Exhibit 99.01

NASDAQ: TNXP Investor Presentation November 2015 © 2015 Tonix Pharmaceuticals Holding Corp.

2 Cautionary note on forward - looking statements Certain statements in this presentation regarding strategic plans, expectations and objectives for future operations or results are “forward - looking statements” as defined by the Private Securities Litigation Reform Act of 1995 . These statements may be identified by the use of forward - looking words such as “anticipate,” “believe,” “forecast,” “estimate” and “intend,” among others . These forward - looking statements are based on Tonix’s current expectations and actual results could differ materially . There are a number of factors that could cause actual events to differ materially from those indicated by such forward - looking statements . These factors include, but are not limited to, substantial competition ; our possible need for additional financing ; uncertainties of patent protection and litigation ; uncertainties of government or third party payor reimbursement ; limited research and development efforts and dependence upon third parties ; and risks related to failure to obtain U . S Food and Drug Administration clearances or approvals and noncompliance with its regulations . As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products . The forward - looking statements in this presentation are made as of the date of this presentation, even if subsequently made available by the Company on its website or otherwise . Tonix does not undertake an obligation to update or revise any forward - looking statement, except as required by law . Investors should read the risk factors set forth in the Annual Report on Form 10 - K for the year ended December 31 , 2014 and Quarterly Report on Form 10 - Q for the period ended September 30 , 2015 , as filed with the Securities and Exchange Commission (the “SEC”) on February 27 , 2015 and November 6 , 2015 , respectively, and future periodic reports filed with the SEC on or after the date hereof . All of the Company's forward - looking statements are expressly qualified by all such risk factors and other cautionary statements .

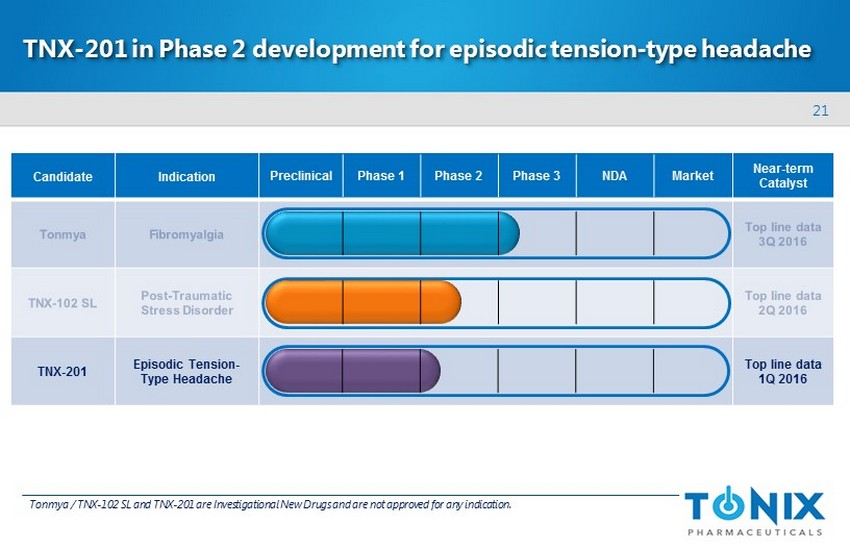

3 Developing innovative medicines for large and growing markets Targeting common pain conditions and a serious psychiatric disorder - Non - opiate, non - barbiturate, non - benzodiazepine medicines - Two clinical - stage proprietary medicines targeting three unique indications - Highly differentiated products with potential for sustainable competitive clinical advantages 2016 to reveal results from three key clinical trials - Fibromyalgia – Phase 3 will report in 3Q - Post - traumatic stress disorder – Phase 2 will report in 2Q - Episodic tension - type headache – proof - of - concept Phase 2 will report in 1Q All intellectual property owned by Tonix – from internal R&D

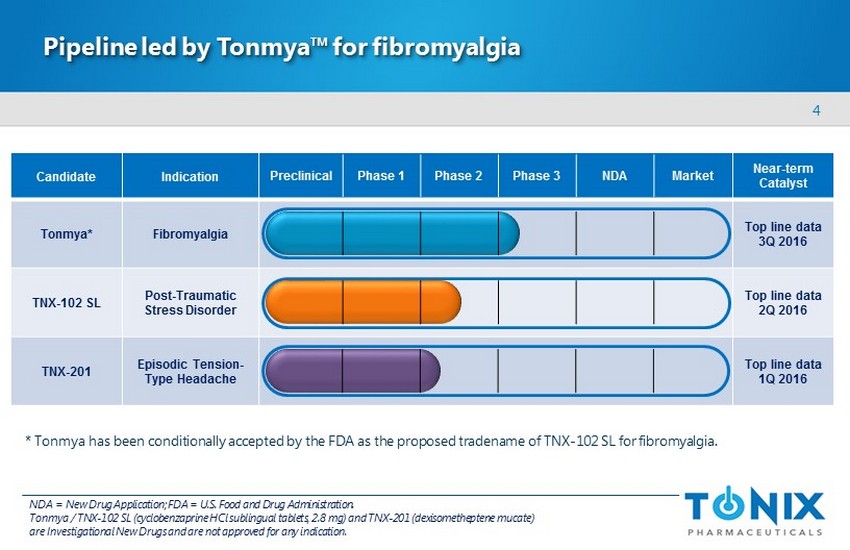

4 Candidate Indication Near - term Catalyst Tonmya * Fibromyalgia Top line data 3Q 2016 TNX - 102 SL Post - Traumatic Stress Disorder Top line data 2Q 2016 TNX - 201 Episodic Tension - Type Headache Top line data 1Q 2016 Pipeline led by Tonmya™ for fibromyalgia Preclinical Phase 1 Phase 2 Phase 3 NDA Market NDA = New Drug Application; FDA = U.S. Food and Drug Administration. Tonmya / T NX - 102 SL (cyclobenzaprine HCl sublingual tablets, 2.8 mg) and TNX - 201 ( dexisometheptene mucate ) are Investigational New Drugs and are not approved for any indication. * Tonmya has been conditionally accepted by the FDA as the proposed tradename of TNX - 102 SL for fibromyalgia.

