the website, www.ClinicalTrials.gov. A trial of Amrix is recruiting subjects (trial NCT01041495), which may indicate that Cephalon is developing its long-acting formulation of cyclobenzaprine to treat symptoms of FM. Another trial of Ultracet® (tramadol and acetaminophen combination) is listed (trial NCT00766675), which may indicate that Johnson and Johnson is developing Ultracet to treat symptoms of FM.

A number of companies are specifically engaged in developing drugs for PTSD. According to ClinicalTrials.gov, ongoing or recent trials of medicines include: quetiapinein by AstraZeneca (trial NCT00237393) and by Mclean Hospital (trial NCT01066156), levetiracetam by UCB (trial NCT00413296), Δ9-THC by Hadassah Medical Organization (trial NCT00965809), paroxetine hydrochloride hydrate by GlaxoSmithKline (trial NCT00557622), topiramate by Ortho-McNeil Janssen Scientific Affairs (trial NCT00203463), hydrocortisone by Lightfighter Trust (trial NCT01090518), mirtazapine by Research Foundation for Mental Hygiene (trial NCT01178671) and by Department of Veterans Affairs (trial NCT00302107), orvepitant by GlaxoSmithKline (trial NCT01000493), d-cycloserine by Weill Medical College of Cornell University (trial NCT00875342), duloxetine by Yale University (trial NCT00763178), ziprasidone by Pfizer (trial NCT00208208),and aripiprazole by Durham VA Medical Center (trial NCT00489866). Other medications that may be used for the treatment of PTSD include anti-depressants such as: nefazodoneand trazodone; the antihistamine cyprohetadine and certain atypical antipsychotics such as olanzepine and resperidone. Several of these products are supported by companies such as AstraZeneca, GlaxoSmithKline and Pfizer.

A potential competing medication for treating FM symptoms at bedtime had been Rekinla® which was being developed by Jazz Pharmaceuticals, or Jazz. The active ingredient in Rekinla® is sodium oxybate, which results in profound sedation and amnesia. Sodium oxybate is the active ingredient in XYREM®, approved by the FDA for the treatment of excessive daytime sleepiness and cataplexy, the sudden loss of muscle tone, in adult patients with narcolepsy. Rekinla® is administered at bedtime and a second dose is administered by awakening the patient four hours later. Jazz’ studies of Reinkla showed that a treatment that affects sleep quality can improve FM symptoms to meet FDA requirements for an effective product. While Jazz obtained compelling evidence supporting the efficacy of its treatment on FM symptoms, the FDA rejected their application to market Rekinla® for treating FM in 2010. Sodium Oxybate is a controlled substance under the auspices of the Drug Enforcement Administration (DEA). In June 2011, Jazz publicly announced their intention to cease development of Rekinla for FM.

Intellectual Property

Proprietary protection for our product candidates, technology and processes are important to our business and we seek patent protection in the U.S. and internationally when we deem appropriate. We also rely on trade secrets, know-how and continuing technological advances to protect various aspects of our core technology. We require our employees, consultants and scientific collaborators to execute confidentiality and invention assignment agreements with us.

We have been granted numerous patent applications in the United States and abroad. We have several patent applications that are in process in the United States and internationally as follows:

|

Patent/ Application

|

|

Number

|

|

Name

|

|

Jurisdiction

|

|

Expiration Date

|

|

Patent

|

|

6,541,523 |

|

“Methods For Treating Or Preventing Fibromyalgia Using Very Low Doses Of Cyclobenzaprine”

|

|

U.S.A.

|

|

August 11, 2020

|

|

Patent

|

|

6,395,788 |

|

“Methods And Compositions For Treating Or Preventing Sleep Disturbances And Associated Illnesses Using Very Low Doses Of Cyclobenzaprine”

|

|

U.S.A.

|

|

August 11, 2020

|

|

Patent

|

|

6,358,944 |

|

“Methods And Compositions For Treating Generalized Anxiety Disorder”

|

|

U.S.A.

|

|

August 11, 2020

|

|

Application

|

|

12/948,828 |

|

“Methods And Compositions For Treating Symptoms Associated With Post-Traumatic Stress Disorder Using Cyclobenzaprine”

|

|

U.S.A.

