UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2013

Commission File Number 001-36019

TONIX PHARMACEUTICALS HOLDING CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

26-1434750

|

|

(State or other jurisdiction of incorporation

or organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

509 Madison Avenue, Suite 306

New York, New York

|

10022

|

(212) 980-9155

|

|

(Address of principal executive office)

|

(Zip Code)

|

(Registrant’s telephone number, Including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

The NASDAQ Capital Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates as of June 28, 2013, based on the closing sales price of the Common Stock as quoted on The Nasdaq Capital Market was $9,146,524. For purposes of this computation, all officers, directors, and 5 percent beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such directors, officers, or 5 percent beneficial owners are, in fact, affiliates of the registrant.

As of March 24, 2014, there were 9,899,497 shares of registrant’s common stock outstanding.

TABLE OF CONTENTS

|

|

|

|

|

PAGE

|

|

|

PART I

|

|

|

|

|

|

|

|

Item 1.

|

|

Business

|

|

3

|

|

|

Item 1A.

|

|

Risk Factors

|

|

25

|

|

|

Item 1B.

|

|

Unresolved Staff Comments

|

|

42

|

|

|

Item 2.

|

|

Properties

|

|

42

|

|

|

Item 3.

|

|

Legal Proceedings

|

|

42

|

|

|

Item 4.

|

|

Mine Safety Disclosures

|

|

42

|

|

|

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

Item 5.

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

43

|

|

|

Item 6.

|

|

Selected Financial Data

|

|

43

|

|

|

Item 7.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

44

|

|

|

Item 7A.

|

|

Quantitative and Qualitative Disclosures about Market Risk

|

|

49

|

|

|

Item 8.

|

|

Financial Statements and Supplementary Data

|

|

F-1 – F-24

|

|

|

Item 9.

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

|

|

50

|

|

|

Item 9A.

|

|

Controls and Procedures

|

|

50

|

|

|

Item 9B.

|

|

Other Information

|

|

50

|

|

|

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance

|

|

51

|

|

|

Item 11.

|

|

Executive Compensation

|

|

55

|

|

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

58

|

|

|

Item 13.

|

|

Certain Relationships and Related Transactions, and Director Independence

|

|

59

|

|

|

Item 14.

|

|

Principal Accounting Fees and Services

|

|

60

|

|

|

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

Item 15.

|

|

Exhibits, Financial Statement Schedules

|

|

61

|

|

|

|

|

|

|

|

|

|

|

|

Signatures

|

|

63

|

|

PART I

ITEM 1 - BUSINESS

This Annual Report on Form 10-K (including the section regarding Management's Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our Management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Factors” below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

This Annual Report on Form 10-K includes the accounts of Tonix Pharmaceuticals Holding Corp. (“Tonix”) and its wholly-owned subsidiaries, as follows, collectively referred to as “we”, “us” or the “Company”: Tonix Pharmaceuticals, Inc., a Delaware corporation ("Tonix Sub"), Krele LLC, a Delaware limited liability company ("Krele"), Tonix Pharmaceuticals (Canada), Inc., a corporation incorporated under the laws of the province of New Brunswick, Canada ("Tonix Canada") and Tonix Pharmaceuticals (Barbados) Ltd., a corporation incorporated under the laws of Barbados ("Tonix Barbados"). Tonix Sub is a wholly-owned subsidiary of Tonix, and Krele, Tonix Canada and Tonix Barbados are wholly-owned subsidiaries of Tonix Sub.

Corporate Structure

We were incorporated on November 16, 2007 under the laws of the State of Nevada as Tamandare Explorations Inc. From inception through October 2011, we were involved in the acquisition, exploration and development of natural resource properties in the State of Nevada. On October 7, 2011, we executed and consummated the Share Exchange.

In the Share Exchange, the Tonix Shareholders exchanged their shares of Tonix Sub for newly issued shares of common stock. As a result, upon completion of the Share Exchange, Tonix Sub became our wholly-owned subsidiary.

Upon completion of the Share Exchange, the Tonix Shareholders received an aggregate of 1,133,334 shares of our common stock. 75,000 shares of common stock were returned to us from the prior officer, which were retired, and our existing shareholders retained 200,000 shares of common stock. The 1,133,334 shares issued to the Tonix Shareholders constituted approximately 85% of our 1,333,334 issued and outstanding shares of common stock immediately after the consummation of the Share Exchange.

As a result of the Share Exchange, we acquired 100% of the capital stock of Tonix Sub and consequently, control of the business and operations of Tonix Sub and Krele. From and after the consummation of the Share Exchange, our primary operations consist of the business and operations of Tonix Sub and Krele.

On October 11, 2011, we changed our name to Tonix Pharmaceuticals Holding Corp. to reflect our new business.

Corporate Background

In 1996, Seth Lederman, MD, and Donald Landry, MD, PhD, formed L & L Technologies LLC, or L&L, to develop medications for central nervous system, or CNS, conditions. Dr. Lederman is our Chairman and Chief Executive Officer and Dr. Landry is a Director. L&L was a founder of Janus Pharmaceuticals, Inc., which later became Vela Pharmaceuticals, Inc., or Vela, which developed various therapeutics, including a very low dose, or VLD, version of cyclobenzaprine, or CBP, under an agreement with L&L. Vela decided to focus its resources on other programs and transferred the rights to VLD CBP and certain other technologies to L&L in March 2006.

Tonix Sub formed in June 2007 as Krele Pharmaceuticals, Inc. by L&L and Plumbline. Dr. Lederman is Managing Partner of Plumbline. Plumbline possessed rights to certain technology for the treatment of alcohol dependence and abuse. In connection with founding Tonix Sub, L&L and Plumbline entered into an intellectual property transfer and assignment agreement with Tonix Sub for the purpose of assigning patents and transferring intellectual property and know-how in exchange for shares of common stock of Tonix Sub. As a result of economic conditions related to the financial crisis of 2007 and 2008, Tonix Sub was not successful in raising money to fund its programs until 2009. As a result, Tonix Sub was unable to advance the development programs and had little activity except for prosecuting and maintaining patents and maintaining contracts.

In 2009, Tonix Sub contracted with the Toronto Psychiatric Research Foundation to analyze the sleep data from a Phase 2a trial of nighttime VLD CBP in fibromyalgia, or FM (“the Moldofsky Study”). The Moldofsky Study was conducted in Canada by the Toronto Psychiatric Research Foundation, and Tonix Sub obtained the data from this study from L&L. In addition, in 2009, Tonix Sub contracted with Caliper Life Sciences Inc., or Caliper, to analyze the interactions of CBP with certain receptors. In June 2010, Tonix Sub entered into consulting agreements with L&L and Lederman & Co., LLC, or Lederman & Co, and also acquired certain rights to develop isometheptene mucate as a treatment for certain types of headaches from Lederman & Co, which we are developing as TNX-201. Dr. Lederman is managing partner of Lederman & Co. Between June 2010 and October 2011, Tonix Sub was active in recruiting new officers and directors and initiating preclinical and clinical development of novel CBP formulations.

In July 2010, Tonix Sub changed its name to Tonix Pharmaceuticals, Inc. In August 2010, we formed Krele to commercialize products that are generic versions of predicate New Drug Application, or NDA, products. We anticipate that when our branded products lose patent protection, Krele may market authorized generic versions of them. Krele also may develop or acquire generic products approved under ANDAs and we may market branded versions (branded generics) of such products. Krele has been issued a state license in New York.

