UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

TONIX PHARMACEUTICALS HOLDING CORP.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

TONIX PHARMACEUTICALS HOLDING CORP.

509 Madison Avenue, Suite 306

New York, New York 10022

Telephone: (212) 980-9155

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of the shareholders of Tonix Pharmaceuticals Holding Corp. (the “Company” or “Tonix”) will be held on Friday, June 16, 2017, at 10:00 a.m. local time at the offices of Sichenzia Ross Ference Kesner LLP at 61 Broadway, 32nd Floor, New York, New York 10006 for the purposes of:

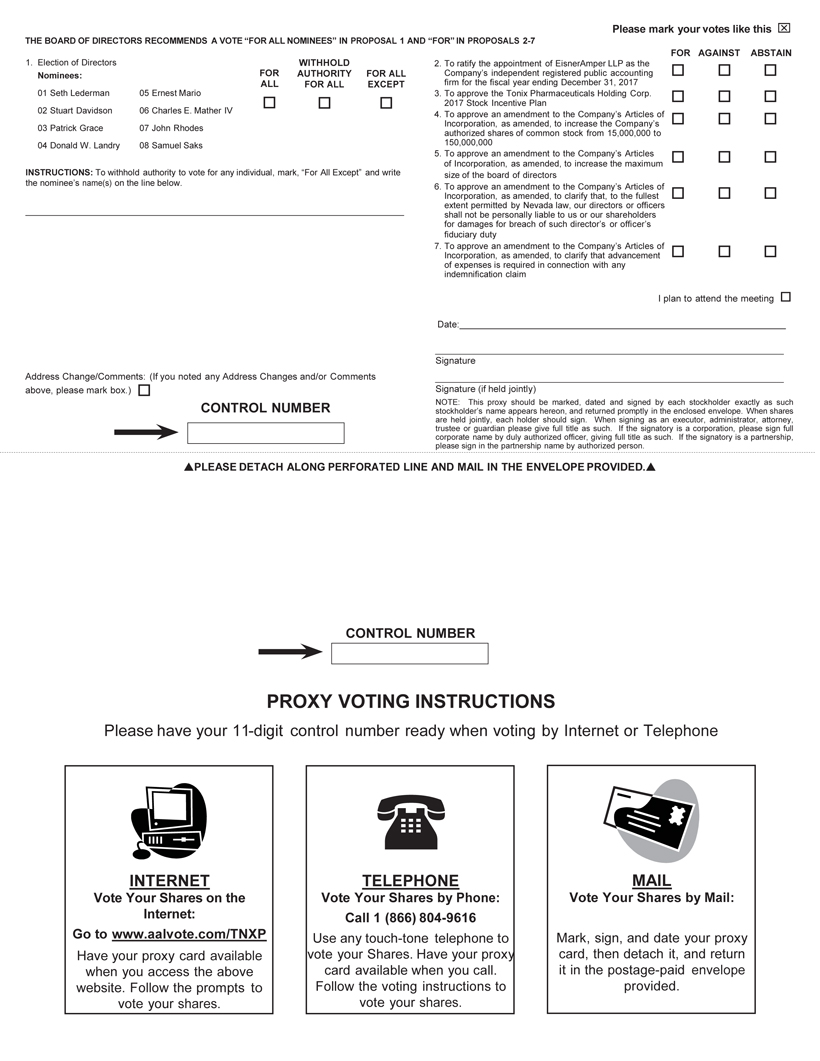

| 1. | To elect the eight director nominees named in the Proxy Statement to hold office until the next annual meeting of shareholders; | |

| 2. | To ratify the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017; | |

| 3. | To approve the Tonix Pharmaceuticals Holding Corp. 2017 Stock Incentive Plan; | |

| 4. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000; | |

| 5. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors; | |

| 6. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty; | |

| 7. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim; and | |

| 8. | To act on such other matters as may properly come before the meeting or any adjournment there. |

Only shareholders of record at the close of business on April 24, 2017, will be entitled to attend and vote at the meeting. A list of all shareholders entitled to vote at the Annual Meeting, arranged in alphabetical order and showing the address of and number of shares held by each shareholder, will be available at the principal office of the Company during usual business hours, for examination by any shareholder for any purpose germane to the Annual Meeting for 10 days prior to the date thereof. The proxy materials will be furnished to shareholders on or about May 5, 2017.

Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting of Shareholders to be held on June 16, 2017:

The Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2016 are available at: http://viewproxy.com/tonixpharma/2017/.

BY ORDER OF THE BOARD OF DIRECTORS

| /s/ Seth Lederman | |

| Seth Lederman | |

| Chief Executive Officer and Chairman of the Board of Directors | |

May 2, 2017 |

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

TONIX PHARMACEUTICALS HOLDING CORP.

509 Madison Avenue, Suite 306

New York, New York 10022

Telephone: (212) 980-9155

PROXY STATEMENT

FOR THE 2017 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, JUNE 16, 2017

INFORMATION CONCERNING THE ANNUAL MEETING

General

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Tonix Pharmaceuticals Holding Corp. (the “Company”), for use at the Annual Meeting of the Company’s shareholders to be held at the offices of Sichenzia Ross Ference Kesner LLP at 61 Broadway, 32nd Floor, New York, New York 10006 on June 16, 2017, at 10:00 a.m. local time and at any adjournments thereof. Whether or not you expect to attend the meeting in person, please vote your shares as promptly as possible to ensure that your vote is counted. The proxy materials will be furnished to shareholders on or about May 5, 2017.

Revocability of Proxy and Solicitation

Any shareholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of this proxy statement and the solicitation of proxies.

Record Date

Shareholders of record at the close of business on April 24, 2017 (the “Record Date”), will be entitled to receive notice of, attend and vote at the meeting.

Action to be Taken Under Proxy

Unless otherwise directed by the giver of the proxy, the persons named in the form of proxy, namely, Seth Lederman, our Chief Executive Officer, and Bradley Saenger, our Chief Financial Officer, or either one of them who acts, will vote:

| · | FOR the election of the eight director nominees named in the Proxy Statement to hold office until the next annual meeting of shareholders; |

| · | FOR ratification of the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017; |

| · | FOR approval of the Tonix Pharmaceuticals Holding Corp. 2017 Stock Incentive Plan; |

| · | FOR approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000; |

| · | FOR approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors; |

| · | FOR approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty; |

| · | FOR approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim; and |

| · | According to their discretion, on the transaction of such other matters as may properly come before the meeting or any adjournment there. |

| 1 |

Should any nominee named herein for election as a director become unavailable for any reason, it is intended that the persons named in the proxy will vote for the election of such other person in his stead as may be designated by the Board. The Board is not aware of any reason that might cause any nominee to be unavailable.