5 Fibromyalgia is a chronic, debilitating disorder that imposes a significant social and economic burden Fibromyalgia is a neurobiological disorder characterized by : Believed to result from amplified sensory and pain signaling in central nervous system 1 Causes significant impairment in all areas of life - Lower levels of health - related quality - of - life – reduced daily functioning - Interference with work (loss of productivity, disability ) Inflicts substantial strain on the healthcare system - Average patient has 20 physician office visits per year 2 - Annual direct medical costs are twice those for non - fibromyalgia individuals 3 1 Phillips K & Clauw DJ, Best Pract Res Clin Rheumatol 2011;25:141. 2 Robinson et al, Pain Medicine 2013;14:1400. 3 White et al, J Occupational Environ Med 2008;50:13. – C hronic widespread pain – Nonrestorative sleep – Fatigue – D iminished cognition

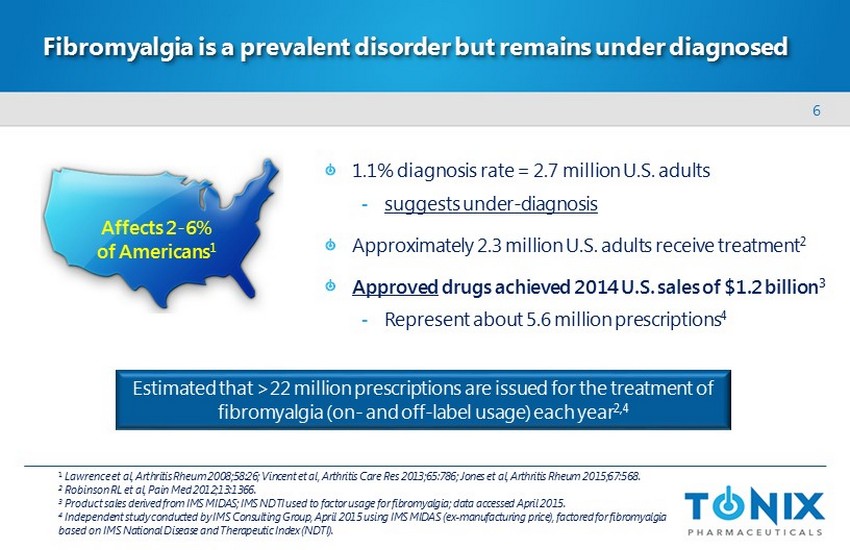

6 Fibromyalgia is a prevalent disorder but remains under diagnosed 1 Lawrence et al, Arthritis Rheum 2008;58:26; Vincent et al, Arthritis Care Res 2013;65:786; Jones et al, Arthritis Rheum 2015; 67 :568. 2 Robinson RL et al, Pain Med 2012;13:1366. 3 Product sales derived from IMS MIDAS; IMS NDTI used to factor usage for fibromyalgia; data accessed April 2015. 4 Independent study conducted by IMS Consulting Group, April 2015 using IMS MIDAS (ex - manufacturing price), factored for fibromya lgia based on IMS National Disease and Therapeutic Index (NDTI). Affects 2 - 6% of Americans 1 1.1% diagnosis rate = 2.7 million U.S. adults - suggests under - diagnosis Approximately 2.3 million U.S. adults receive treatment 2 Approved drugs achieved 2014 U.S. sales of $1.2 billion 3 - Represent about 5.6 million prescriptions 4 Estimated that >22 million prescriptions are issued for the treatment of fibromyalgia (on - and off - label usage) each year 2,4

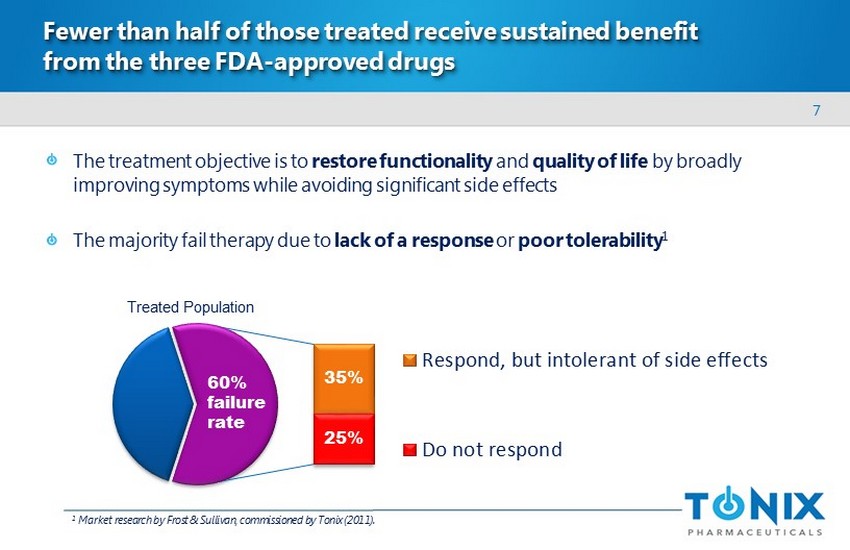

7 Fewer than half of those treated receive sustained benefit from the three FDA - approved drugs The treatment objective is to restore functionality and quality of life by broadly improving symptoms while avoiding significant side effects The majority fail therapy due to lack of a response or poor tolerability 1 Respond, but intolerant of side effects Do not respond 25% 35% 60% failure rate 1 Market research by Frost & Sullivan, commissioned by Tonix (2011). T reated P opulation

8 Large need for new fibromyalgia therapies that provide broad symptom relief with better tolerability Currently - approved medications have side effects that limit long - term use 1 - Many patients skip doses or discontinue altogether within months of treatment initiation Medication - related side effects may be similar to fibromyalgia symptoms High rates of discontinuation, switching and augmentation - A ttempt to treat multiple symptoms and/or avoid intolerable side effects - Average of 2 - 3 medications used simultaneously 2 - The typical patient has tried six different medications 3 Substantial off - label use of drugs to treat pain and other symptoms 1 Nuesch et al, Ann Rheum Dis 2013;72:955 - 62. 2 Robinson RL et al, Pain Medicine 2012;13:1366. 3 “Patient Trends: Fibromyalgia”, Decision Resources, 2011.