On April 23, 2013, we formed Tonix Canada. Tonix Canada is intended to perform research and development efforts in Canada. As a Canadian entity, we expect Tonix Canada will be entitled to receive certain reimbursable tax credits for research expenditures in Canada.

On October 24, 2013, Tonix Sub formed Tonix Barbados. On December 31, 2013, Tonix Barbados entered into a license agreement and a cost-sharing agreement with Tonix Sub, pursuant to which Tonix Barbados acquired the rights to develop and commercialize TNX-102 SL and TNX-201 for non-US markets in exchange for (1) cost sharing of research and development costs going forward and (2) royalties of 8% and 6% on net sales of TNX-102 SL and TNX-201, respectively.

Business Overview

We are a pharmaceutical company dedicated to the development of novel pharmaceutical products for challenging problems. Our lead drug development programs are directed toward CNS conditions that manifest with pain that originates in the brain, or central pain. Central pain results from abnormal sensory processing in the CNS, rather than from dysfunction in peripheral tissues where pain is perceived. Our most advanced development program is for the management of fibromyalgia, or FM, a central pain syndrome. We also have development programs for the management of post-traumatic stress disorder, or PTSD, in which central pain is a component, and for the relief of episodic tension-type headache, or ETTH. We also have a pipeline of additional product candidates that we plan to develop for other CNS indications.

TNX-102 SL

Our lead product candidate, TNX-102 sublingual tablet, or TNX-102 SL, is a small, rapidly disintegrating tablet containing CBP for sublingual administration. We are developing TNX-102 SL as a bedtime therapy for the management of FM and PTSD. CBP is the active pharmaceutical ingredient of two widely prescribed products, and we are pursuing the development of TNX-102 SL for indications distinct from those for which current CBP products are approved. We believe that TNX-102 SL is an optimized CBP product for the treatment of FM and PTSD, and is distinct from current CBP products in three ways: (1) it is being developed at a dose level significantly below the lowest marketed doses of current CBP products; (2) it is placed under the tongue, to disintegrate, dissolve and provide sublingual absorption, whereas current CBP products are swallowed and provide absorption in the small intestine; and (3) it is being developed for chronic use, whereas current CBP products are marketed for two to three weeks of use. We expect that any applications we submit to the Food and Drug Administration, or FDA, for approval of TNX-102 SL will be submitted under Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act, or FDCA, which we believe will allow for a shorter timeline of clinical and non-clinical development as compared to that needed to fulfill the requirements of Section 505(b)(1), under which new chemical entities, or NCEs, that have never been marketed in the United States, are generally developed to meet the FDA’s requirements for new drug approvals.

We have conducted several clinical and non-clinical pharmacokinetic studies of TNX-102 sublingual formulations, which we believe support the development of TNX-102 SL as a novel therapeutic product for FM and PTSD. Results from these studies demonstrate a number of potentially advantageous characteristics as compared to current CBP-containing products (Flexeril® and Amrix®), which are not approved for these indications. For example, our Phase 1 comparative studies showed that TNX-102 SL results in faster systemic absorption and significantly higher plasma levels of CBP in the first hour following administration relative to oral CBP tablets. TNX-102 SL was generally well-tolerated, with no serious adverse events reported in these studies. Some subjects experienced transient numbness on the tongue after TNX-102 SL administration, and other side-effects reported were similar to those associated with current CBP products.

TNX-102 SL – Fibromyalgia Program

We are developing TNX-102 SL for the treatment of FM under a U.S. Investigational New Drug application, or IND, and we held an End-of-Phase 2/Pre-Phase 3 meeting with the FDA in February 2013. TNX-102 SL is currently in a Phase 2b/3 clinical trial for the improvement of pain in subjects with FM, from which we expect to report initial results in the fourth quarter of 2014. Our therapeutic strategy is supported by results from a randomized, double-blind, placebo-controlled Phase 2a study of low dose TNX-102 immediate release capsules, or TNX-102 capsules, which we have also referred to as VLD CBP, taken between dinner and bedtime in 36 subjects with FM, which demonstrated a significant decrease in pain and other symptoms after eight weeks of treatment. This study also demonstrated that TNX-102 capsules led to a significant improvement in objective measures of sleep quality, which we believe relates to the mechanism by which CBP leads to improvement of FM symptoms. We have completed four Phase 1 studies under Canadian Clinical Trial Applications. Our Phase 1 studies demonstrated TNX-102 SL to exhibit a pharmacokinetic profile that we believe supports chronic bedtime administration for the treatment of FM, and is distinct from those of currently-available CBP products.

FM is a chronic syndrome characterized by widespread musculoskeletal pain accompanied by fatigue, sleep, memory and mood issues. According to the National Institutes of Health, there are approximately five million people suffering from FM in the U.S. The peak incidence of FM occurs at 20 – 50 years of age, and 80-90% of diagnosed patients are female. FM may have a substantial negative impact on social and occupational function, including disrupted relationships with family and friends, social isolation, reduced activities of daily living and leisure activities, avoidance of physical activity, and loss of career or inability to advance in careers or education.

Although the disordered brain processes that underlie FM are yet to be fully understood, the mechanisms of drugs that treat central pain are believed to target certain aspects of nerve signaling. Three drugs, Lyrica® (pregabalin), Cymbalta® (duloxetine), and Savella® (milnacipran), are approved by the FDA for the management of FM and are believed to act upon molecular pathways involved in central pain. Lyrica is believed to affect nerve signaling by blocking calcium channels on nerve cells, and is considered a nerve membrane stabilizer. Cymbalta and Savella are believed to directly inhibit the reuptake of serotonin and norepinephrine by nerves, and are referred to as Serotonin and Norepinephrine Reuptake Inhibitors, or SNRIs. CBP, the active ingredient of TNX-102 SL, is a selective antagonist of serotonin and norepinephrine receptors as well as an inhibitor of serotonin and norepinephrine reuptake, and we refer to it as a Serotonin and Norepinephrine receptor Antagonist and Reuptake Inhibitor, or SNARI.

As many products used for the treatment of FM are approved and marketed for other conditions, sales of these products related specifically to FM can only be estimated. Based on information obtained from publicly available sources, we believe U.S. sales of prescription drugs specifically for the treatment of FM totaled approximately $1.5 billion in 2012, and we believe this segment had grown at a compounded annual growth rate of approximately 14% between 2007 and 2012. Based on information obtained from publicly available sources, we believe 2012 sales of Cymbalta, Lyrica, and Savella in FM were approximately $600 million, $475 million, and $100 million, respectively.

Despite the availability and use of a variety of pharmacologic and non-pharmacologic interventions, FM remains a significant unmet medical need. Many patients fail to adequately respond to the approved medications, or discontinue therapy due to poor tolerability. Prescription pain and sleep medications are frequently taken ‘off-label’ for symptomatic relief, despite the lack of evidence that such medications provide a meaningful or durable therapeutic effect. An important goal of FM treatment is to reduce the dependence on opiate analgesic as well as on benzodiazepine and non-benzodiazepine sedative-hypnotic medications by FM patients. Since CBP has no recognized addictive potential, we believe that TNX-102 SL, if approved, could reduce the exposure of FM patients to medications that have not been shown to be effective in treating FM and are associated with significant safety risks.

At our End-of-Phase 2/Pre-Phase 3 meeting with the FDA, we discussed the design of our clinical program, including the acceptability of the pivotal study design and the proposed registration plan, to support the approval of TNX-102 SL for the management of FM. We believe that positive results from two adequate, well-controlled safety and efficacy studies and the establishment of long-term safety for chronic use would support the approval of TNX-102 SL for the management of FM.