|

|

|

|

Application

|

|

61/449,838 |

|

“Methods and Compositions for Treating Depression Using Cyclobenzaprine”

|

|

U.S.A.

|

|

|

|

Application

|

|

13/157,270 |

|

“Method for Improving Fatigue Using Low Dose Cyclobenzaprine”

|

|

U.S.A.

|

|

|

|

Patent

|

|

EP 1202722

|

|

“Uses of Compositions for Treating or Preventing Sleep Disturbances Using Very Low Doses of Cyclobenzaprine”

|

|

European Patent Office, Belgium, France, Ireland, Luxembourg, Monaco, Portugal, Switzerland and United Kingdom

|

|

August 11, 2020

|

|

Patent

|

|

AT 299369

|

|

“Uses of Compositions for Treating or Preventing Sleep Disturbances Using Very Low Doses of Cyclobenzaprine”

|

|

Austria

|

|

August 11, 2020

|

|

Patent

|

|

DE 60021266

|

|

“Uses of Compositions for Treating or Preventing Sleep Disturbances Using Very Low Doses of Cyclobenzaprine”

|

|

Germany

|

|

August 11, 2020

|

|

Patent

|

|

NZ 516749

|

|

“Uses of Compositions for Treating or Preventing Sleep Disturbances Using Very Low Doses of Cyclobenzaprine”

|

|

New Zealand

|

|

August 11, 2020

|

|

Patent

|

|

ES 2245944

|

|

“Uses of Compositions for Treating or Preventing Sleep Disturbances Using Very Low Doses of Cyclobenzaprine”

|

|

Spain

|

|

August 11, 2020

|

|

Patent

|

|

HK 1047691

|

|

“Uses of Compositions for Treating or Preventing Sleep Disturbances Using Very Low Doses of Cyclobenzaprine”

|

|

Hong Kong

|

|

August 11, 2020

|

|

Application

|

|

PCT/US

10/02979

|

|

“Methods And Compositions For Treating Symptoms Associated With Post-Traumatic Stress Disorder Using Cyclobenzaprine”

|

|

PCT

|

|

|

|

Application

|

|

12/145,792 |

|

“Compositions and Methods for Increasing Compliance with Therapies using Aldehyde Dehydrogenase Inhibitors and Treating Alcoholism” (notice of allowance)

|

|

U.S.A.

|

|

|

|

Application

|

|

PCT/US 11/01529

|

|

“Method for Treating Cocaine Addiction”

|

|

PCT

|

|

|

|

Patent

|

|

AU 2002354017

|

|

“Compositions and Methods for Increasing Compliance with Therapies using Aldehyde Dehydrogenase Inhibitors and Treating Alcoholism”

|

|

Australia

|

|

November 4, 2022

|

|

Patent

|

|

CA 2463987

|

|

“Compositions and Methods for Increasing Compliance with Therapies using Aldehyde Dehydrogenase Inhibitors and Treating Alcoholism”

|

|

Canada

|

|

November 4, 2022

|

|

Patent

|

|

EP 1441708

|

|

“Compositions and Methods for Increasing Compliance with Therapies using Aldehyde Dehydrogenase Inhibitors and Treating Alcoholism”

|

|

European Patent Office, Austria, Belgium, Switzerland, Denmark, Luxembourg, Monaco, Germany,

France, Portugal and

United Kingdom

|

|

November 4, 2022

|

|

Patent

|

|

NZ 532583

|

|

“Compositions and Methods for Increasing Compliance with Therapies using Aldehyde Dehydrogenase Inhibitors and Treating Alcoholism”

|

|

New Zealand

|

|

November 4, 2022

|

|

Application

|

|

12/151,200 |

|

“Method For Treating Neurodegenerative Dysfunction”

|

|

U.S.A.

|

|

|

|

Application

|

|

CA 2723688

|

|

“Method For Treating Neurodegenerative Dysfunction”

|

|

Canada

|

|

|

|

Application

|

|

EP 2299822

|

|

“Method For Treating Neurodegenerative Dysfunction”

|

|

European Patent Office

|

|

|

In addition, we have filed one trademark application as follows:

|

Trademark/Application

|

|

Number

|

|

Name

|

|

Jurisdiction

|

|

Application

|

|

85088881 |

|

Tonix Pharmaceuticals

|

|

U.S.A.

|

Our commercial success will depend in part on obtaining and maintaining patent protection and trade secret protection of our current and future product candidates and the methods used to manufacture them, as well as successfully defending these patents against third-party challenges. Our ability to stop third parties from making, using, selling, offering to sell or importing our products depends on the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities. We cannot assure you that our pending patent applications will result in issued patents.