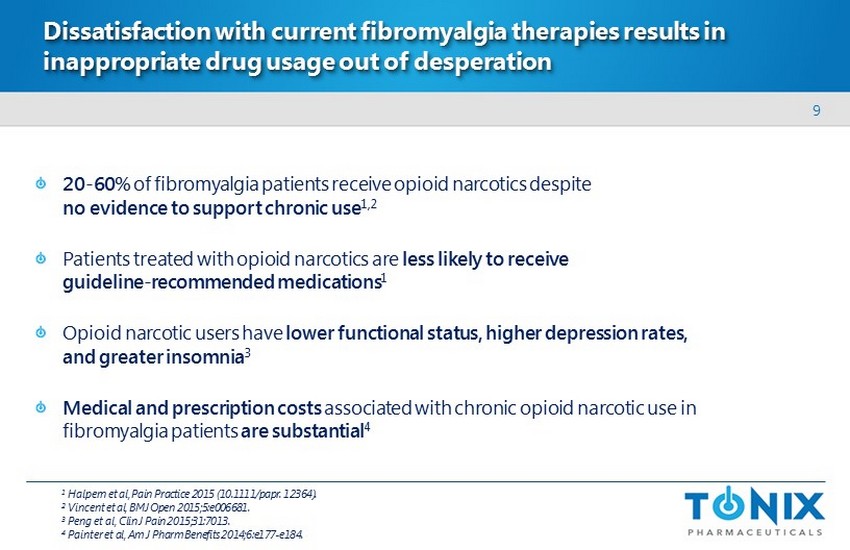

9 Dissatisfaction with current fibromyalgia therapies results in inappropriate drug usage out of desperation 1 Halpern et al, Pain Practice 2015 (10.1111/ papr . 12364). 2 Vincent et al, BMJ Open 2015;5:e006681. 3 Peng et al, Clin J Pain 2015;31:7013. 4 Painter et al, Am J Pharm Benefits 2014;6:e177 - e184. 20 - 60 % of fibromyalgia patients receive opioid narcotics despite no evidence to support chronic use 1,2 Patients treated with opioid narcotics are less likely to receive guideline - recommended medications 1 Opioid narcotic users have lower functional status, higher depression rates , and greater insomnia 3 Medical and prescription costs associated with chronic opioid narcotic use in fibromyalgia patients are substantial 4

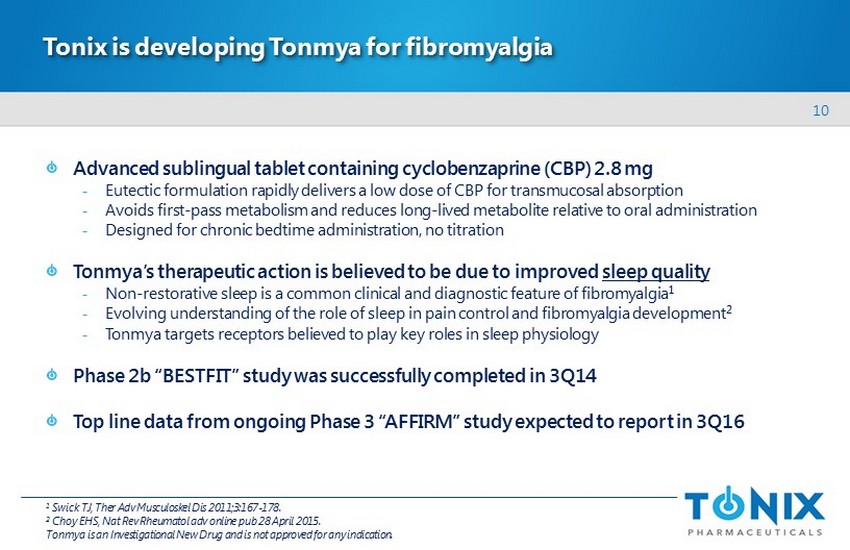

10 Tonix is developing Tonmya for fibromyalgia Advanced sublingual tablet containing cyclobenzaprine (CBP) 2.8 mg - Eutectic formulation rapidly delivers a low dose of CBP for transmucosal absorption - A voids first - pass metabolism and r educes long - lived metabolite relative to oral administration - Designed for chronic bedtime administration, no titration Tonmya’s therapeutic action is believed to be due to improved sleep quality - Non - restorative sleep is a common clinical and diagnostic feature of fibromyalgia 1 - Evolving understanding of the role of sleep in pain control and fibromyalgia development 2 - Tonmya targets receptors believed to play key roles in sleep physiology Phase 2b “BESTFIT” study was successfully completed in 3Q14 Top line data from ongoing Phase 3 “AFFIRM” study expected to report in 3Q16 1 Swick TJ, Ther Adv Musculoskel Dis 2011;3:167 - 178 . 2 Choy EHS, Nat Rev Rheumatol adv online pub 28 April 2015. Tonmya is an Investigational New Drug and is not approved for any indication.

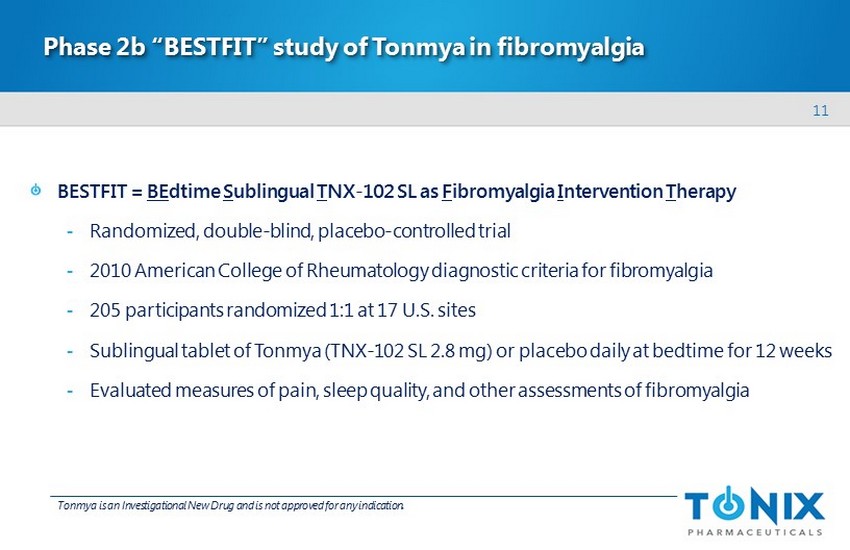

11 Phase 2b “BESTFIT” study of Tonmya in fibromyalgia BESTFIT = BE dtime S ublingual T NX - 102 SL as F ibromyalgia I ntervention T herapy - Randomized , double - blind, placebo - controlled trial - 2010 American College of Rheumatology diagnostic criteria for fibromyalgia - 205 participants randomized 1:1 at 17 U.S. sites - S ublingual tablet of Tonmya (TNX - 102 SL 2.8 mg) or placebo daily at bedtime for 12 weeks - Evaluated measures of pain, sleep quality, and other assessments of fibromyalgia Tonmya is an Investigational New Drug and is not approved for any indication.