Phase 2b/3 “BESTFIT” Study

We are currently conducting the randomized, double-blind, placebo-controlled Phase 2b/3 BEdtime Sublingual TNX-102 SL as Fibromyalgia Intervention Therapy (BESTFIT) trial, which we initiated in September 2013 under the IND. In this multicenter clinical trial, subjects with FM are treated with either TNX-102 2.8 mg sublingual tablets (SL) or a placebo at bedtime daily for 12 weeks. We expect to enroll approximately 200 patients into this study. The primary efficacy endpoint is change in pain from baseline to week 12. If successful, this trial will serve as the first of two pivotal studies to support an NDA for TNX-102 SL in FM. We have engaged Premier Research International, LLC, a contract research organization, or CRO, to provide clinical and data management services for this Phase 2b/3 trial. We expect to report initial efficacy results from the BESTFIT trial in the fourth quarter of 2014.

The primary efficacy measure in this study will be the change in pain severity at week 12 with TNX-102 SL as compared to placebo, as assessed by the Numeric Rating Scale, or NRS. This endpoint is similar to that utilized in clinical trials of drug products currently approved for use in FM. We are also collecting information on other outcome measures, including NRS scores at other time points, the revised Fibromyalgia Impact Questionnaire, and the Patient Global Impression of Change.

Long-Term Safety Exposure Study

In December 2013, we announced the initiation of F203, a 12-month open-label extension study of TNX-102 SL to be taken daily at bedtime, into which patients who have completed the BESTFIT study may enroll. The goal is to obtain sufficient 6 and 12 month exposure data in FM patients to meet the NDA submission requirement.

TNX-102 SL – Post-Traumatic Stress Disorder Program

We are also advancing TNX-102 SL for the management of PTSD. We held a pre-IND meeting with the FDA in October 2012, and we plan to file an IND to pursue this indication in the second quarter of 2014. We plan to begin a Proof-of-Concept (POC) trial of TNX-102 SL in subjects with military-related PTSD in the third quarter of 2014. Based on the results of the POC trial, we will meet with the FDA to finalize the design of the registration studies to support the PTSD NDA. We believe the approval will be based upon positive results from two adequate, well-controlled efficacy and safety studies and long-term (6 and 12 month) safety exposure data. We expect the long-term safety exposure data generated by our clinical development of TNX-102 SL in FM can be used to support the PTSD indication.

TNX-201 – Episodic Tension-Type Headache Program

TNX-201 is a single isomer of isometheptene mucate (IMH) and is under development as a treatment for ETTH, an indication believed to affect approximately 20% of the global adult population. Although currently not approved for any indication, IMH has an extensive history of use as a prescription pharmaceutical in the U.S. as a mixture of two mirror-image isomers, also known as a racemic mixture. Racemic IMH has been marketed in combination products for the relief of tension and vascular headaches (examples include Midrin® and MigraTen®). The selection of a single isomer of IMH for development may confer an improved clinical profile as compared to the racemic mixture, consistent with the FDA Stereoisomeric Drugs Development Policy, and is supported by our pharmacology data. We held a pre-IND meeting with the FDA in January 2014 to discuss the regulatory pathway for the development of TNX-201 for the treatment of ETTH. The initial IND for TNX-201 will not require any additional nonclinical data to support a first-in-man study, and we plan to conduct a Phase I comparative pharmacokinetic and safety study in the fourth quarter of 2014. Although the development of TNX-201 will be based on the available information on racemic IMH, the NDA approval will be required to conform with the 505(b)(1) NDA requirement.

Additional Product Candidates

In addition to TNX-102 SL, we have developed other innovative formulations of CBP, including TNX-102 promicellar gelatin capsule, or TNX-102 gelcap. We have developed TNX-102 gelcap under an agreement with Lipocine, Inc., or Lipocine, a contract formulation developer and small-scale manufacturer. We met with the FDA to discuss the TNX-102 gelcap development program in August 2011 and have generated clinical data that support the further development of this candidate. However, we currently do not plan to advance TNX-102 gelcap, and in March 2014, we notified Lipocine of our decision to not exercise our option to license Lipocine’s technology, although we own all the work product, information and data from the studies conducted.

We also have a pipeline of other product candidates, including TNX-301. TNX-301 is a fixed dose combination of two FDA-approved drugs, disulfiram and selegiline. We intend to develop TNX-301 under the 505(b)(2) provision as a treatment for alcohol abuse and dependence, and plan to begin formulation work on TNX-301 in 2014. In addition, we recently acquired rights to intellectual property on the development of protective agents against radiation exposure and on the development of novel smallpox vaccines. The radio- and chemo-protective technology relates to proprietary forms of a small molecular pharmaceutical agent, which is believed to protect against ionizing radiation after oral administration. The smallpox vaccine technology relates to proprietary forms of live vaccinia vaccines which may be safer than ACAM2000, which is the only currently available replication competent, live vaccinia vaccine to protect against smallpox disease. As we interact with the United States Department of Defense and related biodefense agencies regarding our development of TNX-102 SL for PTSD, we believe these technologies will expand our interaction and cooperation with such agencies. We plan to perform non-clinical research and development on these programs in 2014.

For competitive reasons, we typically do not disclose the identities of the active ingredients or targeted indications in our pipeline until a U.S. patent has been allowed or issued.

Our Strategy

Our objective is to develop and commercialize our product candidates to treat CNS conditions, including FM, PTSD and ETTH. The principal components of our strategy to achieve this objective are to:

|

|

· |

adopt a multi-pronged patent strategy to protect our products, including patents that protect methods of use for the active ingredients in our products, the formulation technology employed in our products, the performance characteristics of our products in the human body and the composition-of-matter of our products;

|

|

|

· |

provide clear value propositions to third-party payers, including managed care companies or government programs such as Medicare, to merit reimbursement for our product candidates; and |

|

|

· |

establish and maintain a sales and marketing infrastructure, such that we will be able to effectively commercialize our products once approved. |

Pursue development and regulatory approval pathways. We are developing TNX-102 SL under the Section 505(b)(2) FDA pathway. This pathway can reduce the time and expense required for our development programs by allowing our use of previously-generated safety and efficacy information regarding the active pharmaceutical ingredients in our lead product candidates to support the filing and approval of our NDA application. Our use of this information may help reduce the size and scope of our preclinical and clinical trials. We expect to develop TNX-201 under Section 505(b)(1), the pathway followed for an NCE or marketed drug without an approved NDA in the United States. For TNX-201, a single isomer of a marketed racemic drug, we are able to leverage the existing racemic IMH human experience to design an efficient development program. While we expect to pursue the development of TNX-301 under Section 505(b)(2), we have not yet discussed this candidate with the FDA. In general, our ability to pursue the 505(b)(1) or 505(b)(2) regulatory pathways will depend, at least in part, on the data available for reference of the particular candidate to support product registration. The use of a drug product for the treatment of a condition other than one of its approved label indications is called off-label use. The development of an existing FDA-approved drug for the treatment of a condition other than one of its approved label indications is considered a “new use”. For companies involved in the ethical development and marketing of prescription drugs in the US, FDA approval of a new use or new label indication is the only legal basis of marketing claims for that use or indication. Off-label use is not recognized by the FDA or FDA-regulated companies as a new use.