Who is Entitled to Vote; Vote Required; Quorum

As of April 24, 2017, there were 7,486,026 shares of common stock issued and outstanding, which constitutes all of the outstanding capital stock of the Company. Shareholders are entitled to one vote for each share of common stock held by them. Except as specified disclosed herein, all share and per share amounts contained in this proxy statement reflect the 1-for-10 reverse stock split the Company effected on March 17, 2017.

One-third (1/3) of the outstanding shares, or 2,495,342 shares, present in person or represented by proxy, will constitute a quorum at the meeting. For purposes of the quorum and the discussion below regarding the vote necessary to take shareholder action, shareholders of record who are present at the Annual Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered shareholders who are present and entitled to vote and are counted towards the quorum.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received such instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. In connection with the treatment of abstentions and broker non-votes, the proposals at this meeting to (i) elect directors, (ii) approve the 2017 Stock Incentive Plan, (iii) approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors, (iv) approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty, and (v) approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim, are considered “non-routine” matters, and brokers are not entitled to vote uninstructed shares with respect to these proposals. Only the proposals to (i) ratify the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm and (ii) approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000, are routine matters that brokers are entitled to vote shares without receiving instructions.

Determination of whether a matter specified in the Notice of Annual Meeting of Shareholders has been approved will be determined as follows:

| · | Those persons will be elected directors who receive a plurality of the votes cast at the Meeting in person or by proxy and entitled to vote on the election. Accordingly, abstentions or directions to withhold authority will have no effect on the outcome of the vote; |

| · | The affirmative vote of the holders of a majority of the total outstanding shares as of the Record Date is necessary to approve the proposals to amend the Articles of Incorporation to (i) increase the number of authorized shares of common stock, (ii) increase the maximum size of the board of directors, (iii) clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty, and (iv) clarify that advancement of expenses is required in connection with any indemnification claim. Accordingly, abstentions and broker non-votes with respect to any such matter will have the effect of a vote against such matter; and |

| · | For each other matter specified in the Notice of Annual Meeting of Shareholders, the affirmative vote of a majority of the shares of common stock cast at the meeting in person or by proxy on such matter is required for approval. Abstentions and broker non-votes will be considered present but will not be counted as votes cast and, therefore, will have no effect on the outcome of the matter. |

Directions to withhold authority to vote for directors, abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present for the Meeting.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Tonix Pharmaceuticals Holding Corp. (sometimes referred to as the “Company,” “Tonix,” “we” or “us”) is soliciting your proxy to vote at the 2017 Annual Meeting of Shareholders. According to our records, you were a shareholder of the Company as of the end of business on April 24, 2017.

| 2 |

You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

The Company intends to mail these proxy materials on or about May 5, 2017 to all shareholders of record on the Record Date entitled to vote at the Annual Meeting.

What is included in these materials?

These materials include:

| · | this proxy statement for the Annual Meeting; and |

| · | the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2016, as filed with the SEC on April 13, 2017. |

What is the proxy card?

The proxy card enables you to appoint Seth Lederman, our Chief Executive Officer, and Bradley Saenger, our Chief Financial Officer, as your representative at the Annual Meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting.

When and where is the 2017 Annual Meeting being held?

The 2017 Annual Meeting will be held on Friday, June 16, 2017 commencing at 10:00 a.m., local time, at the offices of Sichenzia Ross Ference Kesner LLP at 61 Broadway, 32nd Floor, New York, New York 10006.

Can I view these proxy materials over the Internet?

Yes. The Notice of Meeting, this Proxy Statement and accompanying proxy card and our Annual Report on Form 10-K for the year ended December 31, 2016 are available at http://viewproxy.com/tonixpharma/2017/.

Who can vote at the Annual Meeting?

Only shareholders of record at the close of business on April 24, 2017 will be entitled to vote at the Annual Meeting. On this Record Date, there were 7,486,026 shares of common stock outstanding and entitled to vote.

The 2017 Annual Meeting will begin promptly at 10:00 a.m., local time. Check-in will begin one-half hour prior to the meeting. Please allow ample time for the check-in procedures.

Shareholder of Record: Shares Registered in Your Name

If on April 24, 2017 your shares were registered directly in your name with Tonix’s transfer agent, VStock Transfer, LLC, then you are a shareholder of record. As a shareholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 24, 2017, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, rather than in your name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the 2017 Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

The following matters are scheduled for a vote:

| 1. | To elect the eight director nominees named in the Proxy Statement to hold office until the next annual meeting of shareholders; |

| 3 |

| 2. | To ratify the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017; | |

| 3. | To approve the Tonix Pharmaceuticals Holding Corp. 2017 Stock Incentive Plan; | |

| 4. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000; | |

| 5. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors; | |

| 6. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty; | |

| 7. | To approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim; and | |

| 8. | To act on such other matters as may properly come before the meeting or any adjournment there. |

The Board is not currently aware of any other business that will be brought before the 2017 Annual Meeting.

How do I vote?

You may vote “For” all the nominees to the Board, you may “Withhold” your vote for all nominees or you may vote “For” all nominees except for any nominee(s) you specify. For the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record as of the Record Date, you may vote in person at the 2017 Annual Meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| · | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. You should be prepared to present photo identification for admittance. A list of shareholders eligible to vote at the Annual Meeting will be available for inspection at the 2017 Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at our principal executive offices, which are located at 509 Madison Avenue, Suite 306, New York, New York 10022. |

| · | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your completed and signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail your voting instructions as directed by your broker or bank to ensure that your vote is counted. Alternatively, you may be able to vote by telephone or over the Internet by following instructions provided by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What is a quorum for purposes of conducting the 2017 Annual Meeting?