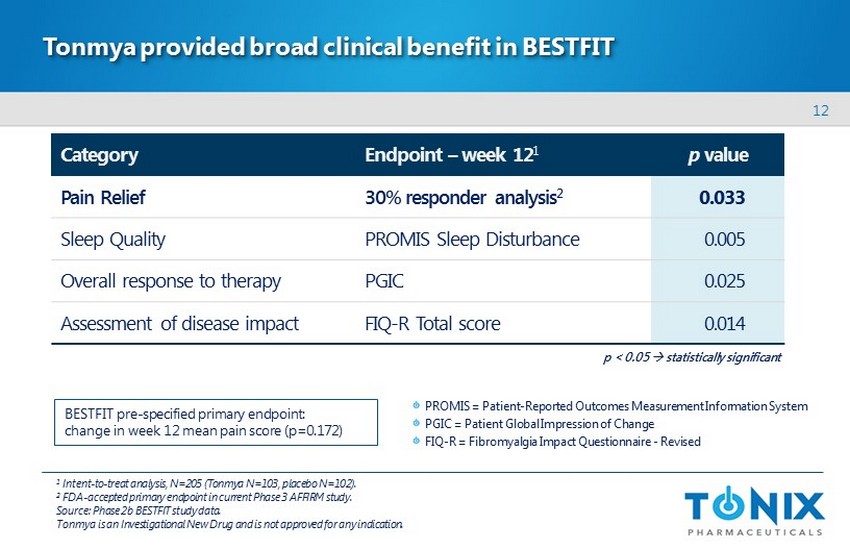

12 Tonmya provided broad clinical benefit in BESTFIT Category Endpoint – week 12 1 p value Pain Relief 30% responder analysis 2 0.033 Sleep Quality PROMIS Sleep Disturbance 0.005 Overal l response to therapy PGIC 0.025 Assessment of disease impact FIQ - R Total score 0.014 1 Intent - to - treat analysis, N=205 (Tonmya N=103, placebo N=102 ). 2 FDA - accepted primary endpoint in current Phase 3 AFFIRM study. Source : Phase 2b BESTFIT study data. Tonmya is an Investigational New Drug and is not approved for any indication. BESTFIT pre - specified primary endpoint: change in week 12 mean pain score (p=0.172) PROMIS = Patient - Reported Outcomes Measurement Information System PGIC = Patient Global Impression of Change FIQ - R = Fibromyalgia Impact Questionnaire - Revised p < 0.05 s tatistically significant

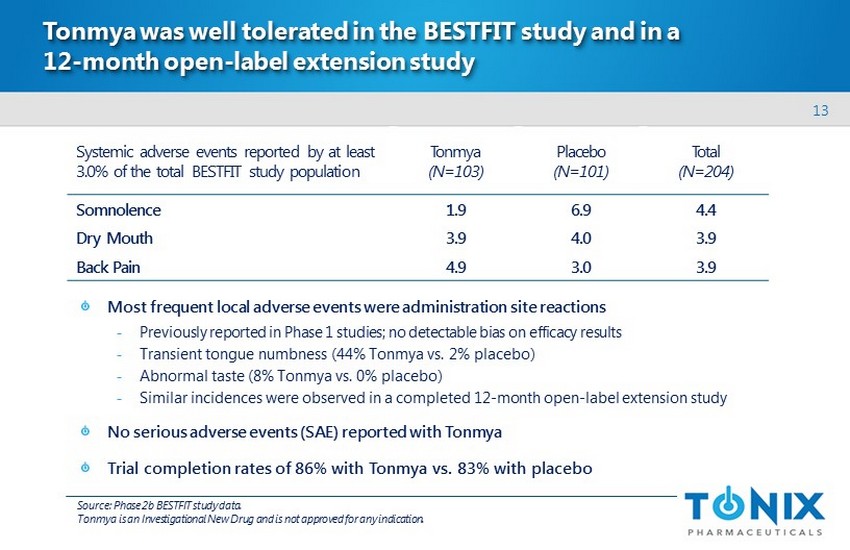

13 Tonmya was well tolerated in the BESTFIT study and in a 12 - month open - label extension study Most frequent local adverse events were administration site reactions - Previously reported in Phase 1 studies; no detectable bias on efficacy results - Transient tongue numbness ( 44% Tonmya vs . 2% placebo) - Abnormal taste (8% Tonmya vs . 0% placebo ) - Similar incidences were observed in a completed 12 - month open - label extension study No serious adverse events (SAE) reported with Tonmya Trial completion rates of 86% with Tonmya vs. 83% with placebo Systemic adverse events reported by at least 3.0% of the total BESTFIT study population Tonmya (N=103) Placebo (N=101) Total (N=204) Somnolence 1.9 6.9 4.4 Dry Mouth 3.9 4.0 3.9 Back Pain 4.9 3.0 3.9 Source: Phase 2b BESTFIT study data. Tonmya is an Investigational New Drug and is not approved for any indication.

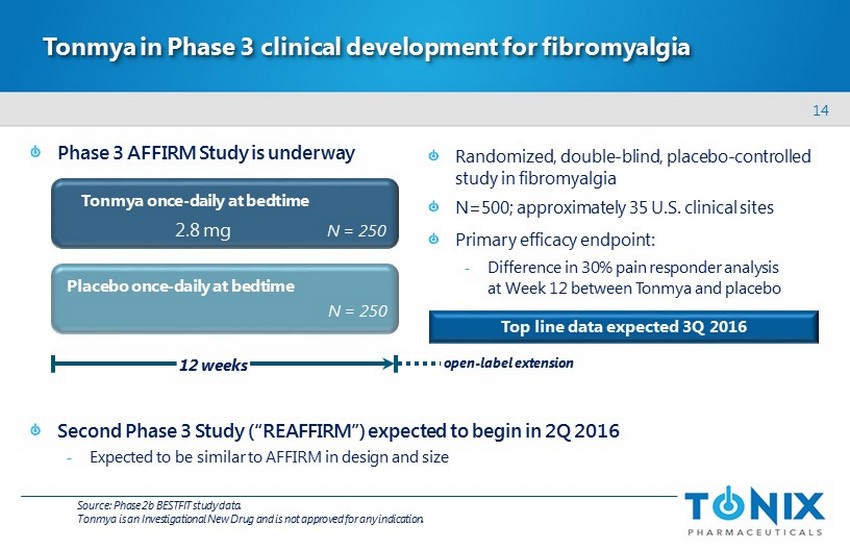

14 Phase 3 AFFIRM Study is underway Second Phase 3 Study (“REAFFIRM”) expected to begin in 2Q 2016 - E xpected to be similar to AFFIRM in design and size Tonmya in Phase 3 clinical development for fibromyalgia Randomized, double - blind, placebo - controlled study in fibromyalgia N=500; approximately 35 U.S. clinical sites Primary efficacy endpoint: - Difference in 30% pain responder analysis at Week 12 between Tonmya and placebo Placebo once - daily at bedtime 12 weeks Tonmya once - daily at bedtime N = 250 N = 250 2.8 mg open - label extension Source: Phase 2b BESTFIT study data. Tonmya is an Investigational New Drug and is not approved for any indication. Top line data expected 3 Q 2016

15 Candidate Indication Near - term Catalyst TNX - 102 SL Post - Traumatic Stress Disorder Top line data 2Q 2016 TNX - 102 SL in Phase 2 development for post - traumatic stress disorder (PTSD) Preclinical Phase 1 Phase 2 Phase 3 NDA Market Tonmya / T NX - 102 SL and TNX - 201 are Investigational New Drugs and are not approved for any indication.