Adopt a multi-pronged patent strategy. We are pursuing a multi-pronged patent strategy by seeking intellectual property protection on several aspects of our products. Aspects we seek to protect include, among others, methods of use for certain known active pharmaceutical ingredients, formulation technologies incorporated into our products, performance characteristics of our products in the human body and the composition-of-matter of our products. With respect to methods of use patents, we believe the therapeutic uses we target are new uses for these active ingredients and we have been issued patents directed to certain aspects of our new uses. For example, the invention of bedtime TNX-102 as a treatment for FM was novel and unexpected when our patents were filed in 2000. We are seeking additional patents to cover other new uses. For example, we filed a patent application seeking to protect the use of CBP in PTSD. With respect to formulation patents, we believe our products will be protected by patents that describe inventions of technology for making new formulations, which may include novel routes of delivery for the active ingredients. With respect to patents related to the performance characteristics of our products in the human body, we believe our products will be protected by patents that describe novel pharmacokinetic properties of the active ingredient, as well as of its active metabolites, at certain times after administration. For example, we filed a patent application seeking to protect novel pharmacokinetic properties of CBP as enabled by TNX-102 SL. In the case of TNX-201, for which the active ingredient is a single isomer of racemic isometheptene, we have filed a patent application seeking to protect the composition-of-matter of oral dosage forms that contain only the single isomer and not the racemic mixture.

Provide clear value propositions to third-party payors to merit reimbursement for our product candidates. We are designing our clinical development programs to demonstrate compelling competitive advantages to patients and prescribers and also to demonstrate value propositions to third-party payors. We believe TNX-102 SL might help in the management of FM by reducing pain and other symptoms, such as fatigue. In addition, primarily as a result of its lower dosage, we believe that bedtime treatment with TNX-102 SL will have fewer day time side-effects than off-label bedtime treatment with immediate-release CBP products approved for the treatment of muscle spasm, or CBP IR. For FM, we believe an FDA-approved product would capture some of the off-label use of CBP IR. Because FDA approvals are based on objective data, we believe that third-party payors will provide reimbursement for an FDA approved product, even at a premium price relative to other drugs that are used off-label, such as CBP IR, tizanidine, baclofen, carisoprodol or metaxalone. For example, third-party payors reimburse the use of Lyrica, Cymbalta and Savella for FM despite the availability of off-label generic versions of drugs with similar mechanisms of action, for example, Neurontin® (gabapentin) and generic anti-depressants, respectively. Cymbalta lost its U.S. patent exclusivity in December 2013.

Establish and maintain an effective sales and marketing infrastructure. We believe TNX-102 SL and TNX-201 can be marketed to physicians in the United States by means of a sales force built by or engaged by us. Many large and small pharmaceutical companies engage contract sales organizations, or CSOs, to launch products and contracts with such organizations can be structured as a “rent-to-buy” model. The flexibility and scalability of such organizations has made it possible for many emerging companies to decide to market their own products. Therefore, we plan to work with CSOs to develop the capabilities of building a sales force, initially through contracting, and we may eventually internalize the sales and marketing capabilities. Another option for certain of our drug development candidates, including TNX-102 SL and TNX-201, would be to partner with companies that already have significant marketing capabilities in the same, or similar, therapeutic areas. If we determine that such a strategy would be more favorable than developing our own sales capabilities, we would seek to enter into collaborations with pharmaceutical or biotechnology companies for the commercialization of our products.

Our Lead Product Candidate

Our lead product candidate is TNX-102 SL, which we are developing for the treatment of FM and PTSD. TNX-102 SL consists of CBP in a mixture of inactive ingredients that are called “excipients”, which we believe will improve the absorption rate of CBP in ways that will optimize the product for bedtime treatment. The excipients used in TNX-102 SL are approved by the FDA for pharmaceutical uses.

Cyclobenzaprine

CBP was first synthesized in 1961 by Merck, and the 10 mg Flexeril immediate-release, or IR, dose form was FDA approved in 1977 for the relief of muscle spasm associated with acute, painful musculoskeletal conditions as an adjunct to rest and physical therapy.

Although a number of clinical studies have addressed the potential use and benefit of CBP in treating symptoms of FM, to our knowledge these studies have not motivated a sponsor to pursue FDA approval.

Based on CBP’s safety and efficacy for treating muscle spasm, in the 1990s, Merck conducted studies to support an application to market a 5 mg Flexeril tablet for the over-the-counter, or OTC, market, whereby patients can purchase medicine without a physician’s prescription. Although Merck’s studies re-affirmed the safety and demonstrated efficacy of 5 mg Flexeril in several large trials, the OTC division of the FDA rejected the application for use without a prescription, apparently, we believe, because muscle spasm was deemed a condition that required a physician to diagnose and supervise treatment.

Merck divested the Flexeril franchise to Alza Pharmaceuticals, or Alza, which was subsequently acquired by Johnson and Johnson and Flexeril is part of its McNeil Consumer Healthcare division, or McNeil. Based largely on the Merck studies, McNeil won approval of Flexeril 5 mg tablets as a prescription medicine to treat muscle spasm. McNeil promoted Flexeril 5 mg tablets for the three year period of market exclusivity based on The Drug Price Competition and Patent Term Restoration Act of 1984, generally referred to as the Hatch-Waxman Act. Following this exclusivity period, several generics entered the market and took market share from Flexeril. McNeil has discontinued the manufacture of Flexeril.

Despite the approved uses of CBP in treating muscle spasm, we believe current marketed formulations of CBP are limited for treating FM by slow and unpredictable absorption. Following the ingestion of CBP IR, it takes more than one hour for clinically-meaningful blood levels to be achieved. As described in the Flexeril package insert, the amount of CBP absorbed into the bloodstream varies between 33 – 55% of the dose ingested. The variability in absorption may be due to several factors, including effects of the stomach pH (acidity or base) on the dissolution of the tablets, as well as the context of either an empty stomach or a recent meal. Food in the stomach and small intestine from a recent meal contributes to variability in absorbing other drugs. The uncertainties in absorption rates make it challenging for a physician contemplating a bedtime treatment for FM to ensure the intended therapeutic effect is achieved without risking side effects like next-day drowsiness, which could result if the patient has too much CBP remaining in the bloodstream the next day.

If a product could provide rapid and consistent absorption of CBP, patients would be more likely to receive a drug exposure profile that is aligned with the intended period of exposure and less likely to receive too little drug to receive a therapeutic effect. Conversely, patients would be less likely to receive too much drug, which might lead to potential side effects, including next-day drowsiness. An optimal bedtime CBP product could have faster absorption, lower blood levels in the morning and more predictable effects than the IR tablet format. We have tested a number of technologies to optimize the properties of CBP as a bedtime therapy for FM and PTSD. Our lead product, TNX-102 SL is a novel sublingual tablet form of CBP that we have tested in pre-clinical and clinical studies. We entered TNX-102 SL into a potential pivotal clinical trial in FM in September 2013, and we plan to begin a POC trial in PTSD in the third quarter of 2014. We believe the unique properties of TNX-102 SL, as demonstrated by the results of our studies, support its development in both FM and PTSD.

TNX-102 SL in Fibromyalgia Syndrome

TNX-102 SL, our lead product candidate, is a rapidly disintegrating tablet containing CBP that is designed to be placed under the tongue at bedtime. The development of TNX-102 SL in FM is supported by the results of the Moldofsky Study, which evaluated oral administration of TNX-102 capsules in the evening, as well as by preclinical and comparative clinical pharmacokinetic studies.

In the Moldofsky Study, which was a randomized, double-blind, placebo-controlled, Phase 2a trial, it was demonstrated that TNX-102 capsules, swallowed between dinner and bedtime, resulted in significant decreases in next-day pain and other core FM symptoms after eight weeks of treatment, as well as in a significant improvement in sleep quality. We believe that CBP exerts its benefit in FM via its ability to improve the restorative quality of sleep, which has been shown to be frequently impaired in patients with FM. Current CBP products are believed to be widely used off-label by FM patients.