Research and Development

We have one employee dedicated to research and development. We anticipate that our research and development expenditures will increase several fold as we move TNX-102 and TNX-105 into clinical development and investigate other product candidates for incorporation into our portfolio. We need to raise additional capital to fund our development plans and there is no certainty that we will be successful in continuing to attract new investments. Our research and development operations are located in New York, NY. We expect to use third parties to conduct our preclinical and clinical trials.

Manufacturing

We intend to contract with third parties for the manufacture of our compounds for investigational purposes, for preclinical and clinical testing and for any FDA approved products for commercial sale. We have contracted with Lipocine Inc. to manufacture TNX-102 for use in our ongoing pharmacokinetic study study. We will need to contract with a larger scale cGMP contract manufacturer for product to be used in further studies of TNX-102, which we do not anticipate any problems in securing as needed. All of our compounds are small molecules, generally constructed using industry standard processes and use readily accessible raw materials.

Government Regulation

The FDA and other federal, state, local and foreign regulatory agencies impose substantial requirements upon the clinical development, approval, labeling, manufacture, marketing and distribution of drug products. These agencies regulate, among other things, research and development activities and the testing, approval, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, advertising and promotion of our product candidates. The regulatory approval process is generally lengthy and expensive, with no guarantee of a positive result. Moreover, failure to comply with applicable FDA or other requirements may result in civil or criminal penalties, recall or seizure of products, injunctive relief including partial or total suspension of production, or withdrawal of a product from the market.

The FDA regulates, among other things, the research, manufacture, promotion and distribution of drugs in the United States under the FFDCA and other statutes and implementing regulations. The process required by the FDA before prescription drug product candidates may be marketed in the United States generally involves the following:

| |

•

|

|

completion of extensive nonclinical laboratory tests, animal studies and formulation studies, all performed in accordance with the FDA’s Good Laboratory Practice regulations;

|

| |

•

|

|

submission to the FDA of an IND, which must become effective before human clinical trials may begin;

|

| |

•

|

|

for some products, performance of adequate and well-controlled human clinical trials in accordance with the FDA’s regulations, including Good Clinical Practices, to establish the safety and efficacy of the product candidate for each proposed indication;

|

| |

•

|

|

submission to the FDA of an NDA;

|

| |

•

|

|

satisfactory completion of an FDA preapproval inspection of the manufacturing facilities at which the product is produced to assess compliance with current Good Manufacturing Practice, or cGMP, regulations; and

|

| |

•

|

|

FDA review and approval of the NDA prior to any commercial marketing, sale or shipment of the drug.

|

The testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for our product candidates will be granted on a timely basis, if at all.

Nonclinical tests include laboratory evaluations of product chemistry, formulation and stability, as well as studies to evaluate toxicity in animals and other animal studies. The results of nonclinical tests, together with manufacturing information and analytical data, are submitted as part of an IND to the FDA. Some nonclinical testing may continue even after an IND is submitted. The IND also includes one or more protocols for the initial clinical trial or trials and an investigator’s brochure. An IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions relating to the proposed clinical trials as outlined in the IND and places the clinical trial on a clinical hold. In such cases, the IND sponsor and the FDA must resolve any outstanding concerns or questions before any clinical trials can begin. Clinical trial holds also may be imposed at any time before or during studies due to safety concerns or non-compliance with regulatory requirements. An independent institutional review board, or IRB, at each of the clinical centers proposing to conduct the clinical trial must review and approve the plan for any clinical trial before it commences at that center. An IRB considers, among other things, whether the risks to individuals participating in the trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the consent form signed by the trial participants and must monitor the study until completed.

Clinical Trials

Clinical trials involve the administration of the product candidate to human subjects under the supervision of qualified medical investigators according to approved protocols that detail the objectives of the study, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor participant safety. Each protocol is submitted to the FDA as part of the IND.