16 PTSD is a chronic stress disorder triggered by a traumatic event PTSD is characterized by: Considered a stress response, but prolonged and does not resolve with time - 20% of women and 8 % of men who experience significant trauma develop PTSD 1 Associated with significant life disruption - Social isolation, inability to maintain employment, loss of independent living - Unpredictable acts of violence, suicidal thoughts – re - experiencing the triggering event – negative alterations in mood/cognition – situation/stimulus avoidance – hypervigilance (anxiety, difficulty sleeping) 1 Kessler et al, Arch Gen Psychiatry 1995;52:1048.

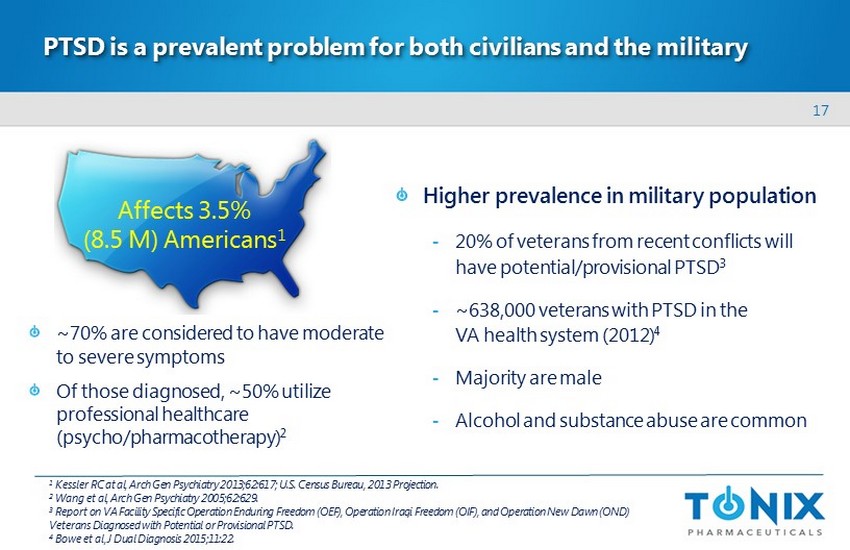

17 PTSD is a prevalent problem for both civilians and the military ~70% are considered to have moderate to severe symptoms Of those diagnosed, ~50% utilize professional healthcare (psycho/pharmacotherapy) 2 1 Kessler RC at al, Arch Gen Psychiatry 2013;62:617; U.S. Census Bureau, 2013 Projection. 2 Wang et al, Arch Gen Psychiatry 2005;62:629. 3 Report on VA Facility Specific Operation Enduring Freedom (OEF), Operation Iraqi Freedom (OIF), and Operation New Dawn (OND) Veterans Diagnosed with Potential or Provisional PTSD. 4 Bowe et al, J Dual Diagnosis 2015;11:22. Affects 3.5% (8.5 M) Americans 1 Higher prevalence in military population - 20% of veterans from recent conflicts will have potential/provisional PTSD 3 - ~638,000 veterans with PTSD in the VA health system ( 2012) 4 - Majority are male - Alcohol and substance abuse are common

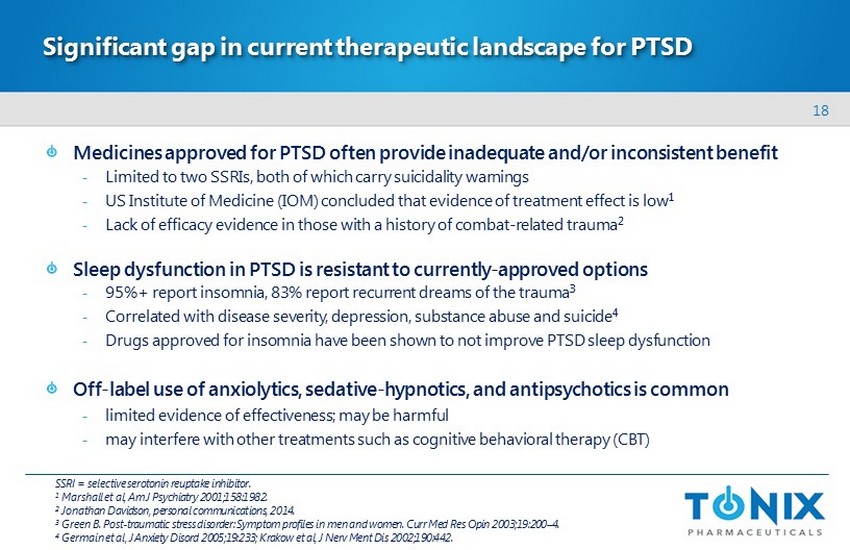

18 Significant gap in current therapeutic landscape for PTSD M edicines approved for PTSD often provide inadequate and/or inconsistent benefit - Limited to two SSRIs, both of which carry suicidality warnings - US Institute of Medicine (IOM) concluded that evidence of treatment effect is low 1 - Lack of efficacy evidence in those with a history of combat - related trauma 2 Sleep dysfunction in PTSD is resistant to currently - approved options - 95 %+ report insomnia, 83% report recurrent dreams of the trauma 3 - Correlated with disease severity, depression, substance abuse and suicide 4 - Drugs approved for insomnia have been shown to not improve PTSD sleep dysfunction Off - label use of anxiolytics, sedative - hypnotics, and antipsychotics is common - limited evidence of effectiveness; may be harmful - m ay interfere with other treatments such as cognitive behavioral therapy (CBT) SSRI = selective serotonin reuptake inhibitor. 1 Marshall et al, Am J Psychiatry 2001;158:1982. 2 Jonathan Davidson, personal communications, 2014. 3 Green B. Post - traumatic stress disorder: Symptom profiles in men and women. Curr Med Res Opin 2003;19:200 – 4 . 4 Germain et al, J Anxiety Disord 2005;19:233; Krakow et al, J Nerv Ment Dis 2002;190:442.