FM is diagnosed by groups of symptoms that have been defined by committees of the American College of Rheumatology, or ACR, and a committee of experts from the organization Outcome Measures in Rheumatology. In 2007, Pfizer’s Lyrica became the first medicine approved by the FDA for the management of FM. In 2008, Eli Lilly’s Cymbalta became the second medicine approved by the FDA for the management of FM. In 2009, Savella was the third medicine approved by the FDA for the management of FM. Savella is marketed by Forest Laboratories.

Product Development Plan

Phase 2a Data of TNX-102 capsules in FM Patients

Our motivation to focus our efforts on developing TNX-102 SL for FM stems from the results of the Moldofsky Study, the related rights to which we acquired from L&L. Specifically, this study was a randomized, double-blind, placebo-controlled, dose-escalating eight week trial conducted at two study centers. The study randomized 36 subjects, all of whom met ACR criteria for FM.

Patients received TNX-102 capsules or placebo to ingest after dinner and before bedtime. Each TNX-102 capsule contained 1 mg of CBP. Initially, patients took one capsule each evening, but over the course of the study, they were allowed to increase the number of capsules taken, up to four per evening.

At week eight, patients treated with TNX-102 capsules demonstrated significant improvements in pain, fatigue and tenderness relative to baseline, whereas placebo-treated patients did not improve. Although this study excluded patients who met formal criteria for major depressive disorder or any anxiety disorder, there is a high degree of co-existing symptoms of depression and anxiety associated with FM. Relative to baseline, treatment with TNX-102 capsules also resulted in a significant reduction in total Hospital Anxiety and Depression Scale score, which measures symptoms of anxiety and depression, and the HAD depression subscore which measures depressive symptoms.

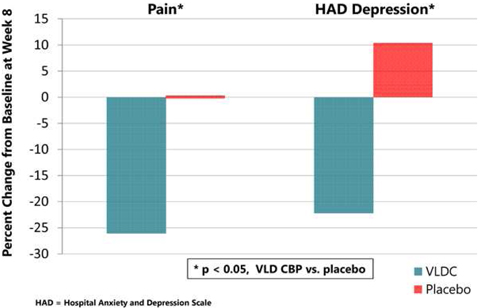

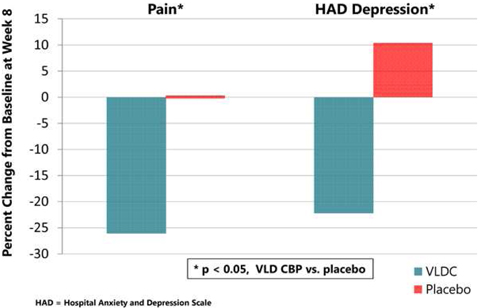

Figure 1: Results of a Phase 2a Study of TNX-102 capsules in FM patients as administered between dinner and bedtime.

As illustrated in Figure 1, this study showed that treatment with TNX-102 capsules as compared to treatment with placebo:

|

|

· |

decreased musculoskeletal pain, by demonstrating a significant decrease in mean subject-assessed numeric pain score (p<0.05); and |

|

|

· |

improved mood, by demonstrating a significant decrease in mean HAD depression subscore (p<0.05). |

This study also showed that TNX-102 capsules taken between dinner and bedtime resulted in a significant improvement in objective measures of sleep quality. We believe that CBP exerts its benefit in FM via its ability to improve the restorative quality of sleep, which has been shown to be frequently impaired in patients with FM.

In this study, TNX-102 capsules were well tolerated, with no serious adverse events or discontinuations due to adverse events.

This research was published in the Journal of Rheumatology, in an article entitled “Effects of Bedtime Very Low Dose (VLD) Cyclobenzaprine (CBP) on Symptoms and Sleep Physiology in Patients with Fibromyalgia Syndrome (FM): A Double-blind, Randomized, Placebo-controlled Study.” The citation is: Moldofsky H, Harris H, Kwong T, Archambault WT and Lederman S. J Rheum 2011 Dec;38(12):2653-63.

Pharmacokinetic and Bioavailability Studies

We have conducted preclinical and clinical studies of our sublingual formulations of CBP, which have evaluated the pharmacokinetics of these formulations as well as their comparative bioavailability to oral CBP.

Our preclinical and clinical studies demonstrated that our sublingual formulations provide faster delivery and more efficient systemic absorption of CBP as compared to current oral forms of the drug.

In three Phase I comparative pharmacokinetic and bioavailability studies, TNX-102 SL was generally well tolerated. There were no unexpected adverse events, with the exception of a mild, temporary numbness at the tongue experienced by less than one-third of the subjects that received TNX-102 SL tablets.

Phase 2b/3 “BESTFIT” Study

We are currently conducting a Phase 2b/3 study of TNX-102 SL in FM called the BESTFIT trial. In this multicenter, randomized, double-blind, placebo-controlled clinical trial, FM patients will be administered either TNX-102 SL or placebo at bedtime nightly for 12 weeks. We expect that our BESTFIT trial, if successful and accepted by the FDA, will be one of the two pivotal studies required to support the NDA approval. The study began in September 2013 and we expect to announce initial results in the fourth quarter of 2014.

Long-Term Safety Exposure Study

In December 2013, we announced the initiation of F203, a 12-month open-label extension study of TNX-102 SL to be taken daily at bedtime, into which patients who have completed the BESTFIT study may enroll. The goal is to obtain sufficient 6 and 12 month safety exposure data in FM patients to meet the NDA submission requirement.

Prospective Confirmatory Phase 3 Study

If our Phase 2b/3 BESTFIT study of TNX-102 SL in FM is successful, then we expect to conduct a 12-week, randomized, double-blind, placebo-controlled confirmatory Phase 3 study of TNX-102 SL in support of product registration. It is likely that the primary efficacy measure in this study will be the change in pain severity with TNX-102 SL as compared to a placebo at week 12, as assessed by the NRS, similar to the primary efficacy measure of BESTFIT. Secondary outcome measures will be determined based on the results from the BESTFIT study. These will be carefully selected to support competitive labeling for TNX-102 SL for FM.

Prospective Multi-dose Pharmacokinetic Study

Since CBP will be used chronically in TNX-102 SL, we plan to study TNX-102 SL in comparison to CBP IR in a multiple-day dosing (once daily) study. The results of this study will provide information regarding blood levels of CBP resulting from use of the marketed IR tablet and our sublingual TNX-102 SL tablet when taken in a multiple day regimen. We expect the data from this study to serve as a ‘bridge’, in that they will allow us to use the CBP IR tablet as the reference product in our submission of a Section 505(b)(2) NDA for TNX-102 SL.

Prospective Study Comparing Safety and Tolerability of TNX-102 SL with CBP IR

We plan to conduct a small study designed to evaluate next morning drowsiness and other cognitive measures following the bedtime use of TNX-102 SL and the bedtime use of CBP IR. The goal of this study is to determine the potential benefit of TNX-102 SL compared with CBP IR on next morning drowsiness and on other cognitive functions.