The presence, in person or by proxy, of the holders of one-third (1/3rd) of the issued and outstanding common stock, or 2,495,342 shares, entitled to vote at the meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented at the Annual Meeting, the shareholders entitled to vote thereat, present in person or by proxy, may adjourn the Annual Meeting from time to time without notice or other announcement until a quorum is present or represented.

| 4 |

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” the election of each of the eight (8) nominees for director, “FOR” the ratification of EisnerAmper LLP as independent registered public accountants of the Company for its fiscal year ending December 31, 2017, “FOR” approval of the Tonix Pharmaceuticals Holding Corp. 2017 Stock Incentive Plan; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim; and “FOR ” approval of any adjournment of the 2017 Annual Meeting, if necessary or appropriate, to transact such other business as may properly come before the meeting and all adjournments and postponements thereof; and if any other matter is properly presented at the meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares “FOR” the election of each of the eight (8) nominees for director, “FOR” the ratification of EisnerAmper LLP as independent registered public accountants of the Company for its fiscal year ending December 31, 2017, “FOR” approval of the Tonix Pharmaceuticals Holding Corp. 2017 Stock Incentive Plan; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors; “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty; and “FOR” approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim. Unless you provide other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board as set forth in this Proxy Statement.

Who is paying for this proxy solicitation?

We will bear the cost of solicitation of proxies. Proxies may be solicited by mail or personally by our directors, officers or employees, none of whom will receive additional compensation for such solicitation. We have retained Alliance Advisors, LLC to assist in the solicitation of proxies at an estimated cost of approximately $6,000, plus reasonable expenses. Those holding shares as of record for the benefit of others, or nominee holders, are being asked to distribute proxy soliciting materials to, and request voting instructions from, the beneficial owners of such shares. We will reimburse nominee holders for their reasonable out-of-pocket expenses.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

I share the same address with another Tonix Pharmaceuticals Holding Corp. shareholder. Why has our household only received one set of proxy materials?

The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our shareholders. This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered only one set of proxy materials to shareholders who hold their shares through a bank, broker or other holder of record and share a single address, unless we received contrary instructions from any shareholder at that address. However, any such street name holder residing at the same address who wishes to receive a separate copy of the proxy materials may make such a request by contacting the bank, broker or other holder of record, or Broadridge Financial Solutions, Inc. at (800) 542-1061 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717. Street name holders residing at the same address who would like to request householding of Company materials may do so by contacting the bank, broker or other holder of record or Broadridge at the phone number or address listed above.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy card with a later date; |

| · | You may send a timely written notice that you are revoking your proxy to the Company at 509 Madison Avenue, Suite 306, New York, New York 10022, Attn: Chief Financial Officer; or |

| 5 |

| · | You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, “non-routine” matters include director elections (whether contested or uncontested) and matters involving a contest or a matter that may substantially affect the rights or privileges of shareholders.

In connection with the treatment of abstentions and broker non-votes, the proposals at this meeting to (i) elect directors, (ii) approve the 2017 Stock Incentive Plan, (iii) approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors, (iv) approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty, and (v) approve an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim, are considered “non-routine” matters, and brokers are not entitled to vote uninstructed shares with respect to these proposals. Only the proposals to (i) ratify the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm and (ii) approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the Company’s authorized shares of common stock from 15,000,000 to 150,000,000, are routine matters that brokers are entitled to vote shares without receiving instructions.

Our election of directors (Proposal No. 1), approval of the 2017 Stock Incentive Plan (Proposal No. 3), approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the maximum size of the board of directors (Proposal No. 5), approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty (Proposal No. 6), and approval of an amendment to the Company’s Articles of Incorporation, as amended, to clarify that advancement of expenses is required in connection with any indemnification claim (Proposal No. 7) are considered to be “non-routine” matters and as a result, brokers or nominees cannot vote your shares on these proposals in the absence of your direction.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For,” “Withhold” and “Against” votes, abstentions and broker non-votes. Abstentions and broker non-votes will not be counted as votes with respect to any matter, but may have the effect of a vote against certain matters to come before the meeting, as described elsewhere in this Proxy.

How many votes are needed to approve each proposal?

For the election of directors, the eight (8) nominees receiving the most “For” votes at the meeting in person or by proxy will be elected. The affirmative vote of the holders of a majority of the total outstanding shares as of the Record Date is necessary to approve the proposals to amend the Articles of Incorporation to (i) increase the number of authorized shares of common stock, (ii) increase the maximum size of the board of directors, (iii) clarify that, to the fullest extent permitted by Nevada law, our directors or officers shall not be personally liable to us or our shareholders for damages for breach of such director’s or officer’s fiduciary duty, and (iv) clarify that advancement of expenses is required in connection with any indemnification claim. Approval of all other matters requires the affirmative vote of a majority of the votes cast on the applicable matter at the Annual Meeting in person or by proxy.

Is my vote kept confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| · | as necessary to meet applicable legal requirements; |

| · | to allow for the tabulation and certification of votes; and |

| · | to facilitate a successful proxy solicitation. |

| 6 |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be discussed in a Form 8-K filed after the Annual Meeting.

Who can help answer my questions?

If you need assistance with voting or have questions regarding the Annual Meeting, please contact:

Alliance Advisors, LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

888-991-1293

| 7 |

ELECTION OF DIRECTORS

Information about the Nominees

At the Annual Meeting, the shareholders will elect eight directors to serve until the next annual meeting of Shareholders or until their respective successors are elected and qualified. In the event any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the proxies may be voted for the balance of those nominees named and for any substitute nominee designated by the present Board or the proxy holders to fill such vacancy, or for the balance of the nominees named without nomination of a substitute, or the size of the Board may be reduced in accordance with the Bylaws of the Company. The Board has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee or as a director if elected.

Assuming a quorum is present, the eight nominees receiving the highest number of affirmative votes of shares entitled to be voted for them will be elected as directors of the Company for the ensuing year. Unless marked otherwise, proxies received will be voted "FOR" the election of each of the eight nominees named below. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of as many of the nominees listed below as possible, and, in such event, the specific nominees to be voted for will be determined by the proxy holders. All of the director nominees currently serve as directors.

| NAME | AGE | CURRENT POSITION | ||

| Seth Lederman | 59 | President, CEO and Chairman of the Board of Directors | ||

| Stuart Davidson | 60 | Director | ||

| Patrick Grace | 61 | Director | ||

| Donald W. Landry | 62 | Director | ||

| Ernest Mario | 78 | Director | ||

| Charles E. Mather IV | 57 | Director | ||

| John Rhodes | 60 | Lead Director | ||

| Samuel Saks | 62 | Director |

The following information with respect to the principal occupation or employment of each nominee for director, the principal business of the corporation or other organization in which such occupation or employment is carried on, and such nominee's business experience during the past five years, as well as the specific experiences, qualifications, attributes and skills that have led the Board to determine that such Board members should serve on our Board, has been furnished to the Company by the respective director nominees:

Seth Lederman, MD became our President, Chief Executive Officer, Chairman of the Board and a Director in October 2011. Dr. Lederman founded Tonix Pharmaceuticals, Inc., a wholly-owned subsidiary of the Company (“Tonix Sub”) in June of 2007 and has acted as its Chairman of the Board of Directors since its inception and as President since June 2010. Dr. Lederman is an inventor on key patents and patent applications underlying our programs including: TNX-102 SL’s eutectic composition; TNX-102 SL’s pharmacokinetic profile and related therapeutic properties, and TNX-102 SL for posttraumatic stress disorder (PTSD). Dr. Lederman has been the Chairman of Krele since its inception in August 2010. Dr. Lederman has also been the President and a director of Tonix Pharmaceuticals (Canada), Inc. since its inception in April 2013, a director of Tonix Pharmaceuticals (Barbados), Ltd. from December 2013 until it was dissolved in 2015. Lederman served as a director of Tonix Pharma Limited between December 2014 and September 2015 and Tonix Pharma Holdings Limited between December 2014 and November 2015. Since 1996, Dr. Lederman served as an Associate Professor at Columbia University, and retired on April 13, 2017. As an Assistant Professor at Columbia, Dr. Lederman discovered and characterized the CD40-ligand and invented therapeutic candidates to treat autoimmune diseases and transplant rejection. Dr. Lederman has been a Manager of L&L Technologies LLC, or L&L, since 1996. In addition, Dr. Lederman has been the Managing Member of Seth Lederman Co, LLC since January 2007 and the Managing Member of Lederman & Co, LLC, or Lederman & Co, since 2002, both of which are biopharmaceutical consulting and investing companies. Dr. Lederman has also been the Managing Member of Targent Pharmaceuticals, LLC, or Targent, since 2000, and Managing Member of Plumbline LLC since 2002. Targent was a founder of Targent Pharmaceuticals Inc. on which Board of Directors Dr. Lederman served from inception in 2001 until the sale of its assets to Spectrum Pharmaceuticals Inc. in 2006. Between January 2007 and November 2008, Dr. Lederman was a Managing Partner of Konanda Pharma Partners, LLC, a Director of Konanda Pharma Fund I, LP, and a Managing Partner of Konanda General Partner, LLC, which were related private growth equity fund entities. As well, between January 2007 and November 2008, Dr. Lederman was Chairman of Validus Pharmaceuticals, Inc. and Fontus Pharmaceuticals, Inc., which were portfolio companies of the Konanda private growth equity funds. Since December 2011, Dr. Lederman has served as CEO and Chairman of Leder Laboratories Inc., or Leder Labs, and Starling Pharmaceuticals Inc., or Starling, which are biopharmaceutical development companies. Since March 2013, Dr. Lederman has been the chairman of Leder Laboratories, Ltd., a wholly-owned subsidiary of Leder Laboratories Inc. In 2015, Dr. Lederman served as a member of the US – Japan Business Council. Between 2006 and 2011, Dr. Lederman was a director of Research Corporation, a New York-based non-profit organization. Dr. Lederman received his BA degree in Chemistry from Princeton University in 1979 and his MD from Columbia University in 1983. Dr. Lederman has been a New York State licensed physician since 1985. Dr. Lederman’s significant experience with our patent portfolio and his experience as an entrepreneur, seed capital investor, fund manager, and director of start-up biopharmaceutical companies were instrumental in his selection as a member of the Board.

| 8 |

Stuart Davidson became a Director in October 2011. Between July 2010 and October 2011, Mr. Davidson served as a director of Tonix Sub. Since 2011, Mr. Davidson has been a Managing Director of Sonen Capital. Since 1994, Mr. Davidson has been a Managing Partner of Labrador Ventures. Prior to Labrador, Mr. Davidson founded and served as CEO of Combion, Inc., which was acquired by Incyte. He also served as President of Alkermes, Inc., a biotechnology company focused on drug delivery. Mr. Davidson received his Bachelor’s Degree from Harvard College in 1978 and his MBA from Harvard Business School in 1984. Mr. Davidson’s prior experience as a venture capital investor, entrepreneur, and biotechnology industry executive experience in the leadership of pharmaceutical companies was instrumental in his selection as a member of our Board.

Patrick Grace became a Director in October 2011. Between June 2007 and October 2011, Mr. Grace served as a director of Tonix Sub. Mr. Grace was the co-founder of and served as the Managing Partner of Apollo Philanthropy Partners, L.L.C. from October 2008 until October 2012. He has also been President of MLP Capital, Inc., an investment holding company, since 1996. Mr. Grace served in various senior management roles with W. R. Grace & Co. from 1977 to 1995, and was last President and CEO of Grace Logistics Services, Inc. From January 2002 to August 2002, Mr. Grace was also President and Chief Executive Officer of Kingdom Group, LLC (“Kingdom”), a provider of turnkey compressed natural gas fueling systems, and he was Executive Vice President of Kingdom from August 1999 to December 2000. Since 1996, he has been a director of Chemed Corporation. Mr. Grace was a liberal arts major at the University of Notre Dame and earned a MBA in finance from Columbia University. Mr. Grace’s extensive executive experience, along with his membership on the board of directors of a public company, was instrumental in his selection as a member of our Board.

Donald W. Landry, MD, PhD became a Director in October 2011. Between June 2007 and October 2011, Dr. Landry served as a director of Tonix Sub. Dr. Landry has been a member of the faculty of Columbia University since 1986, and has served as the Samuel Bard Professor of Medicine, Chair of the Department of Medicine and Physician-in-Chief at New York Presbyterian Hospital/Columbia University since 2008. Since November 2015, he has been a director of Sensient Technologies Corp. Dr. Landry was a co-founder and has been a member of L&L since 1996. Dr. Landry received his BS degree in Chemistry from Lafayette College in 1975, his PhD in Organic Chemistry from Harvard University in 1979 and his M.D. from Columbia University in 1983. Dr. Landry has been a New York State licensed physician since 1985. In 2008, Dr. Landry was awarded the Presidential Citizens Medal, the second-highest award that the President can confer upon a civilian. Dr. Landry’s significant medical and scientific background was instrumental in his selection as a member of the Board.

Ernest Mario, PhD became a Director in October 2011. Between September 2010 and October 2011, Dr. Mario served as a director of Tonix Sub. Dr. Mario is a former Deputy Chairman and Chief Executive of Glaxo Holdings plc and a former Chairman and Chief Executive Officer of ALZA Corporation. Since April 2014, Dr. Mario has served as Chairman of Capnia, Inc., a specialty pharmaceutical company in Palo Alto, CA. Between August 2007 and February 2014, Dr. Mario served as the Chief Executive Officer and Chairman of Capnia, Inc. and between February 2014 and April 2014, Dr. Mario served as Executive Chairman. From 2003 to 2007, he was Chairman and Chief Executive of Reliant Pharmaceuticals, Inc. Dr. Mario is currently a director of Capnia Inc. (since 2007), Celgene Corp. (since 2007) and Chimerix, Inc. (since February 2013). Dr. Mario is also Chairman of Chimerix. Dr. Mario served as a director of Boston Scientific Corp. (2001 – 2016), Kindred Biosciences, Inc. (2013 – 2016), VIVUS Inc. (2012 – 2013), XenoPort Inc. (2012 – 2015), and Maxygen Inc. (2001 – 2013). He serves as an advisor to The Ernest Mario School of Pharmacy at Rutgers University. In 2007, Dr. Mario was awarded the Remington Medal by the American Pharmacists’ Association, pharmacy’s highest honor. Dr. Mario received a PhD and an MS in physical sciences from the University of Rhode Island and a BS in pharmacy from Rutgers University. Dr. Mario brings to his service as a director his significant executive leadership experience, including his experience leading several pharmaceutical companies, as well as his membership on public company boards and foundations. He also has extensive experience in financial and operations management, risk oversight, and quality and business strategy.

| 9 |

Charles E. Mather IV became a Director in October 2011. Between April and October 2011, Mr. Mather served as a director of Tonix Sub. Mr. Mather has been a Managing Director of Equity Capital Markets at BTIG since March 2015. From December 2009 to February 2015 he was the Head of Private and Alternative Capital and Co-Head of Equity Capital Markets at Janney Montgomery Scott. Between May 2007 and September 2008, Mr. Mather was the head of the Structured Equity Group at Jefferies Group Inc. Prior to that, Mr. Mather held various senior investment banking positions at Cowen and Company, including as Co-Head of the Private Equity Group. Since July 2015, Mr. Mather has served as a director of the Finance Company of Pennsylvania. Mr. Mather received a BA in History from Brown University and an MBA in Finance from The Wharton School, University of Pennsylvania. Mr. Mather’s extensive experience advising life science companies as an investment banker was instrumental in his selection as a member of our Board.

John Rhodes became a Director in October 2011 and Lead Director in February 2014. Mr. Rhodes has served as President and CEO of the New York State Energy Research and Development Authority since September 2013. Between October 2010 and October 2011, Mr. Rhodes served as a director of Tonix Sub. Between 2005 and 2013, Mr. Rhodes was a director of Dewey Electronics Company, a manufacturer of electronic and electromechanical systems for the military and commercial markets. Between January 2013 and September 2013, he served as director of the Center for Market Innovation at Natural Resources Defense Council. Between April 2007 and June 2010, Mr. Rhodes was a Senior Advisor to Good Energies, Inc., a renewable energy company. Mr. Rhodes is a former Vice President of Booz Allen Hamilton, Inc. Mr. Rhodes is a graduate of Princeton University and the Yale School of Management. Mr. Rhodes’ extensive business and consulting experience, along with his membership on the board of directors of a public company was instrumental in his selection as a member of our Board.

Samuel Saks, MD became a Director in May 2012. Between 2003 and April 2009, Dr. Saks was the chief executive officer and a director of Jazz Pharmaceuticals, Inc., a publicly-held biopharmaceutical company, which he co-founded in 2003. From April 2011 until February 2012, Dr. Saks served as interim Chief Medical Officer of Threshold Pharmaceuticals, a publicly-held biopharmaceutical company. Between November 2013 and May 2015, Dr. Saks served as the Chief Development Officer of Auspex Pharmaceuticals, Inc., a publicly-held biopharmaceutical company. From 2001 until 2003, Dr. Saks was company group chairman of ALZA Corporation and a member of the Johnson & Johnson Pharmaceuticals Operating Committee. From 1992 until 2001, Dr. Saks held various positions at ALZA, including Chief Medical Officer and Group Vice President, where he was responsible for clinical, regulatory and commercial activities. Previously, Dr. Saks held clinical research and development management positions with Schering-Plough, Xoma and Genentech. Dr. Saks formerly served as a scientific advisor to ArQule Pharmaceuticals, CMEA Ventures and ProQuest Investments. Dr. Saks is currently a director of Velocity Pharmaceutical Development LLC (since 2011), Bullet Biotechnology, Inc. (since 2012), NuMedii (since 2013) and PDL BioPharma, Inc. (since September 2015). Dr. Saks served as a director of Depomed, Inc. (2012 – 2017), Auspex Pharmaceuticals, Inc. (2009 – 2015), Trubion Pharmaceuticals, Inc. (2005 – 2010), Corixa Corporation, Coulter Pharmaceuticals, Inc. and Sirna Therapeutics Inc. (formerly, Ribozyme Pharmaceuticals, Inc.). Dr. Saks is board certified in oncology and received a B.S. and an M.D. from the University of Illinois. Mr. Saks’ extensive scientific and medical expertise and experience in formulating partnering and business development strategies, including those involving larger pharmaceutical companies, was instrumental in his selection as a member of our Board.

Directors serve until the next annual meeting of shareholders or until their successors are elected and qualified. Officers serve at the discretion of the Board.

The Board has determined that (i) Seth Lederman, has a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is not an “independent director” as defined in the Marketplace Rules of The NASDAQ Stock Market and (ii) Stuart Davidson, Patrick Grace, Donald Landry, Ernest Mario, Charles Mather, John Rhodes and Samuel Saks are each an independent director as defined in the Marketplace Rules of The NASDAQ Stock Market.

Our CEO also serves as the chairman of the Board. An independent director serves as the Board’s lead director. This structure allows one person to speak for and lead both the Company and the Board, while also providing for effective independent board oversight through an independent lead director. Having Dr. Lederman, our CEO, serve as Chairman creates clear and unambiguous authority, which is essential to effective management. Our Board and management can respond more effectively to a clearer line of authority. By designating our CEO as its Chairman, our Board also sends as an important signal to our employees and shareholders about who is accountable. Further, since Dr. Lederman is the founder of our Company and is an inventor on key patents and patent applications underlying our programs, we believe that Dr. Lederman is best-positioned to set our Board’s agenda and provide leadership.

| 10 |

We have established the position of lead director, which is filled by Mr. Rhodes. The lead director has the following responsibilities, as detailed in the Lead Director charter, adopted by the Board (and also performs any other functions the Board may request):

| · | Board leadership — provides leadership to the Board in any situation where the chairman’s role may be, or may be perceived to be, in conflict, and also chairs meetings when the chairman is absent; | |

| · | Leadership of independent director meetings — leads independent director meetings, which take place without any management directors or Tonix employees present; | |

| · | Additional meetings — calls additional independent director meetings as needed; | |

| · | Chairman-independent director liaison — regularly meets with the chairman and serves as liaison between the chairman and the independent directors; | |

| · | Stockholder communications — makes himself available for direct communication with our stockholders; | |

| · | Board agenda, schedule & information — works with the chairman regarding meeting agendas, meeting schedules and information sent to directors for Board meetings, including the quality, quantity, appropriateness and timeliness of such information; and | |

| · | Advisors and consultants — recommends to the Board the retention of outside advisors and consultants who report directly to the Board on Board-wide issues. |

| 11 |

Risk is an integral part of the Board and Board committee deliberations throughout the year. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives financial risk assessment reports from management. Risks related to the compensation programs are reviewed by the Compensation Committee. The Board is advised by these committees of significant risks and management’s response through periodic updates.

Stockholder Communications with the Board

The Company’s stockholders may communicate with the Board, including non-executive directors or officers, by sending written communications addressed to such person or persons in care of Tonix Pharmaceuticals Holding Corp., Attention: Secretary, 509 Madison Avenue, Suite 306, New York, New York 10022. All communications will be compiled by the Secretary and submitted to the addressee. If the Board modifies this process, the revised process will be posted on the Company’s website.

Meetings and Committees of the Board

During the fiscal year ended December 31, 2016, the Board held 13 meetings, the Audit Committee held six meetings, the Compensation Committee held four meetings and the Nominating and Corporate Governance Committee held three meetings. The Board and Board committees also approved certain actions by unanimous written consent.

The Board has standing Audit, Compensation, and Nominating and Corporate Governance Committees. Information concerning the membership and function of each committee is as follows:

Board Committee Membership

| Name | Audit Committee |

Compensation Committee | Nominating and Corporate Governance Committee |

|||

| Seth Lederman | ||||||

| Stuart Davidson | ** | |||||

| Patrick Grace | ** | * | ||||

| Donald W. Landry | ||||||

| Ernest Mario | * | |||||

| Charles E. Mather IV | * | * | ||||

| John Rhodes | * | ** | ||||

| Samuel Saks | * |

* Member of Committee

** Chairman of Committee

| 12 |

Audit Committee

Our Audit Committee consists of Patrick Grace, Charles Mather and John Rhodes, with Mr. Grace elected as Chairman of the Committee. Our Board has determined that each of Messrs. Grace, Mather and Rhodes are “independent” as that term is defined under applicable SEC rules and under the current listing standards of the NASDAQ Stock Market. Mr. Grace is our audit committee financial expert.

Our Audit Committee’s responsibilities include: (i) reviewing the independence, qualifications, services, fees, and performance of the independent auditors, (ii) appointing, replacing and discharging the independent auditor, (iii) pre-approving the professional services provided by the independent auditor, (iv) reviewing the scope of the annual audit and reports and recommendations submitted by the independent auditor, and (v) reviewing our financial reporting and accounting policies, including any significant changes, with management and the independent auditor. The Audit Committee reviewed and discussed with management the Company’s audited financial statements for the year ended December 31, 2016.

Compensation Committee

Our Compensation Committee consists of Stuart Davidson, Ernest Mario and Samuel Saks, with Mr. Davidson elected as Chairman of the Committee. Our Board has determined that all of the members are “independent” under the current listing standards of the NASDAQ Stock Market. Our Board has adopted a written charter setting forth the authority and responsibilities of the Compensation Committee.

Our Compensation Committee has responsibility for, among other things, evaluating and making decisions regarding the compensation of our executive officers, assuring that the executive officers are compensated effectively in a manner consistent with our stated compensation strategy, producing an annual report on executive compensation in accordance with the rules and regulations promulgated by the SEC and periodically evaluating and administering the terms and administration of our incentive plans and benefit programs. In addition, our Compensation Committee reviews and makes recommendations to the Board regarding incentive compensation plans that require shareholder approval, director compensation, the Company’s compensation discussion and analysis (“CD&A”) and the related executive compensation information for inclusion in the Company’s 10-K and proxy statement, and employment and severance agreements relating to the chief executive officer.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Patrick Grace, Charles Mather and John Rhodes, with Mr. Rhodes elected as Chairman of the Committee. The Board has determined that all of the members are “independent” under the current listing standards of the NASDAQ Stock Market.

Our Nominating and Corporate Governance Committee has responsibility for assisting the Board in, among other things, effecting the organization, membership and function of the Board and its committees. The Nominating and Corporate Governance Committee shall identify and evaluate the qualifications of all candidates for nomination for election as directors. In addition, the Nominating and Corporate Governance Committee is responsible for developing, recommending and evaluating corporate governance standards and a code of business conduct and ethics.

As provided in its charter and our Company’s corporate governance principles, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become directors. The Nominating and Corporate Governance Committee seeks to identify director candidates based on input provided by a number of sources, including (1) the Nominating and Corporate Governance Committee members, (2) our other directors, (3) our shareholders, (4) our Chief Executive Officer or Chairman, and (5) third parties such as professional search firms. In evaluating potential candidates for director, the Nominating and Corporate Governance Committee considers the entirety of each candidate’s credentials.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board. However, at a minimum, candidates for director must possess:

| · | high personal and professional ethics and integrity; |

| · | the ability to exercise sound judgment; |

| · | the ability to make independent analytical inquiries; |

| · | a willingness and ability to devote adequate time and resources to diligently perform Board and committee duties; and |

| · | the appropriate and relevant business experience and acumen. |

| 13 |

In addition to these minimum qualifications, the Nominating and Corporate Governance Committee also takes into account when considering whether to nominate a potential director candidate the following factors:

| · | whether the person possesses specific industry expertise and familiarity with general issues affecting our business; |

| · | whether the person’s nomination and election would enable the Board to have a member that qualifies as an “audit committee financial expert” as such term is defined by the SEC in Item 401 of Regulation S-K; |

| · | whether the person would qualify as an “independent” director under the listing standards of the Nasdaq Stock Market; |

| · | the importance of continuity of the existing composition of the Board to provide long term stability and experienced oversight; and |

| · | the importance of diversified Board membership, in terms of both the individuals involved and their various experiences and areas of expertise. |

The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders provided such recommendations are submitted in accordance with the procedures set forth below. In order to provide for an orderly and informed review and selection process for director candidates, the Board has determined that shareholders who wish to recommend director candidates for consideration by the Nominating and Corporate Governance Committee must comply with the following:

| · | The recommendation must be made in writing to the Corporate Secretary at Tonix Pharmaceuticals Holding Corp.; |

| · | The recommendation must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the recommending person's ownership of the Company’s common stock; |

| · | The recommendation shall also contain a statement from the recommending shareholder in support of the candidate; professional references, particularly within the context of those relevant to board membership, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like; and personal references; and |

| · | A statement from the shareholder nominee indicating that such nominee wants to serve on the Board and could be considered "independent" under the Rules and Regulations of the Nasdaq Stock Market and the SEC, as in effect at that time. |

All candidates submitted by shareholders will be evaluated by the Nominating and Corporate Governance Committee according to the criteria discussed above and in the same manner as all other director candidates.

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and holders of more than 10% of our common stock to file with the SEC reports regarding their ownership and changes in ownership of our securities. We believe that, during fiscal 2016, our directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements.

The proxy holders intend to vote the shares represented by proxies for all of the Board's nominees, except to the extent authority to vote for the nominees is withheld.

The Board unanimously recommends a vote “FOR” each of its nominees

| 14 |

RATIFICATION OF APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of EisnerAmper LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2017, subject to ratification of the appointment by the Company's shareholders. A representative of EisnerAmper LLP is expected to attend the Annual Meeting to respond to appropriate questions and will have an opportunity to make a statement if he or she so desires.

Review of the Company's Audited Financial Statements for the Fiscal Year Ended December 31, 2016

The Audit Committee met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 114 (Codification of Statements on Auditing Standards, AU 380), as amended.

In addition, the Audit Committee discussed with the independent auditors the auditors' independence from the Company and its management, and the independent auditors provided to the Audit Committee the written disclosures and letter required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees).

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations and the overall quality of the Company's internal controls and financial reporting.

Based on the reviews and discussions referred to above, the Audit Committee approved the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2016, for filing with the SEC.

Audit Fees

The aggregate fees billed by our independent registered public accounting firm, for professional services rendered for the audit of our annual financial statements for the years ended December 31, 2016 and 2015, including review of our interim financial statements as well as registration statement filings with the SEC and comfort letters issued to underwriters were $346,138 and $253,271, respectively.

Audit-Related Fees

We did not incur fees to our independent registered public accounting firm for audit related fees during the fiscal years ended December 31, 2016 and 2015.

Tax and Other Fees

We incurred fees to our independent auditors for tax services during the fiscal years ended December 31, 2016 and 2015 of $9,400 in each year.

Pre-Approval Policies and Procedures

Consistent with SEC policies and guidelines regarding audit independence, the Audit Committee is responsible for the pre-approval of all audit and permissible non-audit services provided by our principal accountants on a case-by-case basis. Our Audit Committee has established a policy regarding approval of all audit and permissible non-audit services provided by our principal accountants. Our Audit Committee pre-approves these services by category and service. Our Audit Committee has pre-approved all of the services provided by our principal accountants.

The Board unanimously recommends a vote “FOR” the election of EisnerAmper LLP

as the Company’s independent registered public accounting firm for the year ending December 31, 2017

| 15 |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Tonix Pharmaceuticals Holding Corp. has furnished the following report on its activities during the fiscal year ended December 31, 2016. The report is not deemed to be “soliciting material” or “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed to be incorporated by reference into any prior or subsequent filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent that Tonix Pharmaceuticals Holding Corp. specifically incorporates it by reference into any such filing.

The Audit Committee oversees the financial reporting process on behalf of the Board. Management has the primary responsibility for the financial reporting process, principles and internal controls as well as preparation of our financial statements. For the fiscal year ended December 31, 2016, the members of the Audit Committee were Mr. Grace (Committee Chair), Mr. Mather and Mr. Rhodes, each of whom is an independent director as defined by the applicable NASDAQ and SEC rules.

In fulfilling its responsibilities, the Audit Committee appointed independent auditors EisnerAmper LLP for the fiscal year ended December 31, 2016. The Audit Committee reviewed and discussed with the independent auditors the overall scope and specific plans for their audit. The Audit Committee also reviewed and discussed with the independent auditors and with management the Company’s audited financial statements and the adequacy of its internal controls. The Audit Committee met with the independent auditors, without management present, to discuss the results of our independent auditor’s audits, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

The Audit Committee monitored the independence and performance of the independent auditors. The Audit Committee discussed with the independent auditors the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301—Communications with Audit Committees. The Company’s independent auditors have provided the Audit Committee with the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence, and the Audit Committee has discussed with the independent auditor the independent auditor’s independence. Based upon the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2016, for filing with the SEC.

Mr. Patrick Grace, Committee Chair

Mr. Charles E. Mather IV

Mr. John Rhodes

| 16 |

APPROVAL OF THE TONIX PHARMACEUTICALS HOLDING CORP.

2017 STOCK INCENTIVE PLAN

On April 11, 2017, the Board adopted, upon the recommendation of the Compensation Committee, the Tonix Pharmaceuticals Holding Corp. 2017 Stock Incentive Plan (the “2017 Plan”), subject to and effective upon shareholder approval at the annual meeting. We are asking our shareholders to approve the 2017 Plan in order to permit the Company to use the 2017 Plan to achieve the Company's performance, recruiting, retention and incentive goals.

The 2017 Plan includes a variety of forms of awards, including stock options, stock appreciation rights, restricted stock, restricted stock units, cash awards and dividend equivalents to allow the Company to adapt its incentive compensation program to meet the needs of the Company in the changing business environment in which the Company operates.

We strongly believe that the approval of the 2017 Plan is essential to our continued success. As a clinical-stage biopharmaceutical company with limited cash focused on funding our development programs, we believe that equity, in particular stock option awards, is an important and significant component of our employees’ compensation. The Board and management further believe that equity awards motivate high levels of performance, align the interests of our employees and shareholders by giving directors, employees and consultants the perspective of an owner with an equity stake in the Company, and provide an effective means of recognizing their contributions to the success of the Company.