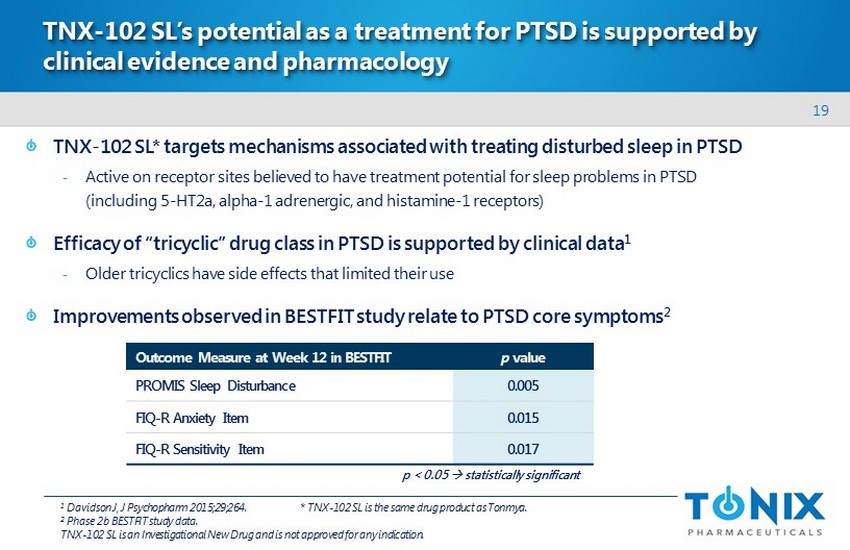

19 TNX - 102 SL’s potential as a treatment for PTSD is supported by clinical evidence and pharmacology TNX - 102 SL* targets mechanisms associated with treating disturbed sleep in PTSD - Active on receptor sites believed to have treatment potential for sleep problems in PTSD (including 5 - HT2a, alpha - 1 adrenergic, and histamine - 1 receptors) Efficacy of “tricyclic” drug class in PTSD is supported by clinical data 1 - Older tricyclics have side effects that limited their use Improvements observed in BESTFIT study relate to PTSD core symptoms 2 Outcome Measure at Week 12 in BESTFIT p value PROMIS Sleep Disturbance 0.005 FIQ - R Anxiety Item 0.015 FIQ - R Sensitivity Item 0.017 1 Davidson J, J Psychopharm 2015;29;264. * TNX - 102 SL is the same drug product as Tonmya . 2 Phase 2b BESTFIT study data. TNX - 102 SL is an Investigational New Drug and is not approved for any indication . p < 0.05 s tatistically significant

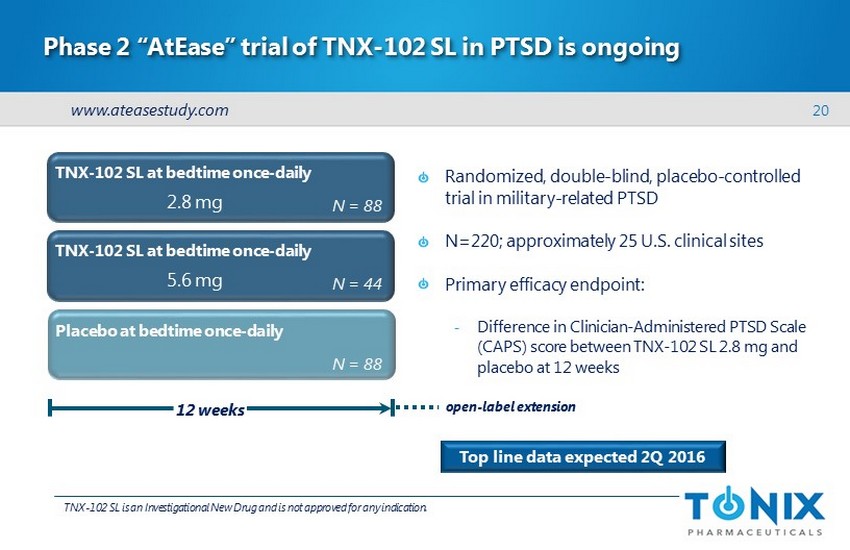

20 Phase 2 “ AtEase ” trial of TNX - 102 SL in PTSD is ongoing Randomized, double - blind, placebo - controlled trial in military - related PTSD N=220; approximately 25 U.S. clinical sites Primary efficacy endpoint: - Difference in Clinician - Administered PTSD Scale (CAPS) score between TNX - 102 SL 2.8 mg and placebo at 12 weeks TNX - 102 SL is an Investigational New Drug and is not approved for any indication . Top line data expected 2Q 2016 TNX - 102 SL at bedtime once - daily Placebo at bedtime once - daily 12 weeks N = 88 TNX - 102 SL at bedtime once - daily N = 88 N = 44 2.8 mg 5.6 mg open - label extension www.ateasestudy.com

21 Candidate Indication Near - term Catalyst TNX - 201 Episodic Tension - Type Headache Top line data 1Q 2016 TNX - 201 in Phase 2 development for episodic tension - type headache Preclinical Phase 1 Phase 2 Phase 3 NDA Market Tonmya / T NX - 102 SL and TNX - 201 are Investigational New Drugs and are not approved for any indication.

22 Episodic tension - type headache ( ETTH) – the most common form of headache More than 75 million adults in the U.S. experience ETTH each year 1 - Constant band of pressure on the back/sides of head; “squeezed in a vice” feeling - Most are infrequent (<1 per month) ; rarely require medical attention, mainly self - treated 21 million experience frequent ETTH each year 1 - Frequent = one to 14 headaches per month over a three - month period - More likely to seek physician care and receive a prescription product 1,2 ETTH is the major contributor to all ‘non - migraine headaches’ 1 - Non - migraine headaches lead to 9.2 million emergency room or office visits each year 3,4 1 Schwartz et al, JAMA 1998;279:381 - 383; Chowdhury, Ann Ind Acad Neurol 2012;15:83 - 88; Tonix analysis of public literature. 2 Scher et al, Cephalalgia 2010;30:321 - 328; Tonix analysis of public literature . 3 Health Care Utilization Project data, 2011. 4 IMS National Disease and Therapeutic Index™ 2013.

23 Many patients do not receive adequate relief from OTC treatments “First - line” treatment - NSAIDs are most common - Many patients self - medicate with a course of over - the - counter NSAIDs before seeing a physician 1 - Less than 50% of treated patients are pain - free at two hours 2 - Some are refractory to NSAIDs when they first seek medical attention 1 - Aspirin - and acetaminophen - containing products also used OTC = over - the - counter; NSAID = non - steroidal anti - inflammatory drug. 1 Based on independent study commissioned by Tonix , based on physician interviews using IMS National Prescription Audit (8/2013 – 7/142014) and IMS National Disease and Therapeutic Index™ Q3 2008 – Q3 2014. 2 Moore et al, Pain 2014;155:2220 - 2228.