Nonclinical

In addition to the clinical data necessary to support the TNX-102 SL 505(b)(2) NDA filing for the fibromyalgia indication, the FDA also clarified the nonclinical studies required for the NDA filing since the information from the reference product is either unavailable for reference or failed to meet the current regulatory standard. In 2014, we will be selecting an FDA-certified Good Laboratory Practices laboratory to conduct a six month repeated-dose toxicology study in rats, a nine month repeated-dose toxicology study in dogs and a peri- and post-natal Segment III study required for the NDA filing. We plan to submit these draft toxicology protocols for FDA review and seek agreement on the doses and facilities chosen for these studies. These studies will be performed concurrently with the Phase 3 study and will be completed ahead of the NDA submission. Based on the Flexeril labeling and post-marketing surveillance information, there is no evidence of abuse for CBP. As a result, we will not have to assess the abuse potential of TNX-102 SL for the NDA submission.

Manufacturing

The TNX-102 SL drug product that has been manufactured for our BESTFIT study was manufactured in a small-scale current Good Manufacturing Practice, or cGMP, facility that is licensed to manufacture clinical trial materials, but not equipped for large-scale commercial production. For the second pivotal study and for the commercial product, we have engaged a commercial cGMP facility that is capable of manufacturing the registration batches to support the NDA. The product’s comparability will be supported by the bioequivalence results from the “bridging” study, TNX-CY-F105.

Other NDA Requirements

We have submitted a Pediatric Study Plan, or PSP, which contains a partial waiver of the requirement to submit pediatric assessments per Section 505B(a)(4)(A)(i) of the FDCA. Final PSP requirement will be determined at the time of NDA approval.

Based our discussions with the FDA and the FDA formal meeting minutes, we will not have to conduct special populations (geriatric and renal/hepatic impaired), drug-drug interaction or a cardiovascular safety study to support the NDA filing. Due to the well-established safety profile of CBP at much higher doses than we proposed for FM, the FDA requests no risk management plan or medication guide for this product.

Regulatory Strategy

The FDA approvals of Lyrica, Cymbalta and Savella establish a regulatory approval standard for the management of FM. However, given the heterogeneity of patients with this disease, it may not prove to be the only pathway or approval requirement. We hope to register TNX-102 SL with the FDA through the provisions of Section 505(b)(2). This regulatory pathway may help to accelerate product development and reduce overall business risk. The 505(b)(2)-based product development plan for TNX-102 SL is designed to leverage the safety data that have been generated by other manufacturers for CBP-containing products and accepted by the FDA in support of their product registrations, in addition to the safety data we generate. TNX-102 SL contains significantly less active CBP than other marketed products. We believe that the safety data package from these products and the CBP prescriptions utilization database analyzed by IMS Health Incorporated will provide adequate safety margin to support TNX-102 SL development. At our End-of-Phase 2/Pre-Phase 3 meeting we held with the FDA in February 2013, we discussed the nature and extent of the Phase 2b and Phase 3 clinical trials we need to conduct to so as to receive regulatory acceptance of our proposed NDA plan for a differentiated product for the management of FM.

If NDA approval of TNX-102 SL is granted, in addition to the three-year marketing exclusivity provided by law, we expect this product to be protected by patents that extend through at least 2021, during which time it should not be subject to generic substitution. We plan to continue to support the TNX-102 SL program with new patent applications as we obtain data from the clinical evaluation of our new formulation in healthy human subjects and in FM patients. For example, we have recently filed patent applications on TNX-102 SL which, if issued, would be expected to provide protection from generic substitution until at least 2033.

TNX-102 SL in Post-Traumatic Stress Disorder

We are also developing TNX-102 SL for the management of PTSD, a psychiatric disorder that begins in the aftermath of traumatic experiences. We held a pre-IND meeting with the FDA in October 2012, at which our clinical program for PTSD was discussed. We plan to file an IND in the second quarter of 2014 to support the initiation of a POC efficacy study in the third quarter of 2014.

Parallels Between FM and PTSD

A number of parallels have been noted between FM and PTSD. In addition, symptom overlap may exist between patients diagnosed with FM or PTSD. In a survey of males with PTSD or major depression (Amital et al, Posttraumatic stress disorder, tenderness, and fibromyalgia syndrome: are they different entities? J. Psychosom. Res. 2006, 61(5):663-9), 49% of PTSD patients met the ACR criteria for FM compared to 5% of major depression patients. Conversely, in a different survey of FM patients (Cohen et al., Prevalence of post-traumatic stress disorder in fibromyalgia patients: overlapping syndromes or post-traumatic fibromyalgia syndrome? Semin. Arthritis Rheum. 2002, 32(1):38-50), 57% of the sample had symptoms associated with PTSD.

A core feature of PTSD is sleep disturbance, including insomnia and nightmares. Sleep disturbances are believed to exacerbate daytime symptoms of PTSD, including irritability, poor concentration, and diminished interest in significant activities. We believe the sleep disturbances of PTSD bear similarity to those associated with FM.

Emerging Market Opportunity

The selective serotonin reuptake inhibitors Paxil® (paroxetine) and Zoloft® (sertraline) are FDA approved for PTSD, but are not satisfactory treatments for many patients. Other drugs that show promise for the treatment of PTSD, but are not FDA approved, include antidepressants such as nefazodone, mirtazapine and trazodone; the antihistamine cyproheptadine; certain atypical antipsychotics such as olanzapine and risperidone; and an adrenergic alpha-1 receptor blocker, prazosin. Prazosin may decrease nightmares and insomnia and has been associated with improvements in daytime PTSD symptoms, depression, and quality of life.

Our rationale for studying the effects of CBP in PTSD derives from the following:

|

|

· |

our clinical studies that treatment with TNX-102 capsules improves FM symptoms, a disorder having significant overlap with PTSD; |

|

|

· |

our clinical studies that TNX-102 capsules can improve sleep quality, which is impaired in PTSD; and |

|

|

· |

in receptor binding studies conducted by Caliper under our direction, CBP interacts with a receptor on brain cells called the serotonin type 2a receptor. Based on numerous peer-reviewed scientific publications, we have identified a number of compounds that bind this receptor that have been shown to have effects in treating PTSD. Therefore, it is our belief that CBP, because it binds to the serotonin type 2a receptor, will have a therapeutic effect in treating PTSD. |

As very little information was available on the biochemical effects of CBP and its primary metabolite, norcyclobenzaprine, or nCBP, in the central nervous system, we have engaged several CROs to better understand the interactions of these agents with certain receptors in the brain. CROs we have engaged in this effort include Caliper, Cerep, Millipore, and DiscoveRx. Results from a series of binding and functional studies show that both of these molecules are potent antagonists of the serotonin type 2a and the histamine H1 receptors, which known to have effects on sleep and sleep maintenance. The results also show that CBP and nCBP antagonize the adrenergic alpha 1A and 1B receptors, which may have effects on autonomic dysfunction. The results of some of these studies were presented at a poster session during the 2012 American College of Rheumatology Annual Meeting (Daugherty et al, “Cyclobenzaprine (CBP) and its Major Metabolite Norcyclobenzaprine (nCBP) are Potent Antagonists of Human Serotonin Receptor 2a (5-HT2a), Histamine Receptor H1 and Alpha-Adrenergic Receptors: Mechanistic and Safety Implications for Treating Fibromyalgia Syndrome by Improving Sleep Quality”, Abstract #960).

Product Development Path

Based on the recommendations and guidance received at our October 2012 pre-IND meeting with the FDA and in consultation with experts in this psychiatric disorder, we plan to file an IND application for TNX-102 SL in the PTSD indication in the second quarter of 2014, and to begin a POC trial in the third quarter of 2014. We expect to be able to use TNX-102 SL tablets manufactured for the FM studies in this clinical trial.