As of March 31, 2017, 122,596 shares were available for grant under our only active, outstanding equity compensation plan, our 2016 Stock Incentive Plan (the “2016 Plan”). No shares are available for grant under the 2012 Amended and Restated Incentive Stock Option Plan and the 2014 Stock Incentive Plan (together with the 2016 Plan, the “Prior Plans”). If our stockholders do not approve this proposal, we may be unable to use equity compensation to the extent needed to make our compensation packages competitive and to motivate our employees and we could be required to increase cash compensation to attract, retain and motivate our employees, which may compromise funding of our development programs. The Board and management believe that equity awards are necessary to remain competitive in our industry and are essential to recruiting and retaining the highly qualified employees who help the Company meet its goals. The Board and management believe that the ability to grant equity awards will be important to the future success of the Company and is in the best interests of the Company's shareholders.

Our gross average share usage rate, sometimes referred to as burn rate, over the three years ended December 31, 2016 (calculated as equity-based awards granted under our equity compensation plan for the relevant year, divided by weighted average basic common shares outstanding for that year) is approximately 5.0%. We expect that the proposed share reserve under the 2017 Plan will be sufficient for awards for two or more years. Expectations regarding future share usage could be impacted by a number of factors such as: hiring and promotion activity at the executive level; the rate at which shares are returned to the 2017 Plan reserve upon awards’ expiration, forfeiture or cash settlement; the future performance of our stock price; and other factors. While we believe that the assumptions we used are reasonable, future share usage may differ from current expectations.

The potential dilution resulting from issuing all of the proposed 1.28 million shares under the 2017 Plan, when combined with shares subject to outstanding awards under the Prior Plans as of March 31, 2017, would be 18.1% on a fully-diluted basis.

If approved, the 2017 Plan will serve as the successor to our Prior Plans. Assuming shareholders approve the 2017 Plan, the 2017 Plan will be effective as the date of the annual meeting and the Prior Plans will terminate on that date (except with respect to awards previously granted under the Prior Plans that remain outstanding) and no further awards will be granted under the Prior Plans. If the 2017 Plan is not approved, we will continue to make grants under the Prior Plans until all shares available thereunder have been issued or the Prior Plans expire.

We are seeking stockholder approval of the 2017 Plan in order to satisfy certain legal requirements, including requirements of The NASDAQ Stock Market and to make awards under it eligible for beneficial tax treatment. In addition, the Board regards stockholder approval of the 2017 Plan as desirable and consistent with good corporate governance practices.

| 17 |

We have designed the 2017 Plan to include a number of provisions that we believe promote best practices by reinforcing the alignment between equity compensation arrangements for directors, employees and consultants and shareholders’ interests. These provisions include, but are not limited to, the following:

| 2017 Plan Provision | Description of Best Practice | |

| ● No Liberal Share Recycling | ● Shares will not be recycled for issuance as awards under the 2017 Plan in the following circumstances: shares delivered as a result of the net settlement of an outstanding SAR or stock option; shares used to pay the exercise price or withholding taxes related to an outstanding award; or shares repurchased on the open market with the proceeds of a stock option exercise price. | |

| ● No Repricing without Shareholder Approval | ● Except in case of certain corporate events, the Company cannot reduce the exercise price of stock options and SARs or buyout for cash underwater options and SARs without the approval of its shareholders. | |

| ● No “liberal” Change of Control Definition; No Automatic Single Trigger Acceleration | ● The definition of change of control in the 2017 Plan is not “liberal” and, for example, would not occur merely upon shareholder approval of a transaction. A change of control must actually occur in order for the Change of Control provisions in the 2017 Plan to be triggered. In addition, the 2017 Plan does not provide for automatic “single-trigger” acceleration on a change of control transaction. | |

| ● Minimum Vesting Requirement Applicable to All Awards | ● All awards will vest no earlier than one year from the date of grant (except with respect to a maximum of 5% of the shares under the 2017 Plan). | |

| ● Restrictions on Dividends and Dividend Equivalents | ● The 2017 Plan prohibits participants from receiving dividends or dividend equivalents before the underlying award vests and does not permit dividends or dividend equivalents to be paid on stock options or SARs. | |

| ● Limits on Individual Director Awards per Year | ● $350,000 in total value, either in cash, shares of stock or a combination of cash and stock, provided, however, that in extraordinary circumstances, that limit can be increased to $500,000. | |

| ● Clawback Provision | ● Includes language subjecting awards to recovery pursuant to any law, government regulation, stock exchange listing requirement including the SEC clawback rules or Company policy. |

The following table sets forth information relating to stock options and full value awards granted in 2016, 2015 and 2014:

| Fiscal Year | Stock Options Granted | Full Value Awards Granted | Weighted-Average Common Shares Outstanding | |||||||||

| 2016 | 69,800 | 11,250 | 2,521,016 | |||||||||

| 2015 | 51,324 | 4,200 | 1,679,106 | |||||||||

| 2014 | 85,030 | 0 | 998,552 | |||||||||

For additional reference the following table sets forth information relating to stock options and full value awards granted in 2016, 2015 and 2014, on a pre-split basis.

| Fiscal Year | Stock Options Granted (Pre-Split) | Full Value Awards Granted (Pre-Split) | Weighted-Average Common Shares Outstanding (Pre-Split) | |||||||||

| 2016 | 698,000 | 112,500 | 25,210,160 | |||||||||

| 2015 | 513,243 | 42,000 | 16,791,059 | |||||||||

| 2014 | 850,300 | 0 | 9,985,515 | |||||||||

The following table sets forth certain information as of March 31, 2017, unless otherwise noted, with respect to the Company’s existing equity compensation plans. The information is shown on a pre- and post-split basis to account for the Company’s 1-for-10 reverse stock split.

| Pre-Split Basis | Post-Split Basis | |||||||

| Number of shares no longer available for issuance as of March 31, 2017 under the 2016 Plan if stockholders approve the 2017 Plan | 1,225,960 | 122,596 | ||||||

| Proposed number of shares under the 2017 Plan | 12,800,000 | 1,280,000 | ||||||

| Stock options outstanding | 3,074,260 | 307,426 | ||||||

| Weighted-average exercise price of outstanding stock options | $ | 6.62 | $ | 66.20 | ||||

| Weighted-average remaining term of outstanding stock options | 8.26 years | 8.26 years | ||||||

| Total full value awards outstanding | 56,250 | 5,625 | ||||||

| Basic common shares outstanding as of the Record Date | 74,860,260 | 7,486,026 | ||||||

| 18 |

The following is a description of the principal terms of the 2017 Plan. The summary is qualified in its entirety by the full text of the 2017 Plan, which is attached as Appendix A to this Proxy Statement.