24 Prescription options for acute therapy are limited and potentially addictive Butalbital combinations are the only FDA - approved prescription products for ETTH - ~3.5 million prescriptions for these products are written per year for non - migraine headaches 1 - Butalbital is a barbiturate – and frequently combined with codeine, an opiate - Not recommended for extended use because of addiction, tolerance and abuse potential 2 Opioid narcotic combination products are used off - label to treat non - migraine headaches - Include products that contain hydrocodone, codeine, and tramadol 1 - ~5.3 million prescriptions for these products issued annually for the treatment of non - migraine headaches 1 1 Based on independent study commissioned by Tonix, based on physician interviews using IMS National Prescription Audit (8/2013 – 7/142014) and IMS National Disease and Therapeutic Index™ Q3 2008 – Q3 2014. 2 Fioricet package insert .

25 Isometheptene previously used for ETTH without an approved NDA Isometheptene (IMH) had been marketed for tension - type headache - Single agent product for migraine was voluntarily withdrawn by Knoll Pharma in 1981 - IMH - containing combination products remained on the market without approved NDAs - FDA label stated that IMH was “possible effective” for migraine 1 2.5 million prescriptions of IMH - containing combination products were filled in 1997 - Midrin ® – NDA withdrawn (2011) - Prodrin ® – now marketed under “Unapproved D rug Other” category 1 IMS Health, National Prescription Audit, 01/1995 – 12/2000 (extracted 8/2014); IMS Health, IMS National Disease and Therapeutic Index™, 01/1995 – 12/2000 (extracted 8/2014).

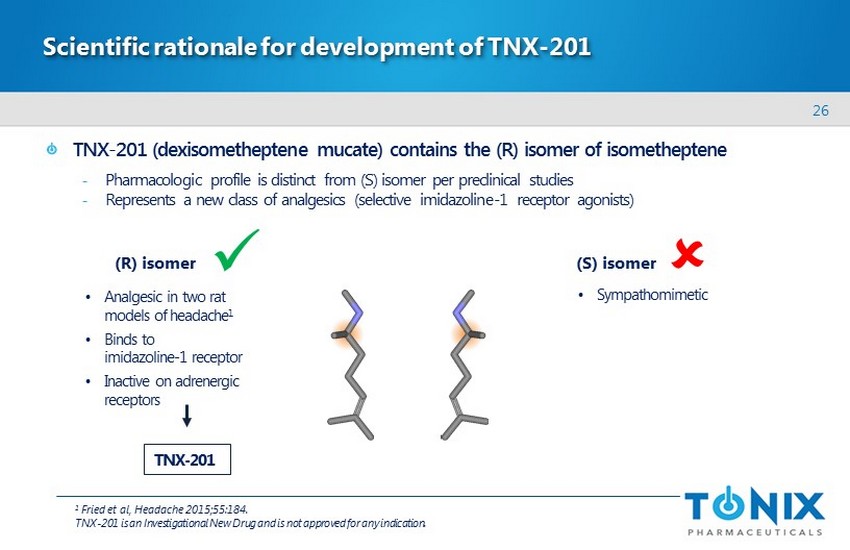

26 Scientific rationale for development of TNX - 201 TNX - 201 ( dexisometheptene mucate ) contains the (R) isomer of isometheptene - Pharmacologic profile is distinct from (S) isomer per preclinical studies - Represents a new class of analgesics (selective imidazoline - 1 receptor agonists) (R) isomer (S) isomer • Analgesic in two rat models of headache 1 • Binds to imidazoline - 1 receptor • Inactive on adrenergic receptors • Sympathomimetic x TNX - 201 1 Fried et al, Headache 2015;55:184 . TNX - 201 is an Investigational New Drug and is not approved for any indication.

27 Current value proposition for TNX - 201 Key attributes - Unique analgesic mechanism of action (imidazoline - 1 receptor agonist) - Differentiated pharmacology as a single isomer of isometheptene - May offer a non - addictive treatment option for ETTH May serve patients who: - Do not adequately respond to an NSAID - Would be candidates for treatment with butalbital and/or opioid narcotics - Suffer from medication overuse headaches - May be caused by NSAIDs, butalbital , or opioid narcotics TNX - 201 is an Investigational New Drug and is not approved for any indication .

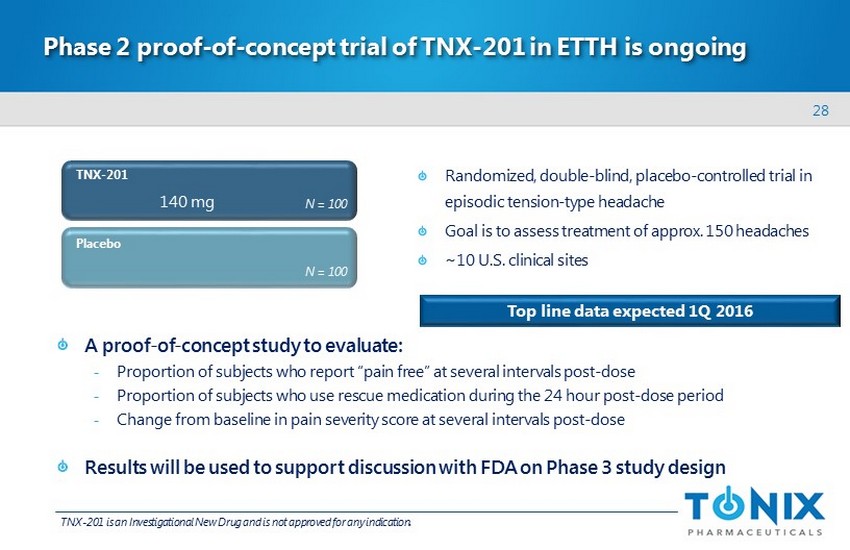

28 Phase 2 proof - of - concept trial of TNX - 201 in ETTH is ongoing Randomized, double - blind, placebo - controlled trial in episodic tension - type headache Goal is to assess treatment of approx. 150 headaches ~ 10 U.S. clinical sites Top line data expected 1Q 2016 Placebo TNX - 201 N = 100 N = 100 140 mg A proof - of - concept study to evaluate: - Proportion of subjects who report “pain free” at several intervals post - dose - Proportion of subjects who use rescue medication during the 24 hour post - dose period - Change from baseline in pain severity score at several intervals post - dose Results will be used to support discussion with FDA on Phase 3 study design TNX - 201 is an Investigational New Drug and is not approved for any indication.

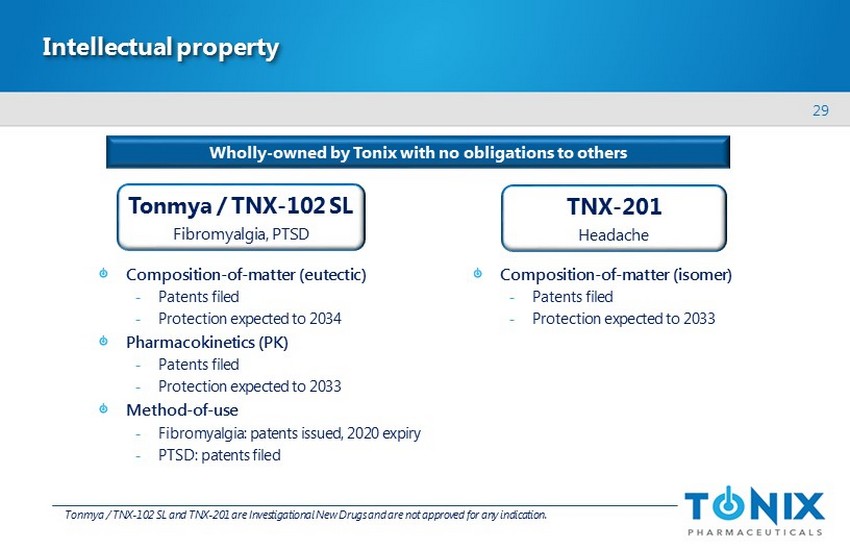

29 Intellectual property Composition - of - matter (eutectic) - Patents filed - Protection expected to 2034 Pharmacokinetics (PK) - Patents filed - Protection expected to 2033 Method - of - use - Fibromyalgia: patents issued, 2020 expiry - PTSD: patents filed Tonmya / TNX - 102 SL Fibromyalgia, PTSD Composition - of - matter (isomer) - Patents filed - Protection expected to 2033 TNX - 201 Headache Tonmya / T NX - 102 SL and TNX - 201 are Investigational New Drugs and are not approved for any indication . Wholly - owned by Tonix with no obligations to others

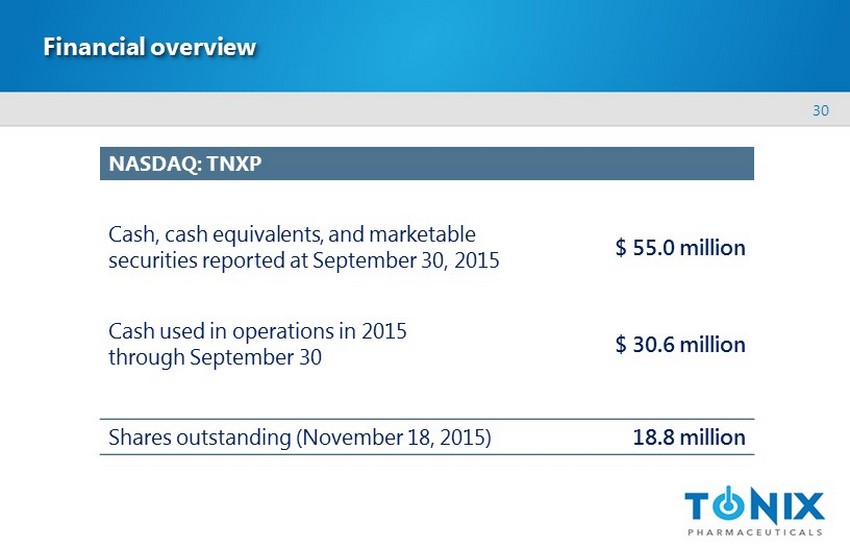

30 Financial overview NASDAQ: TNXP Cash, cash equivalents, and marketable securities reported at September 30, 2015 $ 55.0 million Cash used in operations in 2015 through September 30 $ 30.6 million Shares outstanding (November 18, 2015) 18.8 million

31 Management team Seth Lederman, MD President & CEO Leland Gershell, MD, PhD Chief Financial Officer Bruce Daugherty, PhD Chief Scientific Officer Ronald Notvest, PhD SVP, Commercial Planning & Development Gregory Sullivan, MD Chief Medical Officer

32 Board of directors Seth Lederman, MD Chairman Ernest Mario, PhD ALZA, Glaxo, Reliant Pharma John Rhodes NYSERDA, NRDC, Booz Allen Hamilton Samuel Saks, MD Jazz Pharma, ALZA, Johnson & Johnson Charles Mather BTIG, Janney, Jefferies, Cowen, Smith Barney Stuart Davidson Labrador Ventures, Alkermes , Combion Patrick Grace Apollo Philanthropy, WR Grace, Chemed Donald Landry, MD, PhD Chair of Medicine, Columbia University

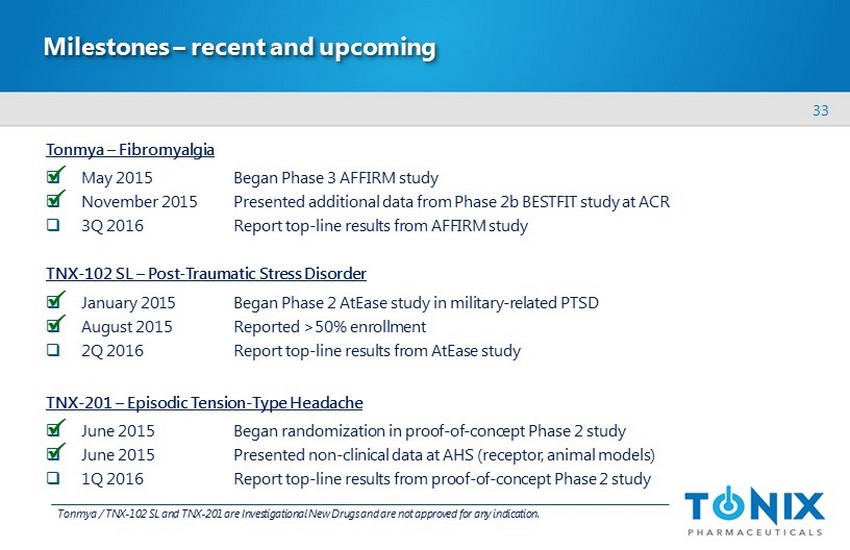

33 Milestones – recent and upcoming Tonmya – Fibromyalgia □ May 2015 Began Phase 3 AFFIRM study □ November 2015 Presented additional data from Phase 2b BESTFIT study at ACR □ 3Q 2016 Report top - line results from AFFIRM study TNX - 102 SL – Post - Traumatic Stress Disorder □ January 2015 Began Phase 2 AtEase study in military - related PTSD □ August 2015 Reported >50% enrollment □ 2Q 2016 Report top - line results from AtEase study TNX - 201 – Episodic Tension - Type Headache □ June 2015 Began randomization in proof - of - concept Phase 2 study □ June 2015 Presented non - clinical data at AHS (receptor, animal models) □ 1Q 2016 Report top - line results from proof - of - concept Phase 2 study x Tonmya / T NX - 102 SL and TNX - 201 are Investigational New Drugs and are not approved for any indication . x x x x x

NASDAQ: TNXP 509 Madison Avenue New York, NY 10022 (212) 980 - 9155 www.tonixpharma.com