Prospective Proof-of-Concept Study

The IND to be filed in the second quarter of 2014 will have the information necessary to support a POC clinical study to ascertain the potential efficacy of TNX-102 SL in PTSD. We expect this will be a randomized, double-blind, placebo-controlled, parallel study of bedtime TNX-102 SL in military-related PTSD subjects. We expect the dosing period to be six weeks, and the primary efficacy measure to be the change in the Clinician-Administered PTSD Scale from baseline to week six.

Prospective Phase 3 Studies

If our POC trial of TNX-102 SL in PTSD is successful, we will meet with the FDA to finalize the design of the registration studies to support the PTSD NDA. We believe the approval will be comprised of positive results from two adequate, well-controlled efficacy and safety studies and long-term (6 and 12 month) safety exposure data. We expect the long-term safety exposure data generated by our clinical development of TNX-102 SL in FM can be used to support the PTSD indication.

Regulatory Strategy

The approvals by the FDA of Paxil (paroxetine) and Zoloft (sertraline) for treating PTSD established a regulatory approval pathway for symptom reduction in PTSD. We believe our clinical development program of TNX-102 SL and the long term safety data generated from the TNX-102 SL FM NDA program will result in a differentiated product suitable for chronic use for the treatment of PTSD. We believe that our planned clinical trials in PTSD, if successful, will provide sufficient evidence of clinical efficacy and safety to support a 505(b)(2) NDA for TNX-102 SL for the management of PTSD.

We held a pre-IND meeting with the FDA on TNX-102 SL in PTSD in October 2012, and we expect to file an IND in the second quarter of 2014 and to initiate a POC study in the third quarter of 2014. We plan to meet with the FDA when we complete the POC efficacy study to further discuss the development plan, especially the design of the pivotal studies. If the results from the POC efficacy study are positive, we plan to seek a Breakthrough Therapy designation for TNX-102 SL in PTSD. The Breakthrough Therapy designation process is a new and uncertain process, in which the majority of requests for designation have been denied.

Drug Delivery Technology

TNX-102 SL

TNX-102 SL is a small tablet that rapidly disintegrates in saliva and delivers CBP across the mucosal membrane into the systemic circulation. In addition to CBP, TNX-102 SL contains excipients, which are well-characterized, are listed in the Inactive Ingredient Guide and are approved for pharmaceutical use. TNX-102 SL contains sublingual absorption-enabling ingredients that promote a local oral environment that facilitates mucosal absorption of CBP. These include agents that favor a mildly basic salivary pH. We own all rights to TNX-102 SL in all geographies, and we bear no obligations to third-parties for any future development or commercialization.

TNX-102 Gelcap

In June 2007, we entered into a Feasibility and Option Agreement with Lipocine, which was amended in October 2010 (the “Feasibility Agreement”). Pursuant to the Feasibility Agreement, we identified and obtained an exclusive worldwide option on technology from Lipocine that employs mixtures of different types of lipids to envelop CBP molecules in the small intestine and facilitate absorption into the bloodstream. We selected a candidate formulation, TNX-102 gelcap, based on properties that included the dispersion of CBP in simulated gastric or small-intestinal fluids and the stability of the formulation over time. Lipocine was also engaged to manufacture gelatin capsules of TNX-102 gelcap for use in a pharmacokinetic trial, for which we reported results in April 2012. In March 2014, we completed the final report of the pharmacokinetic trial (the “Final Report”) and had 30 days to decide whether to exercise the option to license certain technology owned by Lipocine. Following our receipt of the Final Report, in March 2014, we notified Lipocine of our decision to not exercise the option, although we own all the work product, information and data from the studies conducted.

Market Dynamics

We believe the U.S. market for products that treat CNS conditions has several characteristics that make it an attractive market for pharmaceuticals, including that the customer base is driven by physicians who are involved in long-term care of patients with chronic disorders. Patients with CNS disorders sometimes carry disease burdens that require long-term treatment.

We believe the market for FDA-approved FM treatments is underserved and that there is a constant need for new treatment options, since many prescription drugs provide relief only to some of the affected patients, only to some of some patients’ symptoms, or provide relief only for limited periods of time.

In 2007, Lyrica became the first medicine approved by the FDA for the management of FM. Lyrica previously had been approved and marketed to treat pain in other conditions as well as epilepsy. In 2008, Cymbalta became the second medicine approved by the FDA for the management of FM. Cymbalta previously had been approved and marketed to treat depression. FM shares a number of symptoms with depression, and a number of FM patients are believed to experience depression as a co-existing condition. Savella was the third medicine approved by the FDA for the management of FM. Savella’s active ingredient, milnacipran, is approved for the treatment of depression in Europe.

As many products used for the treatment of FM are approved and marketed for other conditions, sales of these products related specifically to FM can only be estimated. Based on information obtained from publicly available sources, we believe U.S. sales of prescription drugs specifically for the treatment of FM totaled approximately $1.5 billion in 2012, and we believe this segment had grown at a compounded annual growth rate of approximately 14% in 2007 – 12. Based on information obtained from publicly available sources, we believe 2012 sales of Cymbalta, Lyrica, and Savella were approximately $600 million, $475 million, and $100 million, respectively. Cymbalta lost its U.S. patent exclusivity in December 2013. Despite the availability of FDA approved products, we believe the current treatment options for FM continue to leave many patients dissatisfied.

Prior to 2007, the landscape of prescription drugs used to treat FM was characterized by off-label use of generically-available therapies. Drugs that had been prescribed as the primary treatments for FM were approved for other indications, with analgesics, antidepressants, and muscle relaxants among the categories receiving the greatest use by the FM population. Despite the significant FM-related sales growth of the three products approved for FM following their approvals for this indication, according to market research performed by Frost and Sullivan on our behalf, the unit volume of medications prescribed to specifically treat FM had been nearly flat between 2007 and 2010, implying that the sales growth of the approved products was mainly driven by patients switching from off-label, generic medications to on-label, branded medications. In particular, these market dynamics are consistent with the interpretation that Lyrica’s growth in FM was driven by switching from off-label analgesics, and Cymbalta’s and Savella’s growth in FM was driven by switching from off-label anti-depressants. Increasingly, Cymbalta, Savella and Lyrica are recognized as central pain inhibitors and not just treatments for their original indications.

Despite the wide use of muscle relaxants by FM patients, this category lacks a product approved for FM. Demand continues to be satisfied by off-label medicines such as CBP, tizanidine, baclofen, carisoprodol and metaxalone. These muscle relaxants have generic and branded versions. According to Frost and Sullivan, 48 million doses of the Flexeril brand and its associated CBP IR generic products were prescribed off-label for FM in 2010 and accounted for approximately 35% of the daily doses of muscle relaxants prescribed for FM that year. These figures indicate that muscle relaxants in general, and CBP in particular, have been widely adopted in FM despite the lack of an approval for this disorder. As FM patients do not typically experience muscle spasm, we believe that the use of muscle relaxants in FM is off-label from a regulatory perspective and provides therapeutic effects to FM patients that are different from those in treating muscle spasm. Therefore, in FM, CBP acts as a central pain inhibitor and not as a muscle relaxant.

Despite the availability and use of a variety of pharmacologic and non-pharmacologic interventions, FM remains a significant unmet medical need. Many patients fail to adequately respond to the approved medications, or discontinue therapy due to poor tolerability. Prescription pain and sleep medications are often taken ‘off-label’ for symptomatic relief, despite the lack of evidence that such medications provide a meaningful or durable therapeutic effect. An important goal of FM treatment is to reduce the dependence on opiate analgesic as well as on benzodiazepine and non-benzodiazepine sedative-hypnotic medications by FM patients. Since CBP has no recognized addictive potential, we believe that TNX-102 SL, if approved, could reduce the exposure of FM patients to medications that have not been shown to be effective in treating FM and are associated with significant safety risks.

Challenges in the Market for CNS Therapies

Developers of pharmaceutical treatments for syndromes and disorders that affect the CNS face special challenges. In many cases, the causes and exacerbating factors of CNS conditions remain unknown. Frequently, key symptoms are known only by patient reports and cannot be objectively validated or measured. Symptoms like pain, fatigue, disturbed sleep, cognitive/concentration problems or altered mood are characteristics of more than one condition. Often, physicians may not agree that a particular patient is affected by one or another condition or by more than one co-existing conditions.

CNS conditions are typically defined by committees of expert professionals who set criteria based on the presence of several symptoms or groups of symptoms. Sometimes groups of subjective symptoms are insufficient to describe CNS disorders and further refinement of diagnostic categories can be achieved by patient demographics, such as gender, age or concurrent medical processes, such as menopause or adolescence. Many CNS conditions, including syndromes and disorders, have not yet been characterized by laboratory tests, such as blood tests or x-ray imaging. However, laboratory tests are often important to exclude other conditions, such as inflammatory or infectious processes. Consequently, a CNS condition is sometimes called a diagnosis of exclusion because inflammation and infection should typically be ruled out by laboratory tests before applying the criteria of groups of symptoms to diagnose it.

Once a CNS condition is diagnosed, physicians may select from among treatment options based on a patient’s symptoms and history. Some medications improve or relieve only one or another symptom in a condition. Consequently, physicians may prescribe several different medications concurrently to treat individual symptoms or groups of symptoms. A desirable quality for CNS medications is the ability to relieve more than one symptom of a CNS condition. Another desirable quality for CNS medications is safety, particularly if a medicine is safe enough to be used with other medicines concurrently or at different times of the day.

Opportunity for New Treatments of FM

We believe the market for the treatment of FM is underserved, which we believe fuels a need for new therapeutic options. Due to the market acceptance of approved FM treatments Cymbalta, Lyrica and Savella, we believe there will be significant interest in effective and well-tolerated drug treatment options.

We believe that if TNX-102 SL won FDA approval, it would be an appealing option because it is believed to act by a different mechanism of action from the currently approved products, and we expect TNX-102 SL will be recommended for use at bedtime. Lyrica is recommended for twice or three-times daily dosing. Cymbalta was found effective at once-daily or twice-daily dosing and is generally restricted to daytime use and not recommended for bedtime use.

Competition

Our industry is highly competitive and subject to rapid and significant technological change. Our potential competitors include large pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug companies, academic institutions, government agencies and research institutions. We believe that key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety, tolerability, reliability, price and reimbursement level. Many of our potential competitors, including many of the organizations named below, have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Accordingly, our competitors may be more successful than we may be in obtaining FDA approval for drugs and achieving widespread market acceptance. Our competitors’ drugs may be more effective, or more effectively marketed and sold, than any drug we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing any of our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. Further, the development of new treatment methods for the conditions we are targeting could render our drugs non-competitive or obsolete.

The markets for medicines to treat FM, PTSD, ETTH and other CNS conditions are well developed and populated with established drugs marketed by large and small pharmaceutical, biotechnology and generic drug companies. Eli Lilly (Cymbalta), Forest Laboratories (Savella), and Pfizer (Lyrica) market FDA approved drugs for FM. Cymbalta lost its U.S. patent exclusivity in December 2013. GlaxoSmithKline (Paxil) and Pfizer (Zoloft) market FDA approved drugs for PTSD. Paxil and Zoloft lost their U.S. patent exclusivities in 2003 and 2006, respectively. Non-prescription medications used for ETTH include non-steroidal anti-inflammatory drugs, including ibuprofen and naproxen; acetaminophen; and aspirin. Medications prescribed for ETTH include Fiorinal, Fiorinal with Codeine, Fioricet, and their generic equivalents.

As of March 2014, we are aware of several companies developing prescription medications for FM, including Allergan, Chelsea Therapeutics, Meda, Merck, Pfizer, RiboCor and Theravance. Clinical trials in the U.S. are registered with the FDA and reported on the website www.clinicaltrials.gov. Medications that are used off-label for the treatment of FM include:

|

|

· muscle relaxants, such as cyclobenzaprine; |

|

|

· anti-depressants, such as amitriptyline, venlafaxine, and trazodone; |

|

|

· benzodiazepine as well as non-benzodiazepine sedative hypnotics. |

A number of companies are developing prescription medications for PTSD, including AstraZeneca, Biotie, Forest, GlaxoSmithKline, Lundbeck, Marinus Pharmaceuticals, Merck, Nanotherapeutics, Johnson and Johnson, Pfizer, and UCB. Medications that are used off-label for the treatment of PTSD include anti-depressants, such as nefazodone and trazodone; the antihistamine cyproheptadine; and certain atypical antipsychotics, such as olanzapine and risperidone.

A number of companies are developing prescription medications for tension-type headache, including Bayer, GlaxoSmithKline, and Pfizer.

Intellectual Property

We believe that we have an extensive patent portfolio and substantial know-how relating to TNX-102 SL and our other product candidates. Our patent portfolio, described more fully below, includes claims directed to TNX-102 SL compositions and methods of use. As of March 21, 2014, we are either the owner of record of or own the contractual right to five issued U.S. patents and 26 issued non-U.S. patents. We are actively pursuing an additional 13 U.S. patent applications, of which three are provisional and 10 are non-provisional, four international patent applications, and 21 non-U.S. patent applications.

We strive to protect the proprietary technology that we believe is important to our business, including our proprietary technology platform, our product candidates, and our processes. We seek patent protection in the United States and internationally for our products, their methods of use and processes of manufacture, and any other technology to which we have rights, where available and when appropriate. We also rely on trade secrets that may be important to the development of our business.

Our success will depend on 1) the ability to obtain and maintain patent and other proprietary rights in commercially important technology, inventions and know-how related to our business, 2) the validity and enforceability of our patents, 3) the continued confidentiality of our trade secrets, and 4) our ability to operate without infringing the valid and enforceable patents and proprietary rights of third parties. We also rely on continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position.

We cannot be certain that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications we may own or license in the future, nor can we be certain that any of our existing patents or any patents we may own or license in the future will be useful in protecting our technology. For this and more comprehensive risks related to our intellectual property, please see “Risk Factors — Risks Relating to Our Intellectual Property.”

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the date of filing the first non-provisional priority application. In the United States, a patent’s term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the U.S. Patent and Trademark Office, or PTO, in granting a patent, or may be shortened if a patent is terminally disclaimed over an earlier-filed patent.

The term of a U.S. patent that covers an FDA-approved drug may also be eligible for patent term extension, which permits patent term restoration as compensation for the patent term lost during the FDA regulatory review process. The Hatch-Waxman Amendments permit a patent term extension of up to five years beyond the statutory 20 year term of the patent for the approved product. The length of the patent term extension is related to the length of time the drug is under regulatory review. A patent term extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved drug may be extended. Similar provisions are available in Europe and some other foreign jurisdictions to extend the term of a patent that covers an approved drug. When possible, depending upon the length of clinical trials and other factors involved in the filing of a new drug application, or NDA, we expect to apply for patent term extensions for patents covering our product candidates and their methods of use.

The patent portfolios for our proprietary technology platform and our three most advanced product candidates as of March 21, 2014 are summarized below.

TNX-102